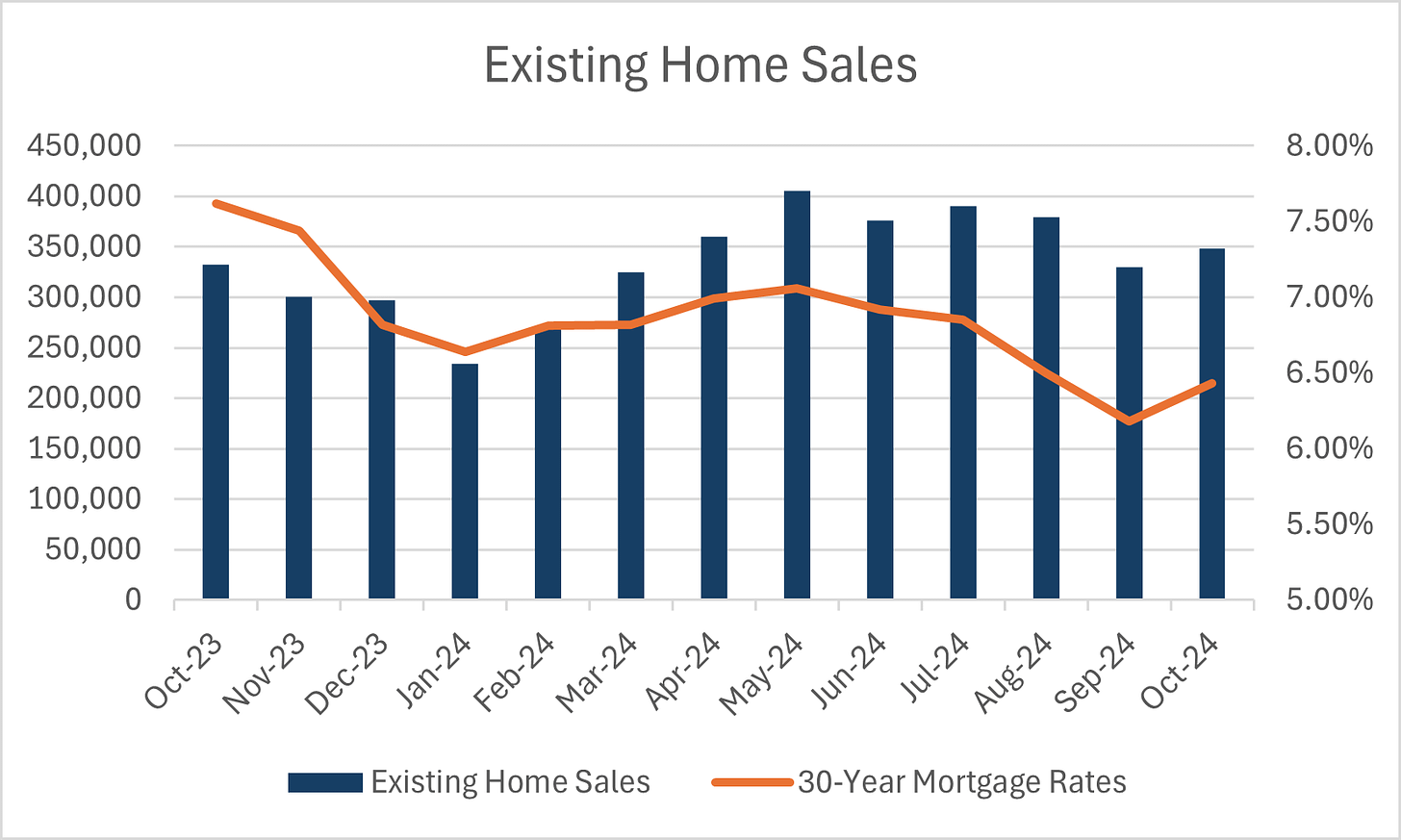

As forecasted in this column, existing home sales came in unseasonably warm both YOY (4.8%) and MOM (5.5%) for the first positive YOY comparison since 2021, buoyed by pre-rate-cut mania, additional business days and sales that were postponed due to Helene…not to mention just how bad sales were this time last year as rates peaked at 7.79% last October. Some of my smaller clients in the mortgage industry celebrated their best month in three years. Is the worst over as many in the housing industry claim?

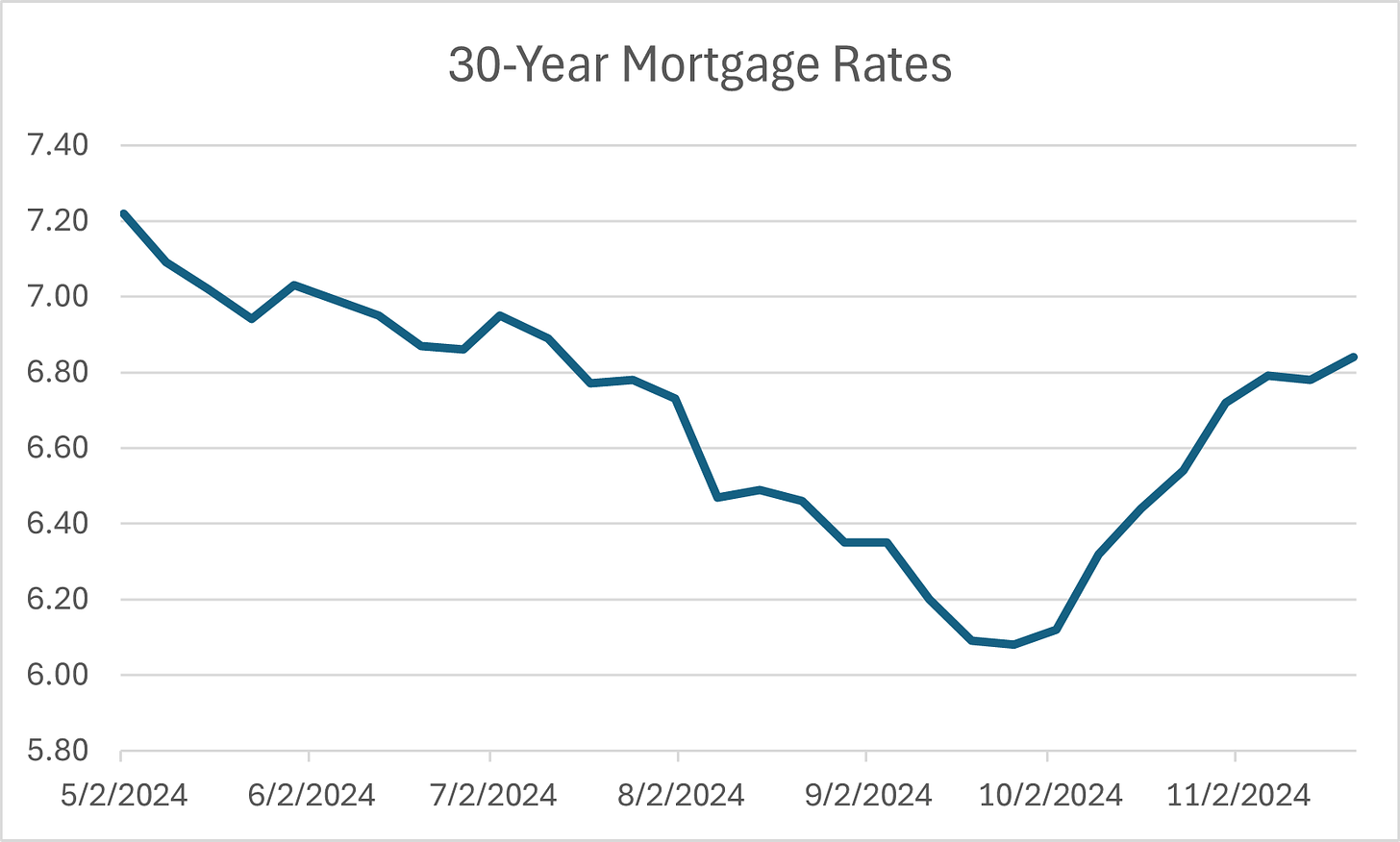

Just as the industry got a little too overexcited by those mortgage rate drops that started their downward path in May, only to be frustrated when mortgage rates started to rise following the jumbo-sized Fed rate cut in September, so do I fear will they be disappointed yet again. The refinance “boom” was stopped dead in its tracks as rates rose yet again.

Source: FRED

Rates, however, were not the only reason that wave was never going to be strong enough to turn the housing and mortgage markets around. I warned several times in this publication and on social media that we should wait and see who could actually qualify for those refinances. Many consumers waived inspections and even appraisals during the frenzied COVID boom. Inflation meant that homeowners put off needed repairs. Additionally, as Fannie Mae noted in an appraisal update after reviewing 7M comparables, 58% of appraisals did not properly list seller concessions, inflating values. Tack on dings the consumer might have taken to their credit due to late payments on cars or credit cards and you have a consumer who is not in great shape. Graphs and commentary abound highlighting the so-called equity the consumer has in their homes, but that has not been put to any test at scale. Those that are testing it are finding if they truly want to sell, the price must come down. Just ask Realtor.com who now sends me multiple messages a day on price cuts.

You don’t have to take my word for it, though. The Federal Reserve Bank of New York recently released its credit access survey and noted that “the average rejection rate for mortgage refinance applications increased to a new series high of 25.6 percent in 2024 from 15.5 percent in 2023.” The mortgage industry’s premature celebration over increases in refinance applications forgot to take into consideration the constrained consumer. As each month passes, distress continues to build.

Do these unseasonably warm results mean that the housing market has started to thaw? For perspective, the average decrease in sales from September to October since 1999 is -1.74%. The 25-year average for existing homes sold in October is 443,080. This month’s sales were 348,000 - just a hair below October 2008 and every other year except for 2010 and 2023.

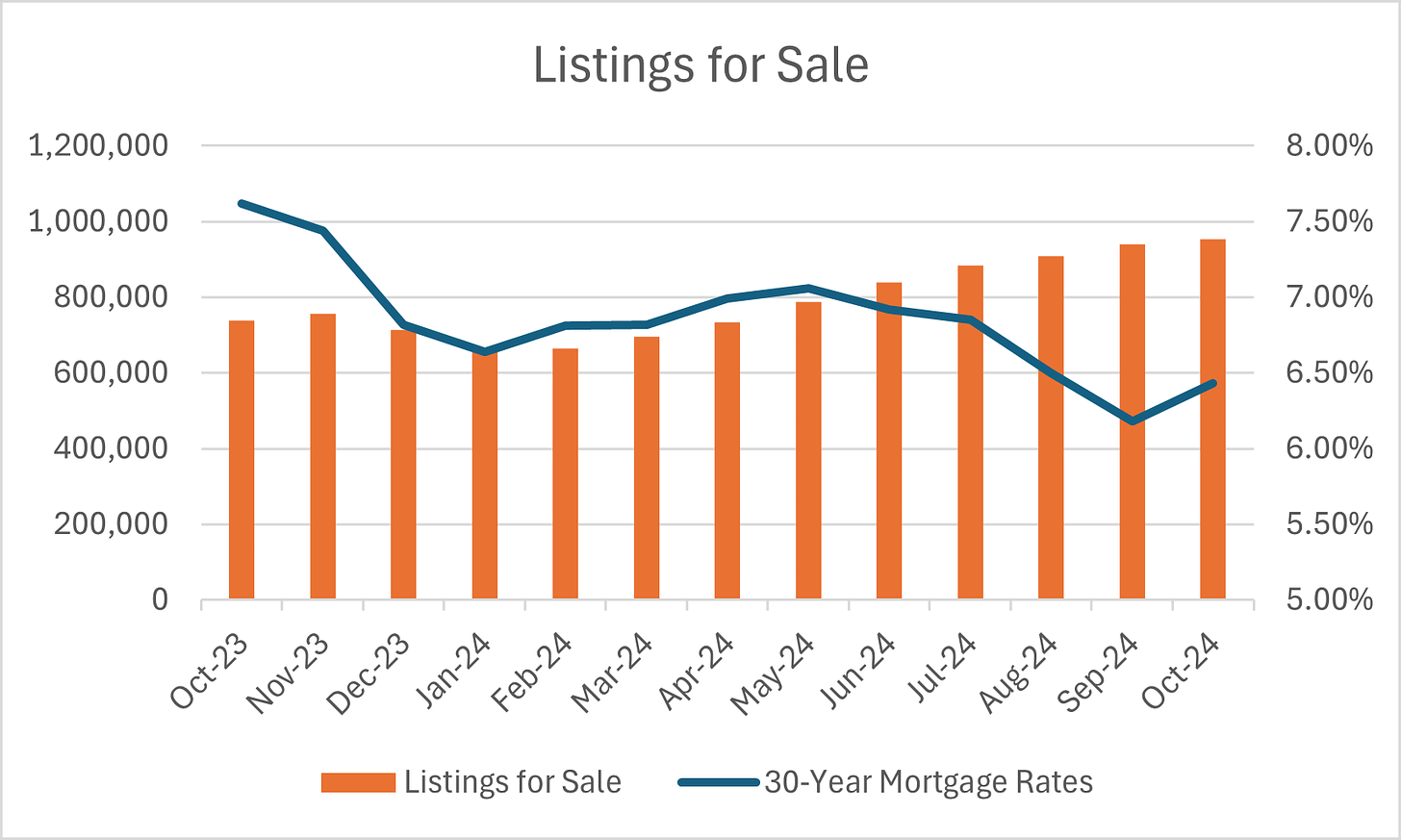

As of today, the 30-year mortgage rate is 7.03% according to the MBS Live Dashboard. As a reminder, the existing home sales series tracks closed sales which can take anywhere from 30-60 days to close once the initial contract has been signed. The average rates from August-October were 6.38% compared to 7.28% last year. The decrease in mortgage rates in my opinion brought out the sellers more so than the buyers. There is no denying that sales came off the floor, but I think the bigger story is the rising inventory as well as acceptance that prices are just too high and price cuts must be made. Although, the median price rose slightly MOM by .12% and by 3.98% YOY, this has more to do with who is transacting - 31.3% of the increase in YOY sales per NAR were for those homes priced over $500K. Typically inventory peaks in the summer and starts its decline in the fall.

Source: FRED

Listings for sale increased 21.09% since May when rates started their downward trajectory. Understanding there is only one way to get buyers back in the market, Realtor has recently pivoted on inventory and price.

For those that (have to) follow these industry publications, this is quite a pivot. In fact, I cannot tell you how many times Realtor and NAR trotted out the 6-months of inventory axiom as justification that inventory was the only issue with the housing market. To hype 4.3 months as a reason for it being the best time to buy in 5 years is astonishing for those of us who can remember the recent past. On a separate note, I spent entirely too much time trying to find analysis steeped in data or reasoning behind that 6-month inventory requirement for a balanced market to no avail. As I’ve argued here, I believe that when all is said and done the lack of inventory on Realtor.com and other MLS has more to do with a transition the industry is making to non-traditional ways of marketing and selling homes. That, however, is a story for another day.

In my weekly tracking using Realtor.com which is also what FRED uses, I can see that listings are being pulled as sellers do not drink from the same hopium-springs-eternal fountain that the industry does. We will likely see a seasonal MOM decline in listings for sale, but I believe that will be short-lived. Florida has started its snowbird season and listings are increasing there, but most of the country will turn its focus to turkey, football, Christmas pageants and the usual holiday fare.

Where are sales heading from here? If you listen to the industry and some corners of the financial media they believe “the worst is over,” but they always believe it to be so.

New home sales, which track contract signings versus closed sales, will be published next week and will offer an interesting comparison to see how higher rates impacted the builders. Since late 2022, the builders have focused on price cuts and rate buydowns to push inventory so theoretically these rate moves should not have had as significant of an impact. We shall see. For today’s post, let’s look at the high-level M3 October summary of results for sales, price, inventory, delinquency, foreclosure and credit metrics to find clues as to what’s next for housing. Additionally, we will check in on our communities impacted by recent hurricanes - those stats are even worse than I feared.

Keep reading with a 7-day free trial

Subscribe to M3_Melody Substack to keep reading this post and get 7 days of free access to the full post archives.