It is difficult to get a man to understand something,

when his salary depends upon his not understanding it!

Upton Sinclair (AND shamelessly stolen from Rudy Havenstein’s recent blog - (2) Monetary policy for rich people. - by Rudy Havenstein (substack.com)

I remember well being much younger and dumber, sitting in the ballroom of an unremarkable Sheraton with a clicker in my hand listening to the latest Cerberus-installed CEO talking about how he just knew the housing market was on the rebound. It was 2009. He asked us to vote, using our clicker, for which year we saw the market coming back - 9, 10, 11 were the choices. My vote was 11 because I was in Finance, and it was my job to track our market drivers.

Or, think about the wonderful scenes in The Big Short….”defaults are regional.” Yes, indeed, they are regional until they are not. And, how would we even have significant defaults yet? The National Emergency Declaration JUST ended. Borrowers are still eligible for COVID forbearances, and according to the St. Louis Fed, about 16% of individuals with mortgages were on a COVID forbearance at some point since 2020. The CFPB requires a borrower be delinquent for 120 days before they can be referred to foreclosure. And, usually in that timeline you have state mediation requirements, loss mitigation review requirements, noticing requirements, etc. I can’t actually remember the last time I saw a FNMA/FHLMC/GNMA loan get referred to foreclosure in 120 days. And, you would be surprised at how long the process takes in judicial states (see FHA diligence timelines in each state for FIRST action - not completion - which is typically filing a complaint or publishing/noticing the sale). During the GFC my job was managing default, and I can tell you how to postpone a foreclosure in any state and many investors/borrowers actually understand this game. They got an object lesson in 2008. The GSEs call them strategic defaulters.

Don’t get me wrong, I am definitely an advocate of helping struggling homeowners, but no one should be relying solely on the data currently coming from the mortgage industry to qualify the health of the U.S. consumer. And, yes, they could have equity, but if they can’t pay their bills and the housing market is FROZEN, then that doesn’t really tell me much.

My point? Recently the inventory nuts are getting louder and louder on FinTwit and seem to be haranguing innocent bystanders for no reason to make their point. And, boy do they act smug. ‘Just look at the data,’ they say. Ummmmmmmm. One thing I can say for sure is we are in a data dungeon. Survey participation is abysmal and I have been trying to get everyone to explain how they define inventory, and they all explain it differently, including the Fed. This means non-governmental data providers can make ridiculous claims about having “all” the data. No they don’t. There are approximately 600 INDIVIDUAL MLS listing sites. And some of them won’t give you the data. Does your data provider tell you how many they are linked to? And, what about pocket listings? Don’t know what those are? Make sure to listen to this Twitter space:

https://twitter.com/m3_melody/status/1643754120573259777?s=20

We are in the soup at the moment and will be for some time. The data is not complete, and if you don’t have a more rounded view you will get caught carrying an albatross around your neck for years to come. And, people are getting scared, really scared, because their paychecks are on the line. Are you scared - maybe just a little? If you are scared, then think about these folks who are sitting on top of a house of cards. This is their job, their livelihood and the money with which they put food on the table.

To that end, I have spent the last two weeks thinking about how to make the M3 update more useful, etc. Twitter threads don’t really allow for the view I wanted to give. So, I’ve compiled a quick summary view of all the cities I’m currently tracking and sharing (for free this week). And, I will continue to add relevant data points in the coming weeks as there are so many. For example, just looking at listings of homes for sale or inventory makes no sense if you are not tracking multifamily construction and population movements, etc. to get a more holistic picture of future trends.

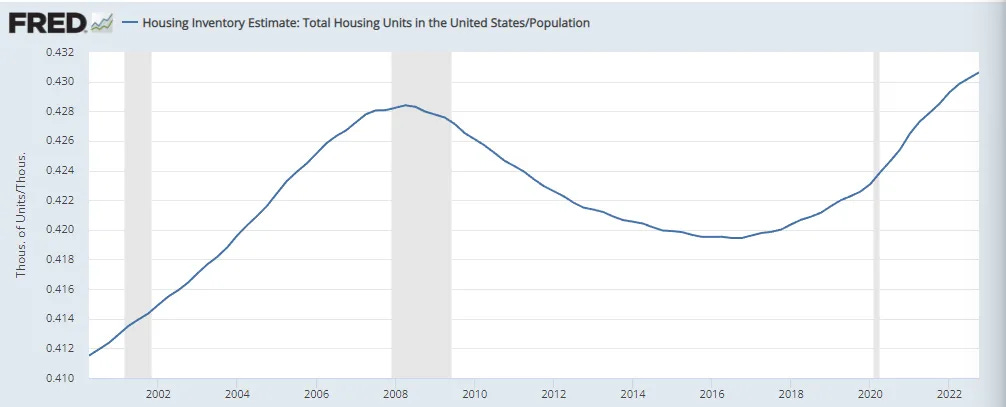

In summary, please be wary the desperate and dangerous narratives that are swirling about. And, if you need a hammer, use the below chart of housing inventory divided by population (TY again to Rudy H for pointing me to this chart).

So, without further ado…..

(Sorry for the image quality. If you message me directly on LinkedIn or Twitter, I will send you the PDF)

Demographics

The demographic story has been one of the biggest drivers of narratives in the media. Unfortunately, those narratives are conflicting and source-dependent. I’m working on a full post comparing Census, NAR, UHAUL, United and I am desperately searching for free cell data, so if you know a source, please message me.

ACS Population Change from 4/1/20-7/1/2021

Top 3 Cities with Highest % of Positive Population Change

Ft. Myers +7.9%

Bentonville +4.8%

Coeur d’Alene +2.5%

Top 3 Cities with Highest % of Negative Population Change

San Francisco -6.7%

New York -3.8%

Boston -3.2%

Redfin - Homebuyer Searches

I newly discovered this on Redfin’s website this week. Although searches certainly do not translate into purchases I think it is an interesting metric similar to consumer sentiment. As mentioned above, we need to be looking at more data instead of less, but none of it should be considered in isolation.

Cities with the Highest % of People Searching to Move INTO that City

Los Angeles, Costa Mesa, Newport Beach, Palm Springs 6.0%

Chicago 4.0%

Seattle 4.0%

Cities with the Highest % of People Searching to Move OUT of that City

Tucson 61%

Destin 49%

Huntsville 41%

Asheville 39%

Cities with the Lowest Inflation-Adjusted Median Average Salary

Knoxville $50,245

Augusta $52,286

Johnson City $53,572

Miami $54,273

Tucson $54,498

Ft. Myers $58,607

(Updated census numbers available in July, so this section will stay somewhat stagnant and will be moved to the end in future updates)

Listings

The current narrative on inventory and listings is more dangerous than any other in my opinion. Imagine if you just found out you got a new job in Austin, or heard about a potential investment property. Your friends tell you inventory is really low there so you immediately feel a little desperate, or a little FOMO. Just watch this video though, it should make you feel better (courtesy of my Austin Twitter buddy (1) Alex (@AlexClouse) / Twitter).

And, please, please heed my warning here:

https://twitter.com/m3_melody/status/1630326855411589120?s=20

Top Cities with Largest % Increase in Inventory from Start (1/1/23)

San Ramon 80%

San Francisco 63.05%

San Jose 41.25%

Denver 38.49%

Coeur d’Alene 28.76%

Boston 28.49%

Austin 28.12%

Top Cities with Largest % Increase in Inventory Week-over-Week (4/9-4/16)

Oakton, VA 25.76%

Denver 16.19%

Costa Mesa 9.60%

Nashville 8.11%

Portland 6.20%

Boston 5.58%

Rent

For the “it’s all going to be fine” group, I believe the price action in Rent is likely going to be one of the narratives they will not be able to dispute (Why rent prices dropped for the third straight month (cnbc.com)). And, this week I definitely saw interesting moves in occupancy and prices. Rent is one of the harder metrics to track as each site “defines” cities differently as well as they don’t often conveniently offer averages. I started tracking the low and high rents on RealPages and averaging them, but I didn’t feel this was adequate to get a real picture. So, after I returned from my road trip I decided to select one of the new (built after 2021) multifamily properties in each location (where available) and track individual properties as well. When I reference “complex” in the metric, it is related to a specific complex. Again, very, very imperfect, but one more piece of the puzzle.

Top Cities with Highest % of Average Rent Price Decreases

Hoboken -34.71%

Asheville -21.23%

Carlsbad -16.53%

Los Angeles -11.58%

Top Cities with Highest % Change in Rent Per Square Foot (RPSF) for Specific New Multifamily Complexes

Ft. Myers -20.99%

Pittsburgh -6.94%

Houston -6.9%

Salt Lake City - 6.03%

And, in other depressing news with respect to how gov’t + investors are fueling price increases: How federally-backed financing is driving up mobile home rents (nbcnews.com)

Airbnb

Inside Airbnb has most of the newest stats available, and I will be doing a deep dive on those next week. But, there were increases in many cities in January listings after some pretty significant drops in December. I have some hunches about this, but I believe that even if we have some blips at the beginning of this year, by the time we see March data those listings will be significantly down.

In the meantime,

Top Cities with Largest % Decrease in Airbnb Prices Week-over-Week (4/9-4/16)

*Airbnb price fluctuations may be subject to variations due to local events, etc. For instance, the dominance of FL cities could be reflecting the end of Spring Break.

Boston -33.93%

Tampa -32.46%

Ft. Lauderdale -21.52%

West Palm Beach -21.52%

Austin -17.84%

Miami -16.26%

Apologies for the delay with this update, but I want to make it more meaningful so needed extra time. More detailed city deep dives coming soon as well as a weekly YouTube video where I discuss the updates (a little terrified, so wish me luck).

Fantastic info. Looking forward to seeing you on YT.

Other issues 99% of the YT alleged “experts” looking for views either ignore or don’t know.

1. Massive amount in EBL loans (100 billion?) used for those “all cash” buys. In the RE market they appear as all cash transactions. But they are anything but. Think that will end well?

2. Institutional all cash transactions essentially the same deal. Some of the loans used to fund those are already inside the rollover window. Think that ends well?

3. % of NQM loans used to purchase income or AIrBNB properties at a level not dissimilar to the % of subprime loans in 2008. Think that ends well?

When people push back and say “it’s different this time” my response is always the same.

No, it’s never different. But if you are correct and it is different, then it will be worse.

Ultimate bottom (national avg) will take until at least mid 2026. Prices will ultimately revert to 2012 levels, in real terms. And I think there is a real chance they could get close to 2012 levels in nominal terms. At that point we can say the asset is cheap and it’s time to buy.

fyi For images, if you click on the top right of the image there should be an option for "set large size" or "set full width". Might help with large images.