Gobble, Gobble

Deer hunting season officially began today in East TN to which I can personally attest. The cracking sounds from the back half of the farm punctuate each sentence that I type. You see, we have a deal with one of the neighbors, the same neighbors who turned on their generator after Helene and had nary a worry. If they supply us throughout the winter with firewood, they can hunt on the property. The fact that the wood-burning stove is my most reliable heat source in this 125-year-old drafty farmhouse which lacks insulation means my tolerance level for such things is much higher than it once was. Like it is for many things these days.

For instance, moving my mother in with me was nothing I would have contemplated even two short years ago as the rift seemed just too large. However, as I dug deeper and deeper into our macroeconomic landscape certain realities began to emerge that I could not ignore. Buying us both a house when home prices, property tax, insurance, replacement costs and general inflation were increasing made zero sense no matter how much I didn’t want it to be so.

What I’ve learned about myself over the years is that I’m better at living in the gray than some and more willing to accept hard truths sooner. This likely comes from years of having to survive some very dangerous situations in which ignoring reality could have meant life or death. For those that are new here - and there are many thanks to Big A who graciously had me on his channel - after my family lost our home to foreclosure when I was nine years old, my childhood became darker as poverty, and that which inevitably follows when adults despair, directed the dangerous play that became my life.

Vowing to escape that life, I took advantage of any advantage I could find. Incapable of asking for help due to “poor pride”, I instead started working and paying taxes at the ripe old age of 12 years old, barely stopping since. It meant that I found myself working in several industries becoming somewhat of a jack-of-all trades. Typically, I would learn one trade, or industry and move on. Growing up the way I did you are intimately aware that being able to pivot in times of stress is your most important asset, above wealth and your Rolodex which I guess is now known just as your contact list.

When I fell into mortgage in 2006, I figured I would only be there for a couple of years. It’s hard to believe that next year will mark almost 20 years in the housing industry. I, for one, would have never believed I could do something so boring. But, of course, 2006 was not a normal year in mortgage. It was the year that those who were paying attention started to wake up to the fact that the music in housing was slowing. That by the way, was not the management team at the company where I worked. Only a few of us could see what was really happening because we were skeptical by nature and also, quite frankly, because we had less to lose being younger than those at the helm.

The crisis became my life, and it was indeed a real crisis. I’ve shared this before, but we totally believed we were part of an effort to save the entire financial system, and I think most of us who fought that fight, sacrificing much, didn’t get rich doing it. What it took many years for me to realize is just how ridiculously fat the fat got, on the back of our sacrifice, as a result of the actions taken following the financial crisis. For those that are new to these concepts or want to learn more, I would recommend Danielle DiMartino Booth’s brilliant book Fed Up. In 2020 when I realized something was deeply amiss as the stock market soared during an economic shutdown, I embarked on a mission to understand what was happening. I found Danielle and joined xTwitter to learn more. In so doing I would have to revise my own history and understanding of what had happened.

Which brings us to today and our turbulent time when nothing is as it seems. With so much noise coming our way it can be difficult to discern the signal and appropriately train our focus. What I try to do here is not only provide you important information about what’s happening in the economy and housing but to also provide tools and resources so that you can become the best Swiss-Army-Knife version of yourself that you can possibly be. When times get tough, it will be important to know how to pivot quickly, to take actions that perhaps were previously unthinkable to protect your future and the future of our collective children.

Much has transpired since we last spoke as has been the case for every day this year. The game that is the financial markets relies on a never-ceasing stream of capital and hype. When that slows, accounting tricks like mark-to-model versus mark-to-market and outright fraud (think accusations lobbed at First Brands) can forestall the final bill, but if the next big thing doesn’t arrive to keep the party going then we get to see who is swimming naked.

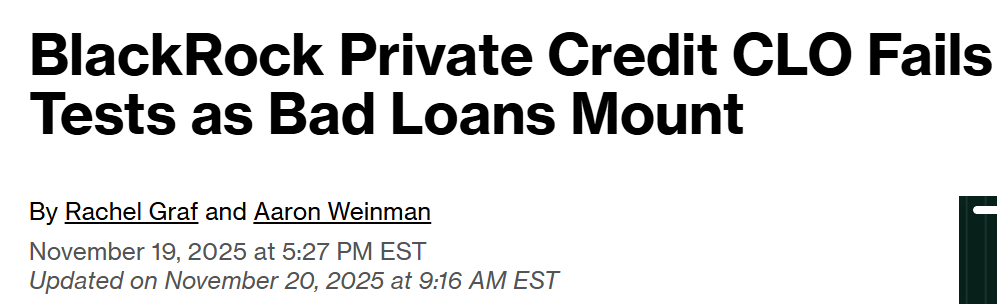

Remember the ending of The Big Short and its mention of CLOs, or collateralized loan obligations? Yep.

Oh BlackRock. How I remember the midnight conversations with your junior analysts, assigned to help with our distressed asset sales, who could not believe me when I said that $27M trading security was worth nada, nothing, zip. One of the most distressing things about our current cycle is that somehow individuals and companies who should have gone bye-bye due to their greed and stupidity in prior cycles are now front and center again.

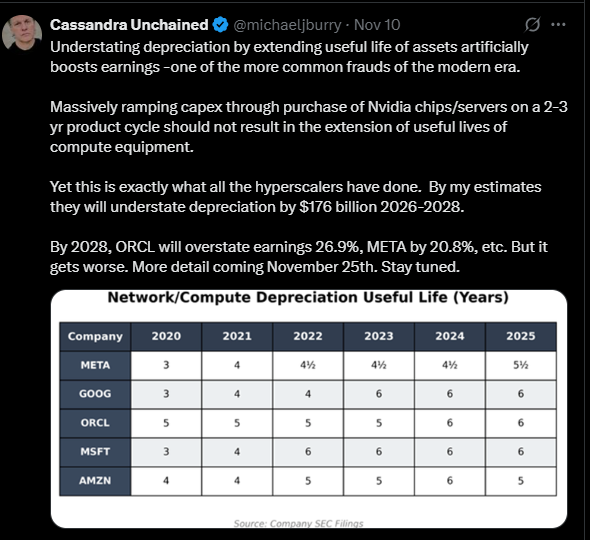

Speaking of, which is likely considered old news now but important for context, Burry sent more shockwaves through financial media after sharing a chart showing how our leather-jacket-wearing Tech Bros have turned to funny accounting to keep the confetti streaming.

Did someone say Oracle?

In case you have a life and didn’t realize, Nvidia announced earnings this past week which topped consensus expectations due to sales that were “off the charts”, according to Huang. On FinTwit the bears quickly pointed out that inventories were piling up which is odd if sales are off the charts but that did not stop the stock from rallying the next morning. Is this the reason the stock faltered and fell before day’s end? Likely not. As much as I’d like to score one for the bears, it is more likely we have just reached the point where the hype can no longer sustain the valuation, or that entities such as SoftBank, who unloaded $5.8B in Nvidia stock, need cash to cover other risky bets.

While more sophisticated folks like Michael Howell provide detailed and in-depth analysis as to where we are with global liquidity, for the past year or so I have used Bitcoin, which is having a really tough time indeed, as a daily quick-and-dirty weathervane. While those of us that watch markets religiously know better than to count the Santa Rally out, this is the first year where I’m not so sure the market has the chops to make it so. We cannot underestimate Wall Street’s voracity for that year-end bonus, but this fall is turning out funkier than even I expected.

One thing I did expect coming into 2025 was home sales to be up a smidge year-over-year due to just how strong last December was. The Tariff Tantrum and rising rates arrested sales at the beginning of the year but they have started to accelerate non-seasonally as evidenced by October existing home sales which we received on Thursday, putting us slightly ahead of where we were this time last year. For today’s post I will deep dive into October existing home sales and Redfin results for the 85 markets I track to illustrate the subtle shifts which are growing in strength, nudging our national housing market into full-blown correction mode. This past week Zillow, who isn’t known for being doomy, published a study showing that 53% of homes across the country have dropped in value last year on average by 9.7%, the most since 2012.

For those who don’t know, 2012 is when home prices hit their bottom of the last cycle, saved from further decline due to the “beneficence” of our institutional investors who bought those homes up at the invitation of the government sponsored enterprises (GSEs) and FHA. In thinking about it, I wonder if that is how Invitation Homes, a Blackstone company, which was founded in 2012, got its name. These companies are known for being clever in that way…even if that’s the limit to their cleverness.

The Zillow press release went on to assure everyone that homes weren’t yet selling at those reduced prices. Rather, that is the reduction in their Zestimate, or estimated value. Until we can get home sales off their 1995 floor which is where they were last year, being the lowest since that period in our history despite population increasing, we will not see the median home sales price nationally decline. Nonetheless, we are seeing it in M3 cities all across the country at twice the levels observed last year. Below, we will discuss sales, price, price reductions, inventory and days-on-market by region. Additionally, I will share the cities where we have motivated, distressed and depressed selling in October.

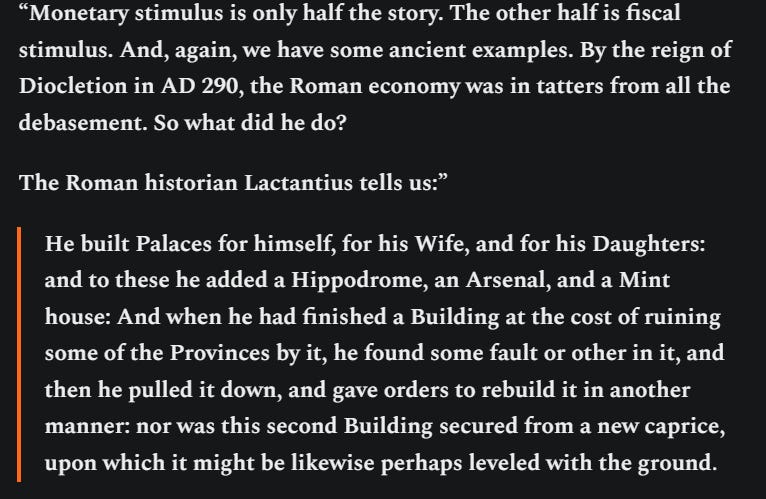

Before we begin and you set off to enjoy Turkey Day, I want to share two excellent reads from this past week. For a historical perspective on our propensity to try to build our way out of economic downturns, check out Rudy Havenstein’s latest, where you will find this quote from Daniel Oliver:

Sound a little like our Commercial Real Estate and new build crisis?

For an electrifying call-to-action, check out Michael W. Green’s piece, entitled Are You an American?, which details how he plans to do his part in finding a politician with actual solutions who is prepared to implement them, no matter if they are not politically palatable.

Without further ado…