It’s hard to describe my state of being these days as I seem to vacillate between a sense of drowning, dread and then for days sometimes my brain lights up like a Christmas tree weaving thoughts and threads from the deluge of information that washes over us daily. By nature I am creative, but not necessarily in the artsy sense (sometimes). My greatest creativity usually comes in solving complex problems within complicated systems. Which is why my GFC lasted longer than most.

In chatting with a pal last week we were discussing our time during the GFC. He said something like “that was a rough couple of years.” Couple, I said? For me at least I would say it was a rough seven or eight years due to the default cleanup followed by four years of hiding in Corporate America as I watched it fall apart, nursing my wounds and wondering what the hell happened and typically what the hell was wrong with me. That is why the Corporate America model worked for so long even as once vibrant operations were being hollowed out…if something wasn’t working it had to be your fault. If you didn’t go along with the status quo, or asked a few too many pointed questions, you would find yourself sidelined, “in trouble” or boxed in some way. One illustrative example is how at one of my employers us middle managers were held accountable for turnover when the company refused to pay a decent market wage. Not only were we not paying competitive wages, but we were also not allowed to actively manage performance issues as everyone was afraid of turnover. The bad apples infected the whole lot creating a vicious cycle. This was 2015-2019 when people were starting to make as much money waiting tables as working an office job. And culture was changing. No longer was getting a stable office job with insurance and a 401K the holy grail that it was when I left graduate school. In this crazy system you would be left trying to figure out how to get performance out of people you could not hold accountable. Numerous times I paid for treats, gift cards, training classes, etc. out of my own pocket. Ridiculous, I know. But, it’s a cool trick to take an overachiever and present them with a problem they cannot solve. Crazily, I believed that I could make a difference from within the system. Through sheer will, you end up solving the problem, but typically at a significant cost to yourself. And, if you assume positive intent as they train you to do (and I generally agree with) it can take a long time to realize that you were living in a Silent Depression and what was happening had everything to do with the fact that your overlords refused to pay a living wage, enriching themselves through bonuses and investors through stock repurchases, etc., while draining people of their sense of humanity and manipulating them to squabble about the things they could not control. This was especially true in my industry who both wore the GFC like a talisman and an excuse for everything that ailed them.

No one was interested in truly fixing things. And that is what I learned so completely as I left GMAC (Ally) and went off to the nonbanks that would step in to replace the banks who had stopped lending as Basel III requirements made holding mortgage assets too costly. At first I was excited about building a company that could disrupt the status quo, take care of our customers and be profitable: “Top 20 the Right Way” was our motto (guess who came up with that?). Riding high on what we had achieved at GMAC - meeting regulatory requirements, keeping the lights on and the loans funding during bankruptcy to ensure a successful auction while focusing on the customer experience - I believed I could help those who hadn’t been crushed under the regulatory actions such as the FRB Consent Order and the AG Settlement to transform the industry. I was an idiot and very naive.

The nonbanks certainly had to appear as if they were playing by the rules and a very small number of people did care, but I soon found at each one of these shops that there was no interest in really changing the game. Were they doing things badly intentionally? No, the regulations and requirements after the regulatory cycle were so onerous that enforcing your own contract was impossible and the available technology was abysmal. The nonbanks became the b*tches of the GSEs in ways that we at GMAC didn’t have to be as we had connections to real money and understood the game. The nonbanks did not, but neither were they interested in learning. Thus, why they are so surprised about the recent uptick in repurchase requests from the GSEs. It’s just getting started….

I exited the belly of the beast in 2019 without a job. Everyone thought I was crazy including myself, but I had recently lost my nephew and I just didn’t see how what I was doing was a life - trying to change something no one wanted changed. So, I found myself at various Fintech companies thinking that if I gave the industry affordable tech tools from outside, I could provide solutions that worked for everybody. Again, I’m a (stubborn) idiot.

The point of this long preamble? More than anything I would like to walk away from what is happening after spending so many years trying to make it better, trying to prevent another crisis. As much as I was disillusioned with the industry I believed, like many of the current insiders - even ones I largely respect, that at least credit quality was ok as 95% of lending was controlled by government-sponsored or backed entities, meaning that the industry largely relied on the automatic underwriting systems provided by these entities. But, as discussed here previously, I was fooled again, not realizing that due to the inflation of credit scores and fancy footwork with student loans that there were issues lurking there as well.

It is with the lens of this history - of which this is a very brief snippet - that I must view what is happening. And there are days when the late stage shenanigans are just a little too much to bear and (almost) too hard to write about as it is so galling and so reminiscent. Late stage shenanigans you say - check out this recent advertisement from the industry:

h/t @TrishaFLSun

580 credit scores….no problem! for FHA/VA loans. Low downpayments, Bank Statement loans (think NINJA), buydowns, no downpayments for reverse mortgages…And this is with early-stage delinquency starting to accelerate as we have discussed here. The COVID forbearance which was an unprecedented 18 months of arrested payments will not be on the other side of these early delinquencies and the available non-COVID workouts aren’t doing the trick. Just ask FHA and VA who are both working on new assistance programs.

And, our builders have piled in offering rate buydowns which will reset in the next few years just as our ARMs of old did. This is in addition to all kinds of incentives like completing your yard in Colorado for instance.

Ok with the rate? Some builders will let you keep those preferred rewards ($51,599.40) as cold hard cash in escrow to use however you so choose if you elect to go ahead and pay the higher rate. And then let’s turn to our non-qualified mortgage (Non QM) or non-agency lenders who make up about 5% of the mortgage market:

h/t @Julio

Lest we forget the multifamily tricks and treats, the new Fannie program only requires 5% down at a time when delinquencies in multifamily credit are increasing. And this is just beginning as occupancy continues to decrease due to the delivery of the most multifamily product since the 70’s without the demographics to support it, constricting cashflow for investors.

And what if you avail yourself of one of these programs to fund your long-term rental? Based on comments from a recent industry survey, things are not looking so good even though the lenders and agencies above have not gotten the memo:

Our applications are down 10% year over year, while we have 20% more homes available for rent than last September - Georgia

Do any of the shenanigans above sound just a teensy bit familiar? If you have been reading my Stack, you know, know that subprime was just one aspect of the previous crisis. The aftermath of the GFC and bursting of the housing bubble was less about subprime loans and more about non-traditional speculation and then the destruction of your Forgotten (Prime) American - just ask the Philly Fed.

God forbid you say any of this on eX Twitter, though, you will be subject to a deluge of useless graphs and tea leaf readings about why it is different this time. Our favorite shillers never answer questions directly when a confusing graph can do the trick. They talk about the data a lot, but never actually give you the data to support their ASSUMPTIONS. Honestly every single one of their arguments is an assumption that they hide behind pretty charts that don’t back up their thesis in any shape, form or fashion. Team - I could spend 8 hours a day writing, giving examples here or on social media about why it isn’t different this time and may be worse. But, alas that would seem a little too reminiscent of all the emails, contests, presentations, pleadings, public pillories I endured the last time I tried to change the minds of those whose vested interests lay with ignoring me completely. My focus instead will be preparing us for what is to come by providing the clearest picture I can of the path ahead.

On that note, Mr. Awsumb is back with us this week to give a little update and peek into why some of the charts being thrown around about our lack of inventory don’t quite tell the whole story about what’s ahead - especially when it comes to new construction and months of supply in the pipeline.

Over to you, Mr. Awsumb…

Hello again, all. Since the Census Bureau just released new construction permit data, I thought I’d add some context and highlight important information.

The Census Bureau breaks these construction permits into stages. Approved (the local authority approved the permit), Starts (work has actually begun) Completions (when the home has finished flooring installed and could technically be considered “done”.

The new homes started for the month across every category is down from September of last year.

All Start types are down 12.1% (-12.1% Year Over Year). And Comparing 2021, 2022, 2023 we’ve got 2 consecutive years of starts decreasing. It’s important to note, these are actual numbers, not seasonally adjusted annual rate (To calculate SAAR, take the un-adjusted monthly estimate, divide by its seasonality factor, and multiply by 12. Analysts start with a full year of data, and then they find the average number for each month or quarter. The ratio between the actual number and the average determines the seasonal factor for that time period. I choose the non-seasonally adjusted data, to be frank, because I don’t care what the bureau forecasts the data to be at year’s end).

I mentioned that housing starts are down, here’s a look at that in a chart. This is single family, duplexes, triplex, and apartments combined:

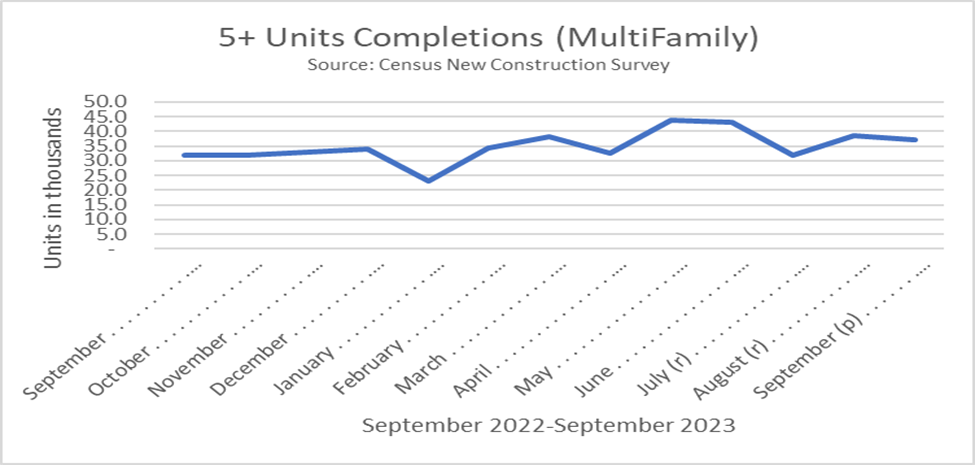

Completions (Delivery of product) of single family (single home units) however, are continuing relatively apace year over year. Which implies, backlogs are becoming inventories. Multi Family Completions are actually increasing. This should put downward pressure on rents, as more apartments become available for lease, while the continued inventory of single family builds should add more pressure to drive down sales price. Rates aside. (Excess supply increases operating expenses of builders and developers, so they become incentivized to move the inventory.)

The Census also tracks sale types. Sold as Not started (A lot ready to build on), Under Construction (Any stage of the home being constructed) and Completed (Ready to live in). One thing to note is that there are more multi family (Apartments, Condos etc) under construction than last year. So despite the number of completions maintaining, there’s even more in the works that will be finished in the next 19 months.

I point this out, because I’m already seeing articles like this:

Note at the bottom, the acknowledgment of both apartments and homebuilders adding incentives to buy/rent? Incentives as in, money back at closing, bought down mortgage rates, free rent for x amount of months. Developers are already feeling the pain of a slowing economy, and increased rates.

As for homebuilders, we discussed inventories piling up, and I should have a better update next week after the lates sales data is released. In the meantime, some interesting points:

The data itself outside of the “excess” uncounted inventory I calculate, and that Melody has documented via video and writing. Here’s a look.

These are important, the number of houses for sale that are completed at the end of each period (Month) are staying elevated. Meaning Inventory. As for the for sale under construction, vs sold under construction, this is a pretty good indication of the late-stage build cycle. And why despite what you may hear -“there’s so few homes for sale” -, the picture is a little different. Allow me to present where months supply peaks:

This chart shows the comparison of homebuilder cycles. Sales under construction and how many are available at that stage. If you ask how many months supply there is, it’s akin to asking “how long until we get there?” during a road trip. If you have a 60 mile trip, at 60mph, you’ll get there in one hour. If you’re traveling at 30mph, you’ll get there in two hours. The opposite is true, if you travel at 120mph, you’ll get there in half an hour. Well, when months supply is decreasing, its because the pace of sales is increasing (more people buying). So builders build more. Slowdowns also happen, like recession. Then months supply peaks for the cycle. This view shows 2023 year to date. And while the supply looks like it’s slightly sideways, the year isn’t over yet. Here’s where it sits month over month.

Thank you for the update, Mr. Awsumb. Looking forward to new home sales tomorrow and further updates. Like you, I believe inventory will keep climbing both with existing homes due to distress in our fraudster and investor class as well as with new-build inventory.

This week’s listing updates include the monthly summary and Redfin data. Sales in the cities I track per Redfin dropped like a stone both month-over-month and year-over-year. Could denial be on its way out? There is a lot going on (too much) and 2024 is an election year, so it is hard to say for sure, but I hope at the very least you are starting to see the path ahead. And, if you don’t believe this two-cycle veteran, check out these guys who have a few more cycles under their belt. Grant Williams believes the moves in the 10-year and yield curve are telling us one thing for sure - pain is ahead for home prices:

Monthly Summary and Weekly Data:

Redfin Monthly Updates

Top 10 Cities with Highest % of Homes with Price Drops for September

Indianapolis 50.30%

Denver 47.90%

Salt Lake City 43.70%

Portland 43.10%

Boise 42.60%

Winter Garden 41.70%

San Antonio 40.30%

Sacramento 39.60%

Austin 39.00%

Carlsbad 37.90%

Top Cities with Largest Drop in Median Sale Price M-O-M

Palm Springs -29.22%

Sevierville - 21.04%

Sedona -16.41%

Brattleboro -12.73%

Tampa -9.78%

Top Cities in Florida with Largest Drop in # of Homes Sold M-O-M & Corresponding Y-O-Y

Winter Garden -34.72% / Y-O-Y -26.60%

Fort Myers -17.80% / Y-O-Y +4.90%

Miami -15.35% / Y-O-Y -16.20%

Fort Lauderdale -12.50% / Y-O-Y +4.08%

Tampa -11.00% / Y-O-Y +10.40%

Top Cities with Largest Drop of # of Homes Sold Y-O-Y

San Ramon -47.30

Portsmouth -37.50

Hoboken -37.20%

Rosemary Beach -35.70%

Cape May - 35.30%

New York - 32.20%

Raleigh - 30.70%

Stamford -30.70%

Sevierville - 29.60%

San Jose -29.50%

Listings for Sale

Of the 71 cities I track 49 had week-over-week inventory increases (up from 41 last week). In aggregate, listings for sale were up week-over-week by 1.07% and 3.93% to the average (compared to .32% and 3.15% last week respectively) and up 18% compared to start.

Top Cities with Largest % Increase in Inventory Week-over-Week (10/7-10/15):

Encinitas 13.91%

Palm Springs 8.70% (#2 last week as well)

Rochester 5.40%

Bozeman 5.36%

Stamford 4.71%

Top Cities with Largest % Increase in Inventory Compared to 15-week Average (10/8-10/15)

Bakersfield 47.29% (data stayed consistent, will continue to monitor)

San Francisco 17.82%

Palm Springs 13.42%

Portsmouth 13.15%

Salt Lake City 12.95%

Top Cities with Largest % Increase in Inventory from Start (1/1/23)

San Francisco 104.93%

San Ramon 95.00%

Bakersfield 81.34%

Couer d’Alene 75.13%

Denver 67.66%

Salt Lake City 50.63%

San Jose 48.06% (up from #8)

Austin 47.67% (down from #7)

Boston 44.84% (new)

Portland 42.83%

*Boston kicked out Galveston this week

Honorable mention - Dallas 41.54%

Top Cities with Highest % Increase of Single-Family Rental Listings (10/8-10/15)

Listings for rent were up 1.81% week-over-week (compared to decrease of -.05% last week) and compared to 14-week average by 6.82% (compared to 6.78% last week) and up in many interesting markets (47 markets overall, up from 42 last week).

Sevierville 54.55% (smaller numbers, but big jump this week - a market to watch)

Rosemary Beach 16.67%

Destin 13.56%

Newport Beach 10.93%

Carlsbad 10.86%

Honorable mention: Austin 6.76%

Top Cities with Highest % Increase of Single-Family Rental Listings to 15-week Average

Cape May 119.61% (small numbers)

Rosemary Beach 96.49%

Galveston 35.45%

Carlsbad 26.78%

San Diego 21.28

Top Cities with Highest % Decrease of Single-Family Rental Listings (10/8-10/15)

Brattleboro -20.00%

Wexford County -16.67%

Bentonville -12.62%

San Ramon -7.69%

Couer d’Alene -7.14%

Top Cities with Highest Decreases in Occupancy for September Year-Over-Year (RealPages)

*Important to note that all the cities with occupancy information available on RealPages showed decreases in occupancy when compared to last year

San Antonio -2.32%

Boise -2.30%

Indianapolis -2.06%

Atlanta -1.94%

Augusta -1.87%

Top Cities This Month With Highest Negative Variance to Average Occupancy for the Month of September

Airbnb/VRBO - Short-Term Rental

Top Cities with Biggest Decrease in Airbnb Average Daily Rate Week-over-Week Compared to Average

Average daily rates were down on average 1% week-over-week and -13.11% compared to their 15-week average

Rosemary Beach -54.83% / M-O-M -5.62% / Y-O-Y -3.92%

Destin -42.89% / M-O-M -8.72% / Y-O-Y -12.69%

Chicago -31.76% / M-O-M -4.84% / Y-O-Y -11.17%

San Francisco -31.11% / M-O-M 1.21% / Y-O-Y -.40%

Portsmouth -29.23% / M-O-M .73% / Y-O-Y 2.17%

Top Cities with Highest % Decrease in STR Listings Year-Over-Year

September listings for short-term rental were up 13.28% compared to September 2022, while Average Daily Rate was up 0.47% and occupancy was down-0.87%.

*Telling that only 2 cities had year-over-year decreases in listings

Fort Myers -37.49% (Ian)

Westchester -11.11%

Top Cities with Highest % Decrease in STR Listings Month-Over-Month

Westchester -20.00%

Hoboken-14.24%

Indianapolis -9.05%

New York -8.54% (AirDNA uses a 3-month average, so this will come down significantly)

Missoula -3.62%

Top Cities with Highest % Decrease in Average Daily Rate (ADR) Year-Over-Year

Fort Myers -22.56%

Palm Springs -15.32%

Destin - 12.69%

Scottsdale - 11.40%

Chicago -11.17%

Top Cities with Highest Average Daily Rate - September 2023

Westchester $951.56

Newport Beach $765.06

Rosemary Beach $733.34

Cape May $665

Encinitas $611.72

Top Cities with Highest Average Daily Rate - September 2022

Rosemary Beach $763.23

Newport Beach $750.16

Palm Springs $704.31

Cape May $648.42

Westchester $558.47

Commercial Real Estate (CRE)

Brief update this week, but check out this tale from Charlotte where I first moved to help a new mortgage nonbank get its start in 2014. Back then, everyone in finance! was moving to Charlotte.

Uptown’s One Wells Fargo goes into receivership after default on $157M loan (yahoo.com)

h/t: Rashad Phillips

Narratives are just narratives are just narratives…sometimes all that is really needed is just a little common sense.

Tremendous work

Great stats!. Keep them coming.