2023 has been a blur and a year that I don’t think I’ll ever forget thanks to all of you who are reading this post and others who have supported me on this incredible journey. At the end of each year, I pick a word for the next year as a way to set my focus. Addicted to self-improvement, it typically centers around something I need to seriously work on based on my behavior in the past year. My word for last year was Believe. Trite you might say and yes, you can find the word stitched on many a’ pillow, but my word from the previous year was Soar. And I ended that year realizing I could not soar unless I believed.

I have always been a great promoter of others - friends, bosses, family, even strangers whose paths I cross, but until very recently the very thought of asking someone to read something I wrote, watch one of my videos or even acknowledge my existence made my skin crawl (and there are plenty of days when it still does). Many will read this and be surprised or unbelieving. Often people who meet me think I exude confidence, but what others see as confidence is just my sharply honed survival skills. Some of you know pieces of my story, some of you do not. We won’t get into it today, but my path has not been what most suspect. Although the early tribulations were not of my making, the later ones were as I tried to tend my wounds. No different in many ways than all of you as we journey through life.

2023 was exceptional as the chorus of certainty at the beginning of the year was soon confounded, thwarted and outsmarted once again. Weirdly, the housing bulls who long-term think the only way for home prices is up thought last year would be a desert. They were completely shocked to see new home sales roar to life and take unprecedented market share as the builders bought down mortgage rates and paid your closing costs and other expenses like solar or HOA dues; in essence effecting a 15-25% price reduction.

And with the ability to buy down consumers’ mortgage rates while still maintaining double-digit margins, new construction grew to comprise roughly 30% of total housing inventory in 2023, more than double a normal year.

I honestly think those price reduction estimates are low because the concessions are listed elsewhere in the MLS where many sales are recorded. When comps are done, your appraiser may or may not factor them in (and I’ve heard largely not), so the top-line price belies the true reality of the situation.

Due to lack of affordability one of the most (insert whatever word you want to here) housing bulls, Logan Mohtashami from HousingWire predicted the following:

Not to pick on Logan - I think many thought prices would come down due to the low levels of affordability, but the builders solved that problem. Additionally, most of the housing industry believed if rates stayed high there would be very limited activity. And, because new home sales have historically been a lower percent of sales, I don’t think many understood how aggressive the builders would be and the impact that would have on the frozen market even though buydowns were started in earnest in July of 2022. That little demand that existed sniffed its way to the builders thanks to some well-placed articles by our friends at Bloomberg. Another factor that escaped notice was how much money was being pumped into downpayment assistance state funds to keep the machine going.

New FHA and VA home loan guarantee endorsements totaled $102.1 billion during the third quarter of 2023, according to a new Inside FHA/VA Lending ranking and analysis. That was a 9.2% increase on a sequential basis at a time when overall mortgage origination volume fell 3.2%.

FHA/VA origination is increasing largely due to the low credit score and downpayment requirements as well as the availability of these downpayment assistance funds. In many ways last year was the tale of the top 20% still rolling along, transacting as if all was indeed just fine, while the less fortunate were lassoed with aggressive late-cycle lending campaigns aka shenanigans.

What did I get wrong about 2023? In January I wrote a piece called Debunking the Housing Inventory Myth in attempts to pull my peers from their doldrums to see what opportunities might exist:

My biggest argument last year was that despite rates being higher there would be demand as well as transactions due to the usual things (not speculation) that drive the housing market: death, divorce, default and the DOD. I argued that lack of inventory was not our issue in the housing market, but due to largely speculative activity gone wrong and the return Treasuries or money market funds would offer we would start to see inventory increases. And, we did in many cities which I have tracked here. By February though I was thoroughly confused as to why the new-builds were not increasing inventory as I believed they should. This led me to take my first trip which included Nashville, Austin, Charlotte, Jacksonville, Tampa, Lakeland and Orlando where I unbelievingly realized that yet again we had been duped and something was seriously amiss with our listing sites. That led me to start investigating pocket listings and all the other ways we could be missing inventory since the Fed’s source is Realtor.com.

As I dove into alternative sources, I realized that no one was adequately tracking inventory as the world had changed with the advent of social media, despite everyone, including NAR, not wanting it to be so. And, not only that, no one and I mean no one including Realtor.com has access to all of the over 600 individual MLS listing sites, independent brokerage or builder sites. And, those MLS listing sites can decide whether they want to syndicate to the larger sites like Zillow, Realtor, etc. I asked Realtor.com twice if they knew and tracked the percentage of listings which were not syndicated to them. Although they answered many of my questions, they would not answer that one even after sending it again as a clarifying question.

In addition to being confused about the amount of inventory out there, I actually believe we will discover that many, many more transactions occurred last year outside of the MLS through private note sales. I will be digging into this space in much more detail next year, but suffice it to say our home sales numbers come from the National Association of Realtors (NAR) and the Survey of Construction. You may recall how NAR, the largest lobbying group in DC based on spend, was besmirched this year in multiple ways as well as that surveys have become problematic since COVID. Neither of these data gathering techniques include looking at public records to count transactions. Some new entrants to the market are trying to scrape that data, but as someone who has had the job of retrieving documents from the over 3,000 counties in this country, many of which still use fax machines, that is a very laborious process. Even providers like FirstAm’s DataTree - the most widely used in the industry which was recently offline due to the hack - can only provide about 60-70% current coverage of recorded documents. And, in many cases, they can provide the documents, but not the data. You would have to build an OCR/scraper tool to grab that. For some counties you can see the data after a long delay (sometimes up to a year), but that obviously means the picture is always fuzzy. Is this me trying not to be wrong….I don’t think so. I still think we are in the fog of war. I will happily admit it when all the facts roll in, and I will work tirelessly to get all the facts, even if they prove me wrong.

In general though, most of us ended 2022 thinking that all the government stimulus was finally petering out and reality was about to come home to roost. We failed to see the impact the ERC tax rebates would have on the economy in 2023 as well as the decision by the Biden administration to provide an “on-ramp” and not credit report missed, “resumed” student loan payments until October 2024, much closer to the election. As such, 40% of student loan borrowers decided not to pay, an increase from the 26% who were not paying prior to COVID. Thanks to the tireless efforts and incredible writing by Danielle DiMartino Booth (does she ever sleep?), awareness of the probable fraud and ridiculousness of the ERC program occurred and payouts were halted, but not before we sent many packing to Europe on a vacation of a lifetime.

What other lessons did I learn this year? I learned, once again, the power of narrative. As someone who studied narrative in my undergrad and graduate studies, you would think I would have a better grasp on its power, but I think that it’s harder to see it when you are smack dab in the middle of it. In the past three years of diving into macro, I’ve had to strip myself of many such delusions about our current reality.

As we close the year, we still only have November data so there is not a period quite yet to put on the end of 2023. However, the data we did get in December on the housing market proved confounding yet again to many. For Zelman, they believe the abysmal new home sales we saw must be due to a data issue. And, I would be a hypocrite if I didn’t give that theory proper credence based on everything I said above. However, I think that just about everyone is a wee bit too focused on rates. That stomach-dropping rate move we’ve seen in the 10-year and mortgage rates infected not only the stock market, but many who I thought would be more sober about the move.

Higher rates have certainly made homes more unaffordable, but why are so many discounting these moves in home prices?

I know in 2021, we thought we were all getting rich as wages finally started to increase. But, what about now? Despite a few victories this year, wages have not kept up with home prices, or most other prices for that matter (I will leave the CPI/PCE debates to those who are more patient than me. I will just simply say - they are not reality, and you knew it every single time you have made a purchase this year). There are several different data series you can use to triangulate where we are with wages, but here is one:

And another, courtesy of (Kenny Capital (@KennyCap_Phd) / X (twitter.com)

As the bulls galloped around in glee over the rate moves, the upward moves in home prices in the lagged indices sent them on a victory lap. For a detailed look at home prices and the various indices, I recommend Bill McBride’s Substack. Although Bill and I disagree on path, I am a serious fan of his detailed dives into these data series.

But, Whoa Nelly, I say. In more recent data from Redfin, we see price drops in many key cities and 37 of the 76 markets that I track even as sales decline month-over-month and year-over-year. Two key reasons I think we have continued to see prices increase (which I said would absolutely be the case in my debate with Logan) is largely due to both the fact that it is those that can afford it who are transacting while at the same time, the builders are not “registering” their net price so comps are skewed. Most in the industry see these two markets - existing and new - as operating separately, but how could that be? I also think we may be getting a skewed picture on existing as well as many took advantage of buydowns offered by their lenders. I hope to do a case study to prove these theories out in the new year.

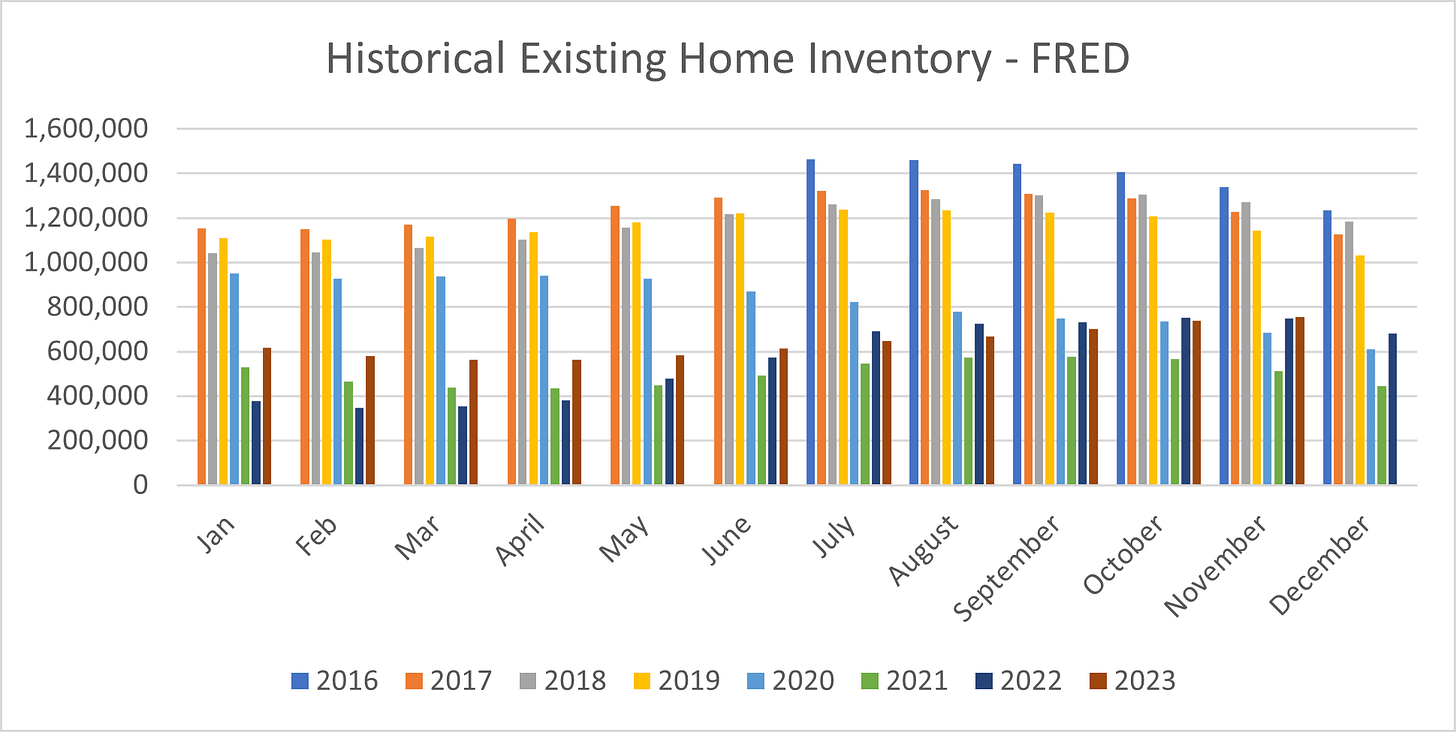

And, what about inventory? To almost everyone’s surprise (except yours), inventory started to increase at the end of the year.

I think we will see the seasonal drop from November to December, and I am seeing it in the cities I track, but come January my belief is that upward trajectory continues which is going to make things really interesting this Spring.

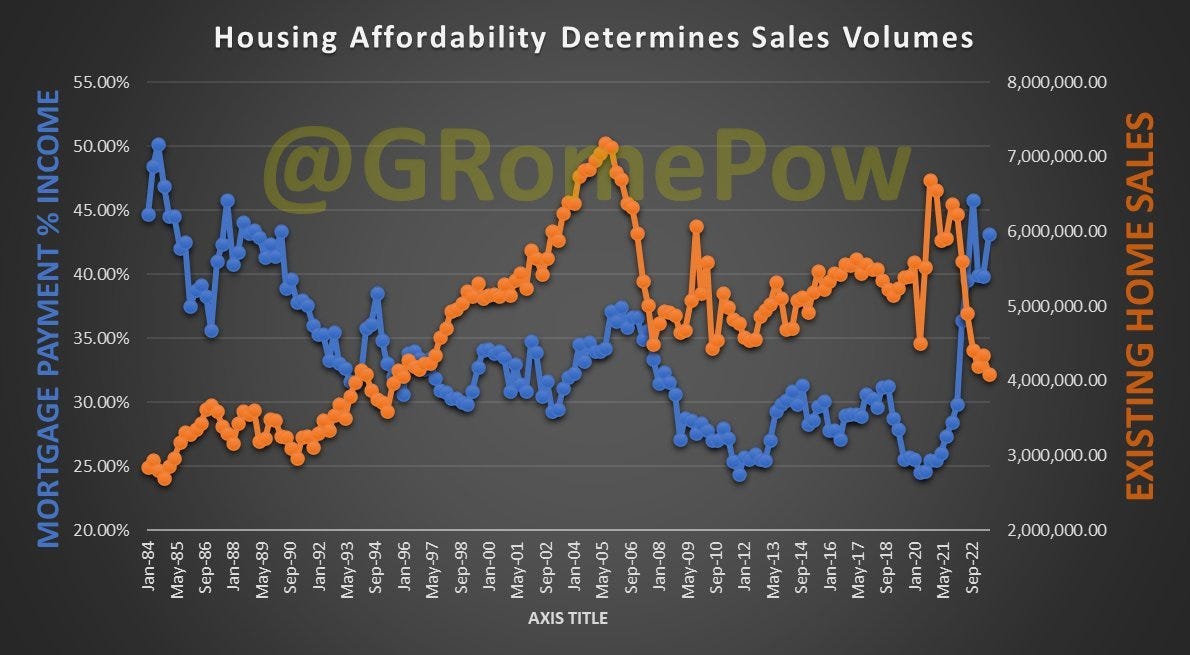

Next week I will focus on what I see in the year ahead, but to close out my musings on 2023 before diving into Denver, I want to focus on affordability. Why does this not matter to anyone? I simply do not understand why people eschew this reality. We absolutely pulled forward demand during COVID as evidenced in the Harvard study, so how many of the top 20%ers out there are going to go nuts and buy more homes than they already have as a result of these rate moves? Fannie Mae did a survey asking people if they planned to stay longer in their homes than originally thought and why in an attempt to gage the lock-in-effect. They came up with some interesting conclusions:

Every time I ask a Boomer why they are staying put, they tell me they can’t find a home at a price that makes sense or preserves the equity they thought they had built. Those of course are the Boomers who have a wide array of choices. As many Boomers try to survive on fixed incomes, they will be forced to make harder choices as we’ve seen property taxes and insurance rise astronomically this year. In Florida, those increases are having an outsized impact.

Lakewood Ranch, featured in a former stack will be one of many epicenters in Florida for what I think may turn out to be a very disorderly spring selling season. My belief is we will see more evidence of this strain later next year as we get more data on migration patterns. According to the USPS, Miami is already in the top 5 for net migration out along with Austin.

I do wonder as well how many may not be able to sustain these costs even as their initial choice was ideological, reversing these COVID trends.

For our other cohorts (GenX, Millennials, GenZ), things are much more dire. In our current day and age, affordability largely comes down to whether that monthly payment will fit within your monthly budget (ability to repay has gone out the window, but that is a discussion for another day).

If we compare to two years ago, there is huge difference in monthly payments. In October 2021, the payment on a $500,000 house, with a 20% down payment and 3.07% 30-year mortgage rates, would be around $1,701 for principal and interest. The monthly payment for the same house, with house prices up 14.4% over two years and mortgage rates at 7.62% in October 2023, would be $3,239 - an increase of 90%! Almost double!!

I think it’s cute that people still use 20% as the standard for downpayments. According to Forbes, the average downpayment in 2023 was closer to 14.4%. The reality, though, is that many, many homebuyers took advantage of the 3% or even no downpayment programs offered by our friends at the agencies.

Rising delinquencies in credit cards, autos and even in early-stage mortgage delinquency (over 9% for FHA!), paints a pretty gnarly picture for next year. Many have taken on two jobs to meet their rising expenses. For those that argue persistent wage gains, I just don’t see that happening at a scale or pace that will stem the tide that threatens to overtake us. Instead, I think many will be dancing their final YOLO dance at New Year’s festivities this evening as they gave up the ghost of home ownership earlier in the year, electing instead to pamper themselves and nurse their wounds with experiences and Starbucks.

As many of you know I believe we are living in a Silent Depression since the GFC, a concept that has been getting much airplay on TikTok with millions of views. Just recently Fox, CNBC and ZeroHedge picked up the story without, however, credit to Emil Kalinowski who originally coined the term.

Soon(ish), though, I believe everyone will be acutely aware of our dire straits even as the PsyOps and narrative machines work on overdrive as the election approaches. For housing and home sales in particular things are looking really ugly.

I could spend the next three weeks writing about what happened in 2023, the push and pull that kept us dazed and confused, but unfortunately there is simply no time for that as we must turn our eyes forward to what is to come. As mentioned, more on 2024 and beyond will be forthcoming next week.

Now to Denver where so many will be left high and dry (pun intended)

Some of you may have already realized I’m a bit of a procrastinator. This is especially true when confronting things that personally resonate with me and such is the case with Denver, my home from 2015-2019. I remember being a 20-something on one of my road trips across the country and driving through Denver traffic with the sun blazing in my eyes thinking I would never live in such a spot. Oh, the ridiculous certainty we have in our 20s….A fan of many other spots in Colorado, Denver seemed very Midwestern blah to me with little diversity and not a lot of charm. But in 2015 after leaving a truly horrible job, I spent a few weeks camping with my nephew and met up with a colleague who had recently taken a job there. Next thing you know, I was headed from Dallas to Denver, hoping for a new start and a place to lick my wounds.

The first things you notice about Denver are how it impacts you physically. At 5,280 feet above sea level going up those stairs takes a little more energy. If you are the frizzy-headed sort like me, your hair will immediately deflate upon arrival. You may also find upon awakening those first few days you have a bloody nose because it is just that dry. I remember stopping for gas in the summer. When I went to retrieve the squeegee to wash my windshield the container was bone dry as was every single other one at the other pumps. Humidifiers are an absolute necessity.

After arriving and spending some time there you realize that despite the fact marijuana is legal, most Denverites, in my limited experience, are very uptight and not the granola sort you might find in Boulder (although there are fewer of those in Boulder now). Interstate driving is on another level as people speed into town at 80 mph from the exurbs into stopped traffic as if they forgot they were no longer on the ranch. I witnessed more traffic accidents in Denver than anywhere else I have lived.

But what I noticed the most in 2015 when I moved there was the unaffordability. The cost of housing - renting or buying - relative to wages was crushing. At the time, many attributed it to the fact that Denver was going to be the next Silicon Valley. Tech, tech, tech was all you heard everywhere you turned. The “Tech Center” was hopping and cranes were a’swinging with new commercial, multifamily and housing construction. Knowing a little something about bubbles, you could tell there was one brewing there.

Almost everyone you met had a second job, or their partner had a second job, or they were “house hacking” (roommate) before it had a cute name. Every person who reported to me at work was struggling financially. Denver is the first place I remember encountering the “labor shortage”. In reality, service jobs had started to offer more competitive wages than the ones my mortgage servicing company was offering. I waged a battle with HR to raise the salary of my team and made a lot of friends (not).

Many I talked to were considering moving out of Denver. And, according to the American Community Survey, Denver did indeed have negative demographic growth from April 2020 to July 2022. While living there I found myself not being able to justify the expense of concerts, eating out, etc. In fact, I have been to more concerts in Denver when I wasn’t living there than during the time I did live there. In many ways I think Denver, like Nashville, caught our COVID bug early and got a running start.

From what I saw out there this past November, I believe the fever dreams are on the cusp of dissipating. I shared in a previous post that it felt like Denver was just one new-build site. For me to say that after witnessing what I did 2015-2019 is saying a lot. The empty offices and commercial buildings in the Tech Center, however, is new. The area I used to avoid like the plague was just an empty shell of its former self. Yet, the multifamily and new-build construction surrounding the empty center had not abated. Every available spot within the perimeter was under construction as well as way out into the ex-ex-exurbs right in the middle of highly flammable prairie grass.

As promised, Travis from Real Estate Mindset shared some of his drone footage so that my readers could get a better view of what I saw:

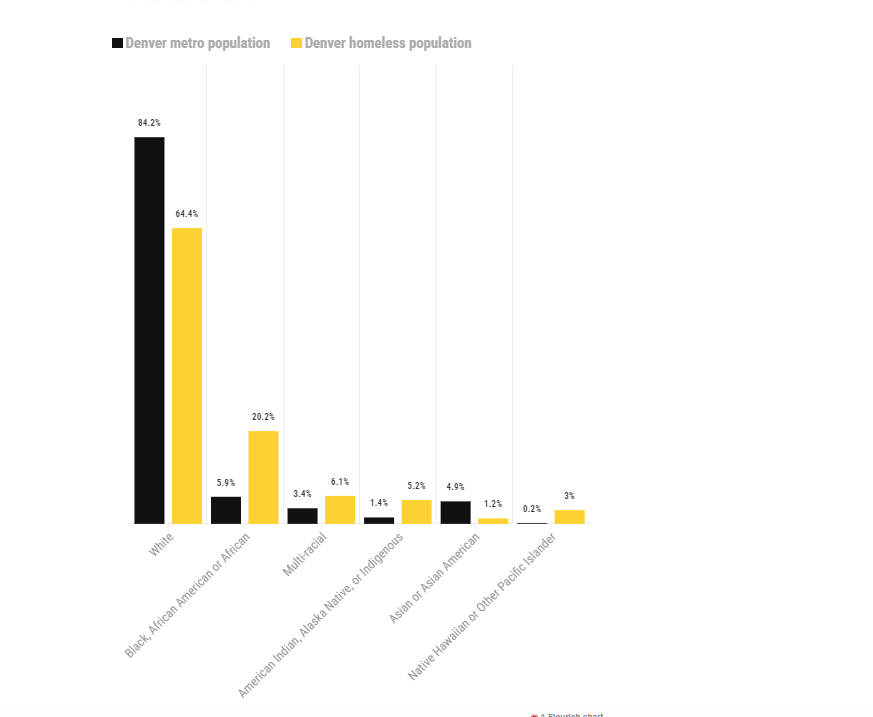

The current median listing price in the United States is $420K. In Denver it is $625K, down from a peak of $695K in May of 2022. Median household income is $86K. Ummmmm…..is it any wonder then, that there is a “burgeoning humanitarian” crisis in Denver with respect to its homeless population? Although some point to the migrant situation as a driver of homelessness, the Colorado Sun reports differently.

My favorite radio station is in Denver, and news segments have been covering Mayor Johnston’s campaign to get 1,000 homeless off the streets by the end of the year. It looks like he will make his goal, just barely.

For the metrics I track, here are some recent stats:

According to Redfin, sales in Denver are down -8.10% year-over-year and -13.17% month-over-month. The median sale price is down -5.2% year-over-year and -3.51% month-over-month. Listings for sale have increased 19.83% since January, while listings for rent have decreased -14.49% compared to its 21-week average. As of October there were 5,670 short-term rental listings according to AirDNA. Multifamily occupancy is at 94.00% compared to the national average for October of 94.3%

The latest data for JOLTS (job openings) in Denver from June shows openings are flat and tracking with the U.S. Most folks in Denver, though, will tell you that the jobs available don’t pay the wages needed to afford housing (see median income).

In the near future, I hope to have a semi-formal scoring system, but until then my outlook for Denver is not good. As I write this, my nephew and brother-in-law are sitting in Mile-High stadium (aka Empower Field at Mile High) trying not to be bummed as the Broncos face the Chargers after the humiliating loss to the Patriots, which all but dashed their playoff hopes, and the benching of Russell Wilson. I, however, could never quite bring myself to root for the Broncos. Nonetheless, for their sake, I hope the Broncos win.

This was a long post and could have been much longer, but there is just so much to report and say. I hope that by turning on paid subscriptions in the New Year I can get a better routine and take on less client work. So, again, thank you, thank you to all of you who have made this year so unbelievable and for believing in me when even I could not.

Happy New Year!

Weekly Updates

Inventory is indeed on the decline, so I wanted to look back historically to see if the decline tracks with prior years, so here are two views updated for November data.

We don’t have December numbers yet, but going back to 2017, inventory declines from November to December on average about 10%. It will be very interesting to see where we land. If I look at the 76 cities I track, we’ve seen month-over-month declines of about 8%.

This week in inventory we saw declines of about -2.86% week-over-week and -3.82% to average due to both seasonal factors and the fact that builders, as mentioned last week, seem to be pulling new listings or strategically placing them on Zillow for instance instead of Realtor.com, the listing site used by the Fed for its inventory sites.

However, rental inventory continues to increase, albeit at smaller amounts and at a slowing pace with a .31% increase week-over-week and 4.71% to the 21-week average.

Listings for Sale

Top Cities with Largest % Increase in Inventory Week-over-Week (12/10-12/17):

Brattleboro 5.88%

Sedona 1.17%

Wexford County, MI 1.11%

Galveston, TX .71%

Lakewood Ranch, FL .64%

Honorable Mention: Fort Lauderdale .45%

Top Cities with Largest % Increase in Inventory Compared to 21-week Average (12/10-12/17)

Hoboken 54.04%

Palm Springs 21.55%

Bakersfield, CA 20.25%

Fort Lauderdale 12.76%

Fort Myers 10.38%

West Palm Beach, FL 8.49%

Johnson City, TN 8.32%

Pembroke Pines, FL 7.95%

Miami 6.36%

Tucson 6.00%

Top Cities with Largest % Increase in Inventory from Start (1/1/23)

Hoboken 79.45% (up from #2)

Bakersfield, CA 70.76% (up from #3)

San Ramon, CA 65.00% (down from #1)

Galveston, TX 43.94% (up from #5)

Fort Myers 37.46% (up from #7)

Coeur d’Alene, ID 37.05%

Dallas 32.25% (up from #8)

Knoxville 30.30%

Denver 30.17%

San Francisco 25.71%

Listings for Rent

Listings for rent were up .31% week-over-week and by 4.71% up compared to their 21-week average.

Top Cities with Highest % Increase of Single-Family Rental Listings (12/10-12/17)

Portsmouth, NH 25.00%

Newport Beach, CA 19.85%

Sedona 19.35%

Tupelo 13.79%

Costa Mesa, CA 13.41%

Top Cities with Highest % Increase of Single-Family Rental Listings to 21-week Average

Sevierville 41.8%

Cape May 32.11%

Destin 30.33%

Dallas 26.74%

Knoxville 25.95% (something’s up in Knox)

Top Cities with Highest % Decrease of Single-Family Rental Listings to 21-week Average (12/10-12/17)

Denver -11.31%

Boise -10.40%

Bozeman -9.84%

San Ramon -8.59%

West Palm Beach -6.57%

Airbnb/VRBO - Short-Term Rental

Airbnb/VRBO will be tracked monthly only as Airbnb has removed the ability to see average daily rates when searching. Hope to have November in the next week or so.

Top Cities with Largest Decline in Short-Term Rental Average Daily Rate Year-over-Year for October

(# of cities with Y-O-Y ADR decline for October is 39 of 76)

Palm Springs, CA -12.65%

El Cajon -10.61%

Destin -8.29%

Nashville -8.18%

Cleveland -7.88%

Top Cities with Biggest Increase in Short-Term Rental Listings for October

Sacramento

Austin

El Cajon

Las Vegas

Knoxville

Top Cities with Highest Average Daily Rate October

Newport Beach $478

Rosemary Beach $463

Palm Springs $410

Encinitas $365

Cape May, NJ $365

Commercial Real Estate (CRE)

The most notable thing (to me) since we last spoke are the accusations by Brookfield that the FDIC didn’t pick the highest bidder in the Signature bank auction.

Brookfield Property Group said the FDIC was running a “secret” process to sell Signature Bank loans. It accused the regulator...of picking some winning bidders for assets at prices substantially below the highest offer.

And, then, over in builder land, Lennar posted its earnings and almost everyone ignored the loss and year-over-year variance in their multifamily unit. Thankfully, CoStar attempted to address it. Quarterra, an arm of Lennar,

Is currently ranked seventh on the National Multifamily Housing Council’s list of largest apartment developers. In 2022, the company broke ground on more than 5,200 units

This is quite frankly just the beginning for Lennar as I heard they are choosing not to build up cash. Guess they are banking on Uncle Sam being there again.

I really love that you aren't afraid to be "human" in your writing. Much more relatable than some of the dry content out there. You are quickly becoming one of my most trusted sources of information for the housing market because of how thoughtful you are.

1. Really appreciate your writings and read them as soon as i notice they are out. Well researched and well thought out. I don't always agree, but they are always worth reading.

2. We kicked the can in 08 and never let anything reset and I have been saying this since, it's obvious when you look back how far living standards have devolved.

3. Denver native here. Moved in and out for a year or two but always back to home. In 2020 after the idiocy (which they were big into) packed up the family, sold the house for a utterly ridiculous price and moved to a small town (NOT in colorado which at this point is just Eastern California and not in a good way) and paid cash with the "winnings" from selling the house. Everyone I know that had a business, productive, big money maker has pulled up stakes and left, after 20/30/100 years there. It's all just takers and fakers at this point.

Dunno if you now but they changed the property tax laws, so it now goes up with the valuation. And of course when they revalued in 2022............guess what? values were way up. AVERAGE valuation in Denver metro was up like 35%. That means a jump in property taxes of 35% AVERAGE. Colorado isn't going to be a low tax state for long (see above about Eastern California). And insurance is close to double because things got expensive, new laws, big fires, etc. Denver (colorado) is going to be just like florida. All those 3% mortgage people who are barely making it and their taxes go up 50% and their insurance doubles (which already isn't cheap). Yeah your conclusion is dead right.

Also you weren't there, but legalizing pot destroyed Colorado. It went from being ok to being a total disaster in 5 years.