Lessons Never Learned

And Other Devilish Details

Except building a reputation on shaky ground is precisely what so many in our post-GFC economy have tried to do. No longer was it about what one actually did but more aptly about what one claimed they did or were going to do. Overnight, analysts, writers, actors, economists, musicians, crypto kings, real estate “experts,” influencers popped up on their favorite social media platform performing expertise. It mattered little what training or experience (if any) they had. One simply had to stake their claim on their profile and post frequently enough using the applicable buzz words to gain a following. Preen on just the right influencers feed to get recognized and that first follow could pay off in spades. Heck - you could even buy followers. And voila a reputation was born often with no real accomplishments to shore it up and based primarily on a fantasy of what one hoped to do in the future. Instead, what often happened would be the resharing or repackaging of the ideas of others with no understanding of or deep research into the subject matter. And then, once some media platform quoted or interviewed this new expert, “As featured on…” could be added to their profile and the deal was done.

Under the influence of our COVID fever dreams we inflated the egos of a large swath of our population. By removing negative consequences from missed payments, we brought unjust confirmation to the idea that hard work did not matter. There would always be another job, another fresh start, another government program, another building to build, another deal to develop…it was so easy to do the first, second, third time. Similarly, we inflated the one thing that working Americans obsess the most about - their credit scores. For those who talk about some type of social credit system as something we might see in the future - I say it already exists in the form of the credit score/background check which could preclude you from working in certain industries already as well as from getting that apartment you wanted in the new, luxury development. I remember in 2014 when I had to approach the leadership of my company and tell them that if we did not change our policy and allow folks with bankruptcies or bad credit to be hired, I would not be able to staff my operational units. Now, of course, had my leadership been willing to pay more we could have solved the problem that way as well. In our low margin business, that was not an option. Can social credit scoring systems get even more restrictive and scary Black-Mirror style? Well, sure. In the meantime, we need to understand exactly what we did to these folks when we allowed their egos and credit scores to be inflated, removing accountability.

The posts I’m seeing from those who were not paying attention to their student loans and the stories I’m hearing are shocking and sad. From junior bankers to tech executives, it seems that there are many that did not think they would have to pay these loans back. Even if they thought they might have to pay them back, in our hyperfinancialized reality we have been taught to deploy capital where it will get the most return - not to pay our debts and slowly accumulate wealth which of course seemed impossible to do when rates you could earn on savings were so low. I remember the first time this was explained to me. Having received zero financial education in school or from my family who had been on a roller-coaster ride since the Reagan decision not to save the farmers, I was eager to learn from my wealthy boyfriend and his family. As we sat around the table in their beautiful New England home, his accomplished father told me that he took out the PLUS loans instead of using his own cash to pay for his son’s education because the interest rate was so cheap. He could make more money deploying the capital in the market. At the time he was in mutual funds. That didn’t seem right to me, but it also didn’t seem to be logically wrong with the limited information I had.

This is the lesson everyone has been taught. What they have not been taught unless they have lived it is what happens when whatever you have invested in goes sour and you can no longer pay that loan. Everyone, and I mean everyone, thinks that there are more Richie Riches out there than there really are. I have some version of this conversation daily. Yes, they go to the Country Club. Yes, they have the big house and boat, but it is all on leverage. They extend and pretend through forms of credit cards, personal loans and on a fake idea of wealth and the reputation that brings so that creditors are willing to lend when they shouldn’t. I remember a conversation I had with a banker about someone she might have to deny because the weekend before he was going to close on a home, he decided to purchase a $30K cruise package on his credit card which dinged his credit. She told me she would likely figure a way to make it work since he was such a high earner but would have to postpone the closing. No matter how much you earn, if you spend more, there will be trouble.

Recently, my buddy Nobody Special did an incredible video with Unicus Research on what’s happening in the auto market. Although I’ve been headline-following the auto market as well as reading and watching the insights brought to light by Danielle DiMartino Booth inThe Daily Feather based on data and observations from Lucky Lopez, I was still surprised by what Laks and team have uncovered. It sounds as if the same shenanigans we’ve seen to hide new and used inventory in housing are at play in the auto market as well. All to avoid true price discovery. Cars and houses make the real economy go round as Dr. Lacy Hunt has taught us, so what does this tell us about where we are? As we have discussed here ad nauseum, homes are out of reach for most Americans and gone are the days when your typical autoworker can afford one of the cars they produce. Ford famously shocked many when he offered $5 a day for eight hours of work in his factory in January of 1914, “double the average factory wage at the time.” If your factory worker only worked 5 days a week, they would bring home $1,300 a year. Ford did this because at the time he was experiencing “chronic absenteeism and lots of worker turnover” after the advent of the conveyor belt. The repetitive tasks were hard on the mind and the body, so he had to give employees a reason to stay.

According to ZipRecruiter, the average autoworker in May of 2025 makes $23.60 an hour, or $49,088 per year. Kelly Blue Book reported in January that the average new car price was $49,740 or $652 more than what your average auto worker makes in a year.

Wikipedia reports the average Model T Ford cost $490 in 1914. If your autoworker had no other expenses in 1914, they could have bought 2.65 cars with the wages they made in a year. Today, you cannot even buy one. How was this colossal rug-pull on the American consumer achieved? We were convinced that debt did not matter and that the only thing that did was whether we could make the payment. In America our reputation is now built on what we say we are going to do (make debt payments), not what we actually produce.

Source: Census, BLS, CPI via FRED

Not having access to new vehicle historical price information, I had to use the CPI index for new vehicles in the graph above which is likely understated. For deep dives into some of the ridiculousness to be found in the CPI indexes (including auto), I highly encourage you to subscribe to Rudy Havenstein’s Substack as he explains better than most the lies and damned lies in those datasets.

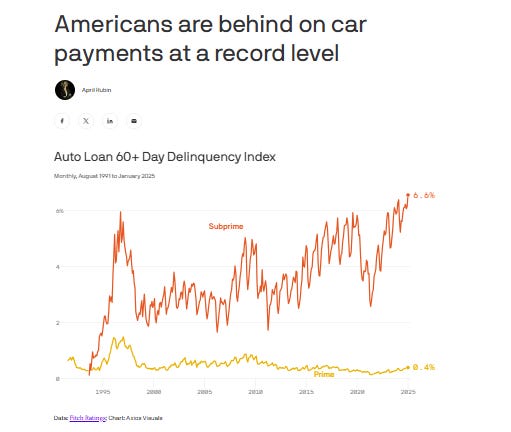

We now have serious stress building in both the auto and housing markets. Both of these markets are backed by complicated securities which are re-hypothecated in the derivatives market.

Someone asked me recently what would wake the market up to just how bad it is in auto or housing? For today’s post I will share my thoughts and initial answer to that question below. Fittingly, the city we will focus on today will be Detroit, the home of General Motors (GM) and Rocket Mortgage.

The home of the Ford Model T is now an abandoned factory complex along busy Woodward Avenue in Highland Park, Mich., and there's not much to distinguish this place from Detroit's other industrial ruins.

But if you stop and walk up to the front of the building, you'll find a historical marker telling us that by 1925, this place churned out more than 9,000 Ford Model T's a day.

And it ends with this: "Mass production soon moved from here to all phases of American industry, and set a pattern of abundance for 20th century living."

Detroit’s ups and downs illustrate well the many failed attempts those in power have made to stimulate the economy since hyperfinancialization took hold. We will dive into the city stats and prospects as well as analyze the city’s most recent “turnaround.” Additionally, we will review the history of the iconic RenCen, soon to be GM’s former headquarters, as a way to contextualize the current state of the economy. While most lay the blame for the commercial real estate distress at the feet of work-from-home that simply does not hold water when you visit these cities.

In other news, the New York Fed just published its Q1 2025 Household Debt and Credit report which I will share below. You are going to want to see the recent upticks in delinquency across the credit spectrum. And, finally, I will give a quick review of where we saw inventory slowing last week and where it is exploding -the West is on fire and Arizona is in trouble - as well as discuss quite the devilish detail that most have missed in that announcement ending some components of the FHA loss mitigation early. All I can say is WOWSER!

Let’s begin…

Keep reading with a 7-day free trial

Subscribe to M3_Melody Substack to keep reading this post and get 7 days of free access to the full post archives.