Grifter Nation

When I stood outside of O Lot, a large homeless camp in San Diego, the labor data I study when doing deep dives came to life in front of my very eyes. Although my colleague, K. Pow had often emphasized the frothiness in the Education and Health Services category tracked by the Bureau of Labor Statistics (BLS) based on his expertise in healthcare, I didn’t really understand the criticality of this sector which many see as recession-proof. I mean, despite a recession, people will still need to seek healthcare. Our top 10%, who are responsible for 50% of consumer spending, will continue to send their kids off to pricey schools, right? But after some quick research to see how O Lot was funded everything became crystal clear. A good deal of the $350B that was sent to state, local, tribal and territorial governments through the American Rescue Plan funded jobs that rolled up into this category.

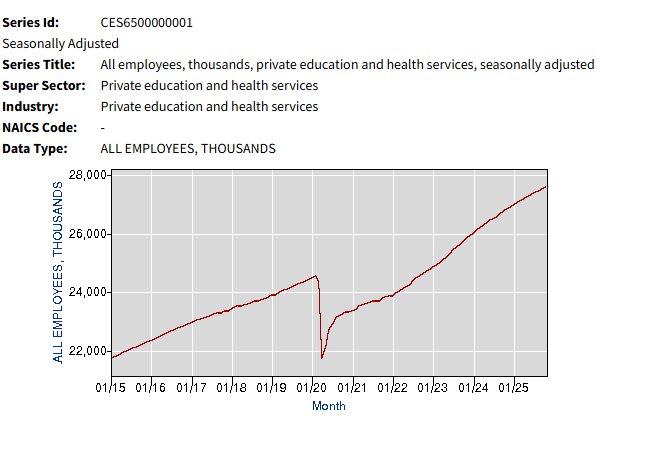

Source: BLS

Since February 2020, prior to the lockdown, nonfarm payrolls have increased from 152,292,000 to 159,552,000 or by 4.77%. Education and Health Services on the other hand has increased by 12.41% from 24,573,000 to 27,623,000. The only other category to see double-digit gains is Transportation and Warehousing. Think of all those Amazon deliveries you received during Covid. However, that category peaked in February 2025 and is now down -1.16% from the peak while jobs in Education and Health Services have increased by 2.09% during the same time period.

So what, you might be asking. Unless you have been on a mission to Mars you have likely heard something about the systemic fraud and abuse uncovered in Minnesota which was detailed in this incredible article in County Highway. While mainstream media plays partisan politics with the story and focuses on a specific group, I encourage you not to lose sight of this story’s importance. Because it’s not just in Minnesota. I have seen evidence of this fraud in my research and travels all over the country in both blue and red states. These public-private partnerships where the government gives money to an organization to provide some type of social service, be it housing assistance or daycare services, are breeding grounds for at best ineffective ministrations or at worst fraudulent activities to finance Lambo purchases.

My travel buddy Real Estate Mindset and I did everything we could to get inside of O Lot. Unfortunately, we were not allowed in even with our press passes. There was also a no-fly zone over the encampment so we could not get aerial footage. However, we were able to interview Anthony as he was leaving the camp. O Lot was created to move the homeless from the underpasses and get them off the streets. Anthony described a program where he felt relatively safe in his tent. What the program did not provide was any means or assistance to find a job or permanent shelter. By the by, there are also still plenty of folks living under underpasses in San Diego. Like the Otay Mesa detention center we would also visit in San Diego, owned by CoreCivic, headcount is of upmost importance for requests for funding. When speaking to a former inmate from Truesdale here in TN, run by CoreCivic, which is under federal investigation, I was told that on his day of release he had to wait until the count had been done. He also detailed stories of how federally mandated provisions were routinely withheld. No milk for prisoners at Truesdale! That of course was not the worst of what he experienced there. Days after he was released the inmates took over the prison which was de facto run by them anyway.

I’m working on a longer version of the Truesdale story, but in the meantime, it is important to understand that the grift stretches from sea to shining sea, and is no way limited to Minnesota and a particular ethnic group. In fact, in a recent America This Week, Kirn and Taibbi conjecture that perhaps this behavior was learned from observing the military grift that can be found overseas in war-torn areas where American forces are present. Think $20 bottles of water. This, by the way, is the same grift I have witnessed over the past year in disaster areas here in the United States. For some hair-raising details about yet more unintended consequences and various forms of grift and money-making schemes which followed our military home from our forever wars, I recommend The Fort Bragg Cartel: Drug Trafficking and Murder in the Special Forces, by Seth Harp.

As we have often discussed here, local municipalities spent money like drunken sailors with very little, if any oversight. Now budgets across the country are getting crushed as they overestimated their population gains and believed the dollars would keep coming. In this Substack, we have detailed specifically housing programs that can be found in Chicago, Portland, Boston, Rochester, etc. to name just a few. While well-intended, an entire cottage industry sprung up to help folks that are not qualified as a nonprofit to get in on the grift. For instance, let’s take some of those nonperforming loan sales that the agencies did which were intended for nonprofits focused on affordable housing. Often what would happen is that a hedge fund would find a willing nonprofit partner who could qualify to then effect a way to profit. When I worked on these sales in the industry in 2015, there were strict reporting requirements about loss mitigation and dispositions. What I have come to understand working with private note buyers is that those reports are no longer required, or if required, not scrutinized.

Get to the point, you might be saying. What if many of the jobs that we think exist out there rolling up under Education and Health Services are actually fraudulent? What does that mean for the state of our economy? That would mean that the category that was one of the only categories to see a positive gain year-over-year (YOY), and the only category to see a gain of more than 1%, might not represent what we think. If you exclude Education and Health Services, the average for the remaining categories combined is a -.49% decline in payrolls YOY.

The noise out there is deafening on all fronts. It can be easy to tune out or shutdown - we cannot. We can ignore the algos working to divide us, but importantly, anyone considering a large purchase based on a rosy view of the economy could find themselves on the side of a losing trade. Home sales have been abysmal this year, like they have been since 2023. Despite that I see news articles from every industry publication touting how 2026 is the year it is all going to turn around. What do they point to? Rates. Rates they do not even understand. You can always refi turned to date the rate in this cycle. The advice from those in the industry was based on what has been not what is. Even with Fannie and Freddie stepping in to buy mortgage-backed securities (MBS), rates still have not reached the lowest level we saw last year.

Could rates go lower as trouble intensifies? It is a possibility, but right now the bond market is being stubborn. Due to what’s happening globally I don’t think rates will go as low as needed to truly improve affordability and turn the housing market around. They may go low enough to generate much-needed activity but not enough to make buying a home make sense for most Americans. In the meantime, many of us do not fully understand that this “resilient” economy has been built upon sand and bezzle which is why we have had any buyers at all. As the winds gain speed, our illusions will become more and more obvious with each passing day.

Speaking of headwinds, as discussed in recent posts, guardrails have been put on the overly generous FHA program, and delinquency is on the rise. That’s not the only reason delinquency is rising, however. For today’s post, we will focus on the latest delinquency data from ICE/Black Knight. Additionally, I will share an interesting read that hit home which offers a compelling theory about what’s really driving the erosion of our middle class. And, finally, I will share top 5 city summaries for sales, price, days on market (DOM) and inventory to highlight regional performance as well as lists for cities where motivated, distressed and depressed selling occurred in November. Several cities in the Midwest showed surprising results, and I believe it is a sign of what’s to come there.

A couple of show notes:

Below, you will find a quick survey to help me gage which cities I should dive into next. There are many requests and some in queue already, but I want to prioritize based on your interest.

Once December results are received for both new and existing home sales, I will provide a final review of 2025 - what I got right, what I got wrong - as well as my tentative forecast for 2026. Without December and all those missing months of new home sale data, we are lacking adequate information to try and attempt that now.

Now to the meat and potatoes…or perhaps more fitting (for Southerners at least), to the collards and black-eyed peas…