Read My Lips

“No New Taxes!” Bush Senior famously said at the 1988 Republican National Convention in New Orleans. The promise not to further tax the American people had been a central theme of his campaign. The reason the saying became infamous of course is because despite “efforts”, in the end, Bush was forced to compromise with the Democratic-controlled House and Senate, signing a deal to raise taxes to reduce the national budget deficit. If you are of a certain age, this phrase, more than any other, represents broken campaign promises.

As I wrote in a recent post, we are firmly in campaign mode now with the midterms marching ever closer. The battle lines are being drawn, and the campaign promises are being A/B tested. If you are not familiar with the concept, it’s where you take two versions of something and shoot it out to the media sphere and see which one gets more traction. As much as I would like to never talk about politics again after having worked far too closely to that particular den of thieves, we do have to understand how politics can impact our families and financial future.

I don’t want to drive housing prices down. I want to drive housing prices up for people that own their homes. And they can be sure that’s what’s going to happen (my emphasis).

Clears throat dramatically. If there is one thing for sure, there is nothing for sure. In fact, as I shared last week, 41 of the 85 cities I track had negative year-over-year (YOY) median sales prices compared to 15 last year. The median list price in December as reported by FRED/Realtor just went below $400K for the first time since 2022. While Case Shiller showed an uptick month-over-month seasonally adjusted for November (slightly down non-seasonally adjusted), the Freddie Mac Home Price Index, which is not as lagged, reported its lowest year-over-year increase (+.70% YOY) in December since we were crawling out of the depths of the last housing correction. This was a similar result to that very small YOY increase we saw in the NAR series in December (+.42%).

Plausible deniability. This phrase is key to understanding politics. As humans, we all make promises, resolutions, goals, etc. We also innately understand that inevitably something comes along the way that derails us. We may reach our goal eventually but on a different timeline. Often politicians make promises they know they cannot keep. As long as they have a plausible reason as to why it didn’t happen, they are largely forgiven. Think about the runup to a wrestling or UFC match where opponents make promises and outlandish claims. It’s with this understanding that I view the drama, or kayfabe, between the Fed Chair and our sitting President. Both are on the hook for economic outcomes, and both need cover. They can point to one other when things go awry. Thinking of our current political sphere as a performative wrestling match may just save your sanity. It has mine.

No matter your political or ideological bent there has been a breaking news story across the narrative spectrum with an all-consuming shiny object just for you. Believe Civil War is imminent? Look no further than Minneapolis. Convinced AGI is at hand, and the robot overlords will destroy humanity? A self-organizing AI social network should do the trick. Of the opinion that the latest mooning in metals signals the end of our current world order as a central bank digital currency gets secretly ushered in? Or that a “stated” Fed pick could bring down the metals market? Here ya go. Worried that we are putting America’s interest behind our own despite campaign promises? The build-up of a “massive armada” near Iran should resonate. And of course, we can’t forget the payload of over 3M pages from the mothership of all motherships which details all sorts of political and financial shenanigans.

While there are aspects of each of these stories that are important, we are getting absolutely blitzed which is telling. Why so much noise right now? In my humble opinion, it’s the economy. Between Amazon, UPS and Home Depot, almost 50K layoffs were announced last week. This on the heels of 2025 which had the highest Q4 layoffs since 2008.

The ability of the AI narrative to drive unchecked enthusiasm and stock buying and paper over the woes in the real economy is petering out. We’ve become accustomed to watching stocks slide, only to rebound as some rando tech company announces a monetary commitment to another rando tech company. On Friday, Huang walked back its latest headline “commitment” saying it was never really a real commitment (plausible deniability). While many of us (myself included) scramble down the rabbit hole, chasing answers we all deserve, corporate insiders, aka the oligarchs, are busily getting their houses in order.

Almost 1000 executives at roughly 6,000 US-listed firms have unloaded shares this month, compared with 207 who added, resulting in the highest sell-to-buy ratio in five years, data compiled by the Washington Service show.

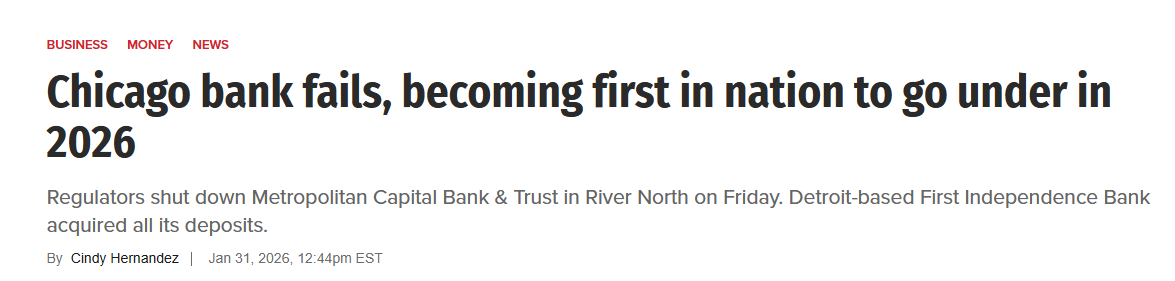

And in case you missed it amidst the deafening media roar, a small bank failed on Friday which is pretty much right on schedule if you have been paying attention.

State regulators closed Metropolitan Capital Bank & Trust, headquartered in Chicago, on Friday. The FDIC was “named receiver and brokered the sale of most of the bank’s $261 million in assets to First Independence Bank in Detroit, including all deposits.” Thus far, details are scarce, with the press release pointing to “unsafe and unsound conditions and an impaired capital position.” We will learn more about those unsafe and unsound practices in the coming days but likely a cockroach will be revealed.

Speaking of cockroaches of which we have a cadre, you may have also missed that BlackRock, the world’s largest asset manager, recently announced a 19% decline in the net asset value of its business development company BlackRock TCO capital which resulted in an $140M loss. The investments had been marked at full value as recently as November. I remember how my life changed from November of 2006 to December of 2006. I have detailed here how my former company went from celebrating its best year ever to writing down millions and millions of dollars seemingly overnight. There were signs at BlackRock in 2024 that all was not well (including one of its loans to Renova, a home repair company) but by moving things around and firing their rating agency they were able to convince any - and there are so few - handwringers that all was fine and dandy. That is of course until oopsie!

BlackRock’s disclosure underscores the risks investors face inside the opaque private-credit world. It can be difficult to know what investments are worth at any given time, given that they hardly ever trade and instead are valued by fund managers using a mix of internal analysis and third-party pricing services. The way private funds mark their holdings determines the fees they charge clients.

We have often discussed here the risk of private credit. The world of hyperfinancialization is so complicated it can make the eyes of even the most studious glaze over. To put it simply, the banks pulled back lending to Main Street after the GFC due to various regulatory requirements. Instead, they lent to or facilitated the lending to companies like BlackRock who then went off and did the risky business. Often, the banks would then sell off that risk into the derivative market making it almost impossible to know who will ultimately lose this game of musical chairs. For perspective, some believe the shadow banking sector is now 2-2.5x bigger than it was in 2008. If interested, I’ve recently been researching and writing about these transactions in the commercial real estate sector at Unicus Research.

This is a long way of saying that 2026 is off to one heck of a start. Trying to keep up will be impossible as the noise will get louder. Nonetheless, my commitment to you is to study the stories for what they could potentially mean for your financial future, especially as it relates to housing. Below I will share the Top 5 city summaries for December sales, price, inventory and days on market as well as lists of cities where there is motivated, distressed and depressed selling. You will absolutely be surprised about where these cities are located with the Northeast and Midwest most assuredly joining the party. Additionally, I will provide the list of cities where there is “low inventory” but YOY price declines yet again debunking that particular myth. In honor of Florida’s frigid weekend, we will stop in Tampa where believe it or not, snow flurries were spotted yesterday. Going back to the 1800s, measurable snowfall has only been recorded twice there: 1899 and 1977.

As there was no accumulation yesterday, January 2026 won’t be added to that list. However, the weather is not the only chilly thing in Tampa.