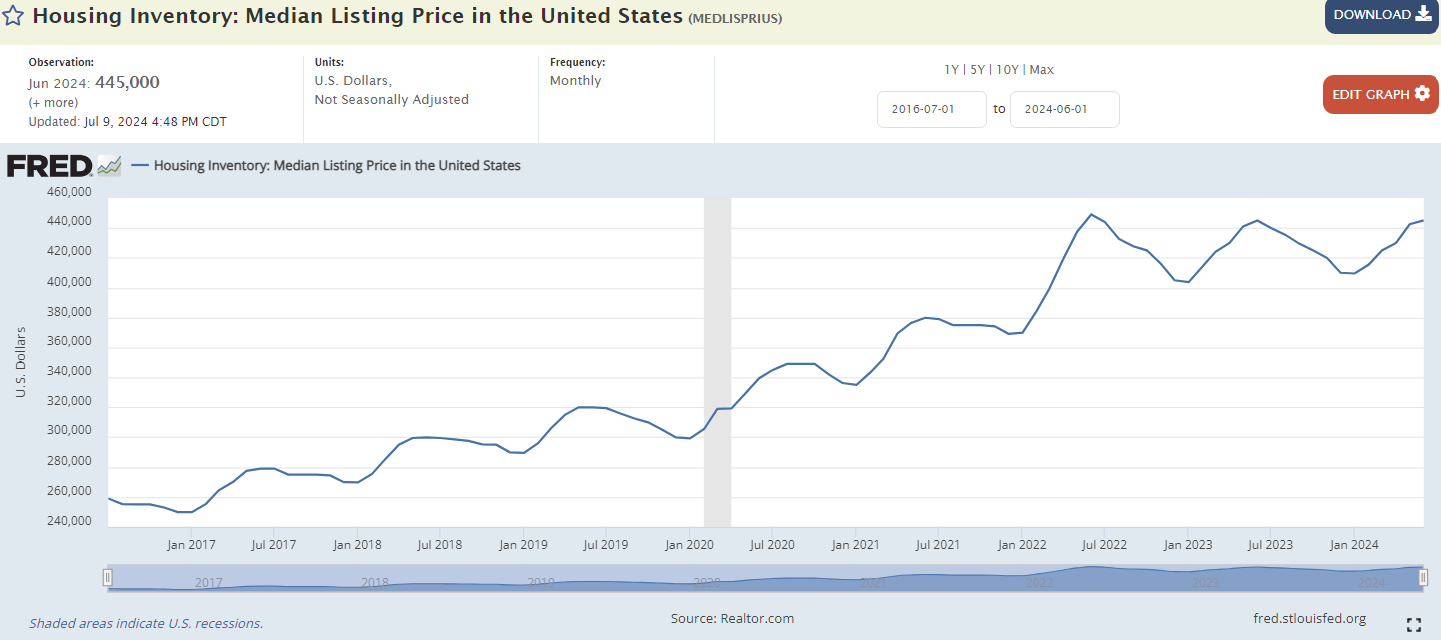

Housing moves at glacial speed until it doesn’t. I’ve said this on xTwitter for at least two years, but it can still shock you when the pace quickens. I’ve also said that turning the Titanic takes much longer than it does to sink it. In June of 2022 we reached the peak in the housing market, and the ship has been turning ever since despite what narrative machines have done to convince us otherwise:

As mentioned in my post on Tuesday, we hit an all-time-high for median existing home prices per the National Assocation of Realtor in June of 2024- $426,900. The graph above though is of the listing price in the United States. We have not reached the peak seen in June of 2022, nor do I believe we will in this cycle. With existing home sales at the lowest levels in 25 years of data and lower than June 2008, something is indeed rotten in the state of Denmark. If I sell four houses - $1.25M, $375K, $575K and $350K - the median sales price is $475K. Fewer sales at higher prices means we are going to see higher median prices. But prices should not be the only thing you look at to understand the path of housing. For the love of God, why would you trust the people who are trying to sell your data and their services to tell you what your home is worth?

In that vein, I hope you check out my second interview in The Forgotten American series with REWatchman on YouTube and Spotify. He’s a citizen data sleuth who has information you need before you buy a home. If you found out a large institutional investor owned properties in the neighborhood where you were looking to buy would you think that is important? Do you think your realtor would tell you? What if you found out they planned to sell large portions of that portfolio at once….at a significant loss? This is exactly what he has found in San Antonio. I hope you check it out to learn how you can protect yourself from these nasty surprises.

If existing home sales were bad, the chill from new home sales strengthened my conviction cuz they were ice cold - Arctic cold. Should I be the first one to say it this year? Winter is indeed coming.

According to the media and the industry, sales were down slightly (cough, cough). Danger Will Robinson! They indeed were not down “slightly” when looking at the non-seasonally adjusted YOY and MOM results. The 25-year average for new home sales in June is 63,400. Builders only sold 53,000 this year even after increasing incentives. But here’s the kicker - they have 8.9 months of unsold supply to unload onto the market and with a quickness. This, my friends, is what matters.

Without further ado, let’s review yesterday’s results and unsold inventory build. Plus, I can’t wait for you to see my combined sales graph with the historical comparisons….June 2024 is one for the record books (we have).

Keep reading with a 7-day free trial

Subscribe to M3_Melody Substack to keep reading this post and get 7 days of free access to the full post archives.