When I left the mortgage industry proper and joined the supposed Fintech revolution -which was largely being fueled by cheap labor in India and Pakistan - I found that if I was going to be successful in working with developers offshore they would need to understand the mortgage industry in the United States which was very different from their own. That was quite a task when most people in the United States can barely understand it and English is our first language. What resulted was weekly trainings at all of the Fintech companies I joined where I went over the history of mortgage and basic concepts with developers, administrators, sales folks, client success teams, etc.

Last week, I received some excellent, constructive feedback that the terminology and jargon that I use can be confusing and overwhelming. As such, I will start building a glossary that I will add to the main Substack page. Additionally, I thought it might be a good idea to do some pillar pieces about the industry and relevant topics so folks can reference and use as a reading companion to future posts.

The most logical place to start is with a little history of mortgage in the U.S. as our mortgage market is very different than most around the globe. But before we do that, let’s start with the word itself. What does mortgage mean? The earliest usage of the word dates back to 14th century France, with its origins traced to the Latin word “mortus” meaning “dead” and “gage” which stems from early German and translates to “pledge.” The concept itself can be found throughout history. The ancient Hindu script, Code of Manu, condemns deceptive and fraudulent practices around property-based lending. The ancient civilizations of Greece and Rome created a market system based on the ancient Talmudic scriptures of Judaism. This Jewish influence continued to impact the mortgage industries of many different societies, such as the British Empire in the English Common Law. In the United States of America, though, we put our own little spin on this practice as we do most things.

A Brief History of Modern Mortgage in the United States - Boom and Bust

1904 – Only 4 in 10 American own homes

•Term of 5-7 years

•Interest Only with Balloon Payment

•50% Down Payment

1929 – The Great Depression and collapse of the U.S. financial system; in 1933 foreclosures would reach a high with over 1,000 foreclosures happening each day.

Per a 2008 report from the St. Louis Fed on the Great Depression:

The sharp increase in mortgage distress during the Great Depression was the result of precipitous declines in income and real estate values following a period of rapid growth in mortgage debt outstanding…many home mortgages were short-term, non-amortizing loans that typically were refinanced on maturity. Refinancing was easily accomplished during the 1920s, when household incomes and property values were generally rising, but next to impossible during the Depression. Falling incomes made it increasingly difficult for borrowers to make loan payments or to refinance outstanding loans as they came due.

February 8, 1933 - Iowa became the first state to enact a moratorium on mortgage foreclosures; over the next 18 months 27 states in total enacted legislation to limit or halt foreclosures

1934 – Federal Housing Administration (FHA) established as part of Roosevelt’s New Deal

•Lower Down Payments

•30-year term

•High Loan-to-Value Ratios

•Universal Qualifying & Construction Standards

1938 – Fannie Mae was founded by the government (FNMA) to provide funding for housing through the secondary mortgage market

1944 – GI Bill was passed providing veterans of WWII funds for college, unemployment insurance and housing

1968 – The Housing and Urban Development Act passed to promote lending and home ownership:

•Ginnie Mae (GNMA) established as financing mechanism for government insured loans (FHA and VA) funded through its guarantee on Mortgage-Backed Securities (MBS)

•64% home ownership rate in the U.S.

•FNMA becomes publicly traded

1970 – GNMA issues the first mortgage-backed security and The Federal Home Loan Mortgage Corporation (FHLMC aka Freddie Mac) is founded by Congress to promote stability and affordability in the housing market by purchasing mortgages from banks and other loan makers

Agency RMBS = residential mortgage-backed securities backed by the agencies Fannie Mae, Freddie Mac and GNMA

1974 – Equal Credit Opportunity Act (ECOA) enacted to prohibit creditors from discriminating against credit applicants on the basis of race, color, religion, national origin, sex, marital status and age

1977 – Community Reinvestment Act (CRA) enacted; requires the Federal Reserve and other federal banking regulators to encourage financial institutions to help meet the credit needs of the communities including low and moderate income neighborhoods

1986 – the Tax Reform Act of 1986 eliminated tax deductions for interest paid on credit cards, encouraging the practice of using home equity lines of credit and second mortgages

1989 - Freddie Mac becomes a public company

1997 – Taxpayer Relief Act enacted including certain exclusions on capital gains which encouraged people to buy more expensive homes or rental properties

2001 – The U.S. Federal Reserve lowers Federal funds rate 11 times from 6.5 to 1.75 (post 9-11)

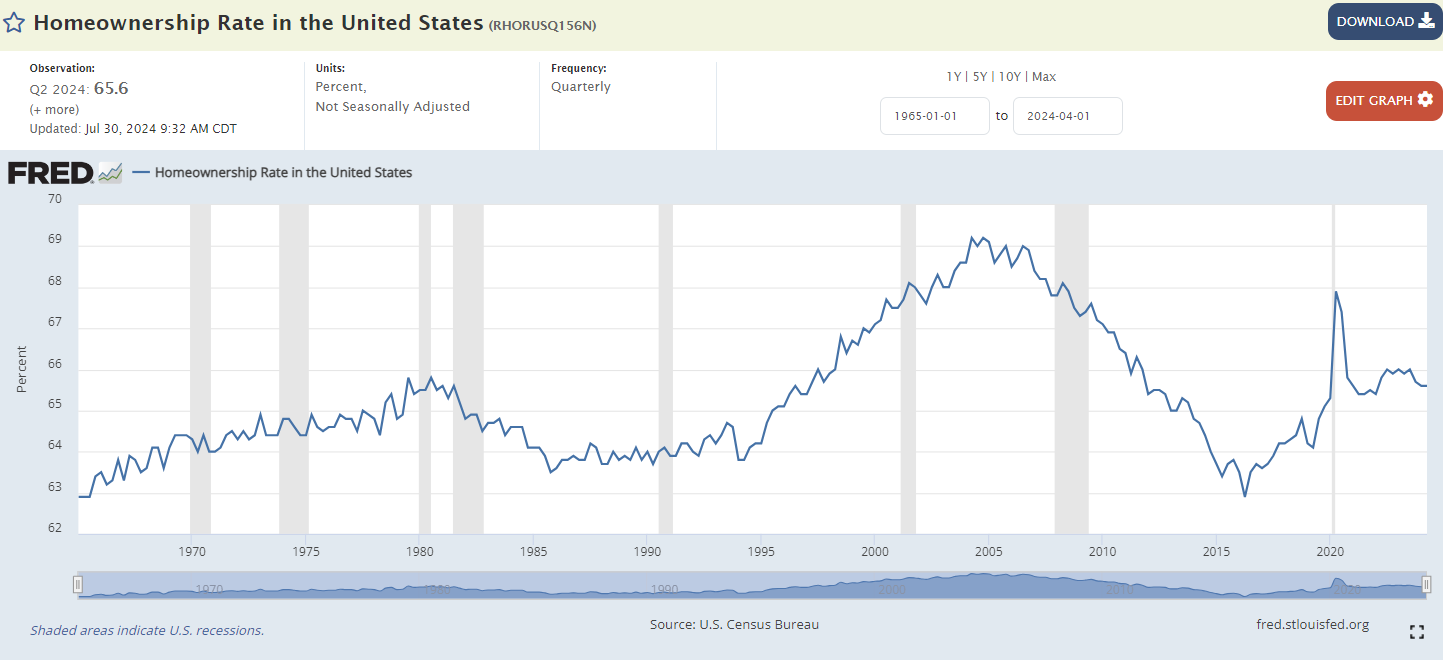

2004 – U.S. Homeownership Rate increased to 69.2% (the highest of all time)

2007 – 2008 – U.S. and Global Financial crisis sparked by risky bets on subprime which caused a collateral shortage in the financial system

•Several financial institutions file bankruptcy, go out of business, are bought or are bailed out: New Century, IndyMac, TBW, Countrywide, Lehman Brothers, Bear Sterns, etc.

September 2008 - The Federal Housing Finance Agency (FHFA) announced that it would place both Fannie Mae and Freddie Mac into conservatorship as both government-sponsored entities had become illiquid as the market for those bonds collapsed

2009 – 2011 – Foreclosures increase exponentially

2010 – Dodd-Frank Wall Street Reform and Consumer Protection Act

April 2011 - the Federal Reserve issues a Consent Order against the largest mortgage servicers related to deficient practices in residential mortgage loan servicing and foreclosures processing

February 2012 - 5 of the largest servicers sign an agreement with the federal government and 49 states to provide relief to distressed homeowners and pay penalties to states. Known as the National Mortgage Settlement or AG Settlement, this settlement accounts for the second largest civil settlement in U.S. behind the Tobacco Master Settlement Agreement

March 2020 - the Fed lowers rates 150 bps and begins purchasing mortgage-backed securities as a response to the COVID-19 crisis, catapulting the homeownership rate to 67.9% in Q2 of 2020

December 2020 - the CFPB publishes two final rules amending the Ability-to-Repay/Qualified Mortgage rule to remove the 43% debt-to-income limit

As stated in current campaign soundbites, the impetus for government intervention is always fueled by the seemingly well-intended goal of increasing homeownership (right?). According to HUD the homeownership rate in the U.S. fluctuated between 43-48% during 1890-1940, but fell to 43.6% by 1940. The government intervention that began in the 30s and accelerated with the GI Bill increased the homeownership rate to around 62%. Since 1965 we have averaged a 65.3% homeownership rate. This series above began in 1965 at 62.9%.

As you can see in the FRED graph, the homeownership rate did not reach the pre-GFC levels of 69.2% during the COVID boom despite all of the massive government intervention including the MBS-buying and almost $10 billion in Homeowner Assistance which was earmarked for delinquent borrowers. Additionally $350B was distributed to the states and local governments through the Coronavirus State and Local Fiscal Recovery Funds (SLFRF) program which could be used (and many did) for downpayment assistance. As of Q2 2024, those funds have yet to be fully spent, with over $2B remaining in Homeowner Assistance Funds for instance. Importantly, as well, the government intervention during the GFC with the Home Affordable Modification Program (HAMP) and foreclosure moratoriums imposed on the larger servicers did not arrest the decline in homeownership to the last cycle low of 62.9%, reached in 2016 (exactly where we started prior to GNMA being formed).

So how does the U.S. mortgage market differ from other countries across the globe? The key differences:

•Mortgages are funded by both depository institutions and capital markets

•Securitizations

•GNMA and Government Sponsored Enterprises (GSE) – Fannie Mae and Freddie Mac

•High Loan-to-Value

•No prepayment penalty

•30-year options

•Fixed rate options

How does the U.S. compare with other countries across the globe when it comes to that homeownership rate?

You may notice something about the list above related to type of governments (communist) with Laos, China, Vietnam and Cuba taking top stops, but I would not jump to easy conclusions. Here’s another view from Europe:

It would take years to discuss why these rates in homeownership differ among countries, but I wanted you to have some context. Although other countries have tried to adopt our model, there are none that have come close when it comes to our utilization of the secondary markets and government-backed securitizations. Yet, we have not achieved homeownership rates seen in other countries. Currently, on average, $297.8B of agency mortgage-backed securities are traded each day. This is big business (cough, cough, I mean gov’t) and big money with other countries being large buyers of MBS as well.

In my next post, I will go over the mechanics of MBS in more detail and the players, but I wanted to provide this very high-level background to set a foundation for future discussions. Although housing is considered to be anywhere from 12-20% of GDP, I don’t believe that takes into consideration the contributions from hyperfinancialization. All we need to do is look at how government intervened in these markets during economic crises to understand its systemic importance. And, what of the cost of that intervention? Politicians argue there is no cost, only benefits, but how do they come to that conclusion? According to a recent report from the Congressional Budget Office (CBO), they are using funny-money accounting allowed under the Federal Credit Reform Act (FCRA) instead of a fair value methodology. If they did use fair-value accounting those programs would not be a benefit as claimed:

Using fair value, the sticker price would be $3.2 billion for loans originated in 2025. For a detailed discussion on the CBO report, please see this weekend’s episode of DNN at the 1 hour 49 minute mark.

Hopefully that was not the most boring history lesson on the planet. Now, let’s get to that ever-perplexing state out West. Inventory increases and Redfin sales and price results point to definite wobbliness in California. Using Case Shiller back to 1987, the CA home price index typically sees modest increases from July to August, not declines. The Nvidia hopium craze has done much to buoy California’s markets in my opinion, so CA will be very important to watch in the months to come for changing trends. Florida always leads, but CA is the largest market in the country.

Thus, let’s take a look at the price and inventory historical arcs as well as employment and default metrics in key cities to build a foundation for tracking California’s path ahead.

Keep reading with a 7-day free trial

Subscribe to M3_Melody Substack to keep reading this post and get 7 days of free access to the full post archives.