Go Back to Sleep!

Fall has arrived here in TN and the days are getting shorter, making those early morning workouts just a teeny bit harder, wishing instead to return to slumber where Twitter trolls, data revisions and empty new-builds only rarely make an appearance. But, alas, there is too much to do, too much to write, too much to say, so as much as I would like to “Go Back to Sleep” that just won’t be happening.

I spent my last day in Florida on 30A, the famed Redneck Riviera, staring out at calm water that seemed ever so close to the sky due to the oppressive clouds which draped the beach. I felt as if I was at the end of the Earth under those clouds. Was it my mood upon arrival, or just a natural response to the weather?

As prepared as I should have been for what I saw on my way out of Florida in Port St. Lucie, Lakewood Ranch, and every other city I passed with “New Home” billboards lining the highway like mile markers, I was still not prepared. The anger, the vitriol, the derision I encountered in my Twitter Wars following the “debate” and Wealthion video only made sense if I was completely wrong, right? But then I was reminded of one of my favorite scenes in The Big Short when Vinny asks the group where the ABX currently stood after receiving a “wrong-number” call from someone looking to short mortgage bonds.

“What’s the ABX?” Porter asks.

“It tracks subprime mortgage bond value. Go back to sleep,” Vinny says.

When Danny realizes the index is down, he says “Wow. Nobody’s talking about that.”

My message is not for the faint of heart and what I understand on my good days is that most everyone just wants to go back to sleep. What else explains how many people are missing this story, and not only missing it, but trying to bury it into the ground? I’m apparently shadow-banned on Twitter, I’ve had some socials hacked, etc. I guess somebody wants me to shut-up. As previously mentioned, I will not be going back to sleep.

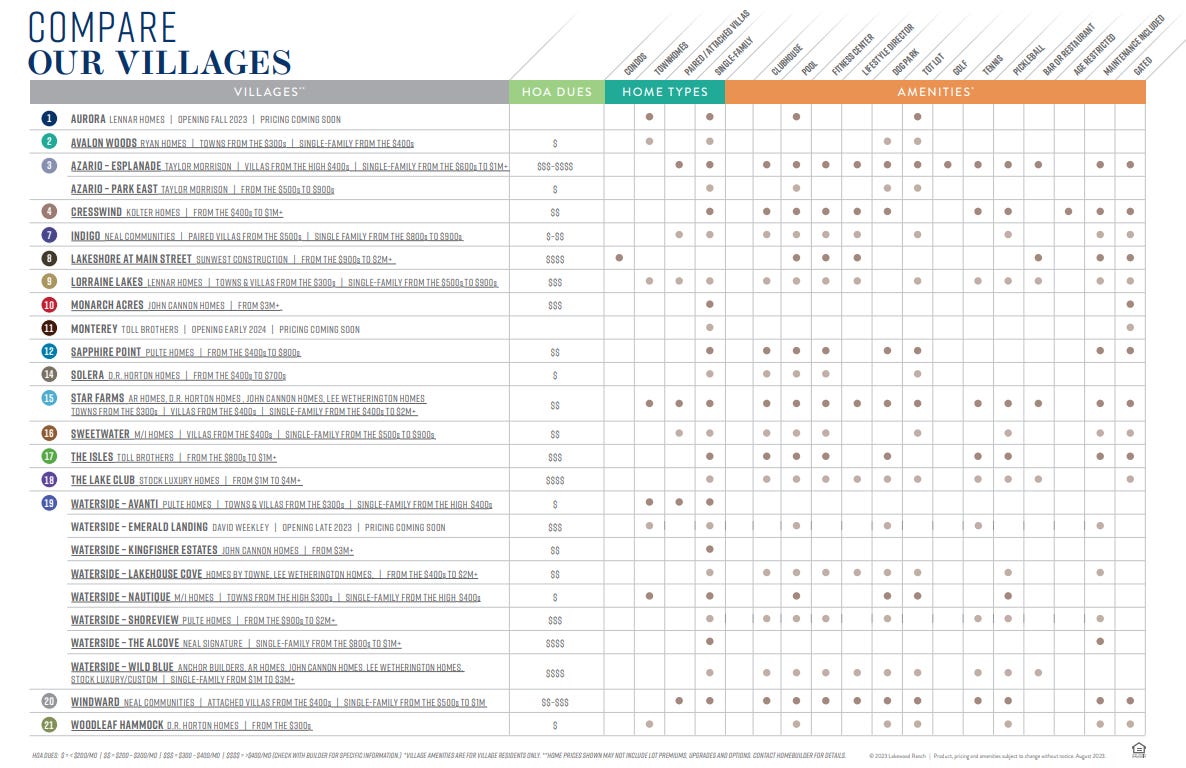

Lakewood Ranch is enough to blow anyone’s mind. I landed there after the suggestion of many Twitter followers telling me I had to see it to believe it. Guided by @IGHO_2022, a local, I spent a few hours in pure disbelief touring this one gigantic megasite, comprised of twenty-one different sites being built by the likes of Lennar, Tayler Morrison, Pulte, John Cannon, DR Horton, M/I, etc. ranging from price points of $300K to $4M (and that’s before adding all the fixings).

I’ve been struggling to fight the funk and find the words ever since because there just aren’t enough words or the right kind to describe what I saw there. Boasting 35K in population, a median income of $110K, 1,800 jobs and 60K homes (thank you @Mr.Awsumb), I believe this spot wants to become the new Boca based on the cute little city center. I couldn’t help but look around and ask again “who” when there are so many other spots in Florida much closer to the beach, or even closer to some sort of industry. There is a hospital, but other than that the commute to Tampa would be a real beast, and if you are in need of a cell signal for GPS, good luck.

The restaurants are aspirational, and I heard tales of folks pulling up in limos at the new tequila bar. Honestly though that would be like taking a limo to an outdoor mall. Like, how insecure are you? Not only are there almost two homes for every resident, but the home prices are insane for the location. I had more than one Twitter follower tell me that they know several people who have severe buyer’s remorse for buying at the top.

But, they are still building and nowhere close to being done, unless they are forced to stop. The videos I took are ginormous as are the sites in this planned development, but I honestly think the interactive matrix might be a better way to see scale. I could have spent a week editing footage, but hopefully this sample will suffice for now - this is just one small section of one of the twenty-one sites.

I will try, try to put together a better montage of this Florida trip, but so much of it, depressingly, looks exactly the same. Like so many other places in Florida, there were sites like these where a lot of was completed, sites where a little was completed and then sites where the land had just been cleared. Earlier this week we heard from NewBuildGuruu (fka RaleighFams) that on an emergency call this past Sunday his employer, a builder, discussed giving back sites to the developer.

Some of you may recall @NewBuildGuruu as the one who told us earlier in the year that the builder who employed him was having them write contracts even when they knew that the borrower would never be underwritten. In this business, you can book that gain-on-sale very early on in the process and put a sold sticker on a home contracted by someone who has no chance of being approved. Layer on the fact that cancellations for new-build homes were up again - approximately 16% - in August after enjoying a reprieve during the spring and summer selling season. Things are not looking good for the builders.

As @MrAwsumb taught us in Down and Dirty there are a lot of homes out there yet to be delivered before year-end. And the builders are in a box - they have to meet the guidance they’ve given the Street, or admit defeat. It sounds like @NewBuildGuruu’s bosses might be rolling up the carpet, but perhaps these are lots slated for next year. We shall see.

Frustrated, I am after what I’ve seen the last several weeks, compounded with what I saw in the Spring, that the same ol song and dance about rates, inventory, credit quality, etc. still rules the airwaves. Let’s take credit quality for a moment. The latest FHFA national mortgage database data has been released, and Bill McBride put together the below chart:

Boy oh boy look at how our credit improved during COVID. We must have all been good little boys and girls to make that happen, right? No - we had unprecedented moratoriums on all the things that would ding those credit scores such as eviction, foreclosure and credit reporting for delinquent debt in forbearance. And due to little nuances on the way Fannie and Freddie treated student loan debt all of our debt-to-income models have been turned upside down.

So, what does that mean? It means that the early delinquencies I’m seeing for our most vulnerable borrowers is going to accelerate as they simply cannot afford to service their auto, mortgage and student loan debt. And the government programs that exist today will not save many of them just as they did not save them last time our economy fell on serious hard times.

And, I’m not saying this is 2008 - it’s not. This credit profile and setup is more similar to where the consumer was in 2006 and 2007 while at the same time we are right smack dab in the middle of a banking crisis and a credit crunch. So, for everyone looking at equity profiles right now and saying everything is fine - they are missing that in many ways we are still pre-gaming. The increases in property taxes and insurance are only beginning to come home to roost with consumers stretched due to biting off a little more than they can chew. God forbid we get meaningful job losses as well. And all that equity everyone thinks they have is a mirage, ever fading, as from this point forward it will be highly unlikely they will be able to realize it. The price concessions have started to accelerate and based on the anecdata I have as well as the 16% increase in price cuts I saw in the cities I track, according to Redfin, the price increases we have seen as the last of our top 20%-ers piled in to grab those investment properties, etc., will also dissipate before our very eyes as we round the corner to year-end.

Why? It’s simple. Inventory is rising due to sellers who have no choice and as some on the margins come under stress, waking from their COVID fever dreams of being just a little richer than they actually are. Only a quarter of Americans could afford homes at these price/rate levels. And, those that can afford it now realize they’ve overpaid. Nearly everyone in the mainstream and industry media want to focus on rates only. Take the recent HousingWire article about price concessions.

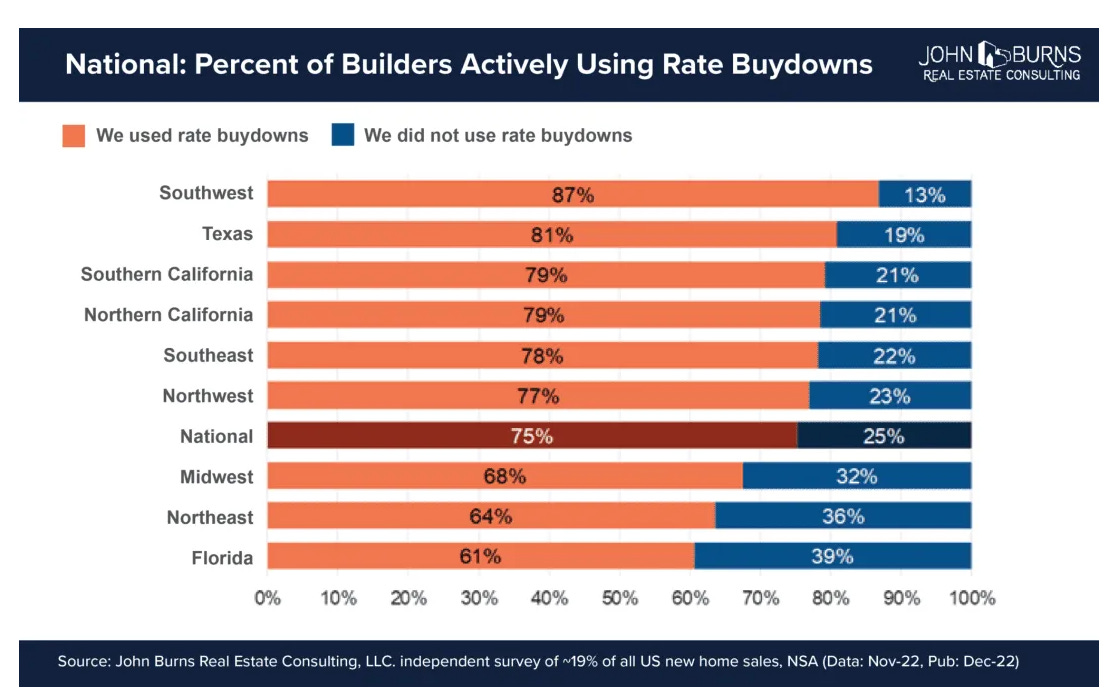

Sure, rising rates make the unaffordable homes even more unaffordable, but what is this obsession with rates? The biggest driver of our recent activity in the housing market is reduced prices on the backs of the builders who effected a 15-25% net reduction through rate buydowns and concessions such as paying closing costs, HOA fees or solar. Even if rates dropped precipitously I can tell you that the many Americans who are “trapped” in a 3% mortgage know absolutely that it wouldn’t be the rates that would be their biggest problem – they would be erasing all of their so-called equity if they tried to purchase another home of same size. All of that wealth they believe they have accumulated, that has fueled that consumption at a frenzied pace despite all the macroeconomic headwinds we are facing, would disappear in an instant. Most everyone believes that owning real estate is about an appreciating asset where you get an actual return on your investment.

And what of those rate buydowns? These are the ARMs (adjustable rate mortgages) of times past.

Seventy-five percent of mortgages utilized for new-home sales included a rate buydown. Depending on the program, some of those rates could already be starting to reset, but many, many more will start to reset next year. Remember what happened last time the ARMs started to reset?

What, what pray tell will come along to save us from our current path? Sure, government will try to intervene, especially as we rev the campaign engines in anticipation of 2024. Already I’m seeing ridiculous slogans and claims around affordable housing (BUILD, BUILD, BUILD, they say).

Do we have affordable housing? No. Do we need to build more? Not likely in many areas as the overabundance of short-term rental and built-to-rent start putting their thumb in the air, whilst showing a little leg. What will probably happen is the government will step in to subsidize the builder write-downs on the promise that they make some of the inventory they’ve already built affordable while the rest of the market chops, chops down as distressed sellers find their way to market.

But there is a lot, a lot that can happen from here to there and there are miles and miles and miles to go before we sleep.

*Weekly stats to be included in a second post later this week.

Thank you for the continuing information on a topic that is major importance. It is essential that you not be deterred from your continuing expression of what you are seeing, since it affects us all.

Thank you Melody! Saw you on Wealthion, followed you from there. If they’re trying to silence you, you’re either close or right over the target.