Riding Bikes With Helmets

It's Time to Take a Stand

I’ve been struggling this week with where to start this post. We are in the late stages of the cycle and it seems many have lost the plot. Those that grew up wearing helmets while riding bikes have zero idea about what’s to come. Their takes are getting worse and worse. Meanwhile, the Boomers in power have gone off the rails driving us straight into command and control, still seemingly believing in their ability to get it “right.”

Everybody seems to be on emotional high alert, more confrontational, and my first instinct is to hide. As a GenXer I usually internalize, but I’ve learned that is incredibly destructive in the long run. I’ve found that out more than a few times in my life.

Is there anything wrong with wearing helmets while riding bikes? I should say not, but there is something to be said for allowing our children to fail, to learn resiliency, to understand that all cannot be cured by a Java Chip Frappuccino at Starbucks. The Pollyannaism out there for those that escaped the inflation era of the 70s and 80s is a bit shocking. Of course, I am not being fair and over-generalizing, but I’m witnessing many in this cohort skate on the surface, fueled by the black hole that is their insecurities - the kind of insecurities you can only get from thinking a participation trophy is “winning,” or that social media is real life. And they are saying whatever they think no matter how asinine it is, believing their own bull%*$+. Much has been written about participation trophies and the ills of social media, but what shocks me the most is a seeming lack of fear to state things that are categorically false. “Study” means reading an AI-generated article versus deep exploration on a topic where you source all the viewpoints and process them yourself in your own thoughtful analysis. If you are going to talk about housing prices, you may want to read multiple takes including one by the guy who created the Case Shiller index. I’m not saying don’t challenge the narratives - I’m just saying, be aware of them. I often find myself muttering “just do the work - PLEASE.”

But, I also have to take responsibility for perhaps not challenging the younger generations more, or helping as they lose their way. GenXers tend to be “live and let live” but that is one of our faults. Our eschewing of community and focus on the individual means that we have not been great mentors. Being reserved, un-emotional and self-sufficient are hallmarks of my generation, and it’s time for us to change. Likely many of us learned this technique for self-preservation as children of divorce. Always, always in the middle, you learned how to self-soothe, console your parents and how to soldier on no matter what life threw at you.

Although I have no desire to participate in the screaming matches, I do believe I have to become a better translator, that it is time for me to claim the role I was certainly prepared for, but with greater authenticity. Upsetting the apple-cart is what children of divorce always avoid, but in the past few weeks I have been fighting myself and my old ways. In many ways this entire social media journey has been a fight with myself. I had no desire to step into this arena, but did so out of what I felt was necessity. An introvert by nature, each post, Tweet, appearance means calling up just about all the strength I can muster. What I would like to ask some of my Millennial counterparts is that they meet me halfway, respect their platform, put in the work, be examples to the even younger Gen Z. If they do so earnestly, I promise I will be there with support every time they get it wrong. From my experience in managing and working with this cohort, oftentimes the reason they don’t do the work is because they fear failure so much. Having rarely failed, they don’t have the mental toughness to handle it, realize it is part of growing, part of being human.

What does this have to do with housing? Narrative is the name of the game, and it is getting uncomfortably loud. Please do whatever you can to stay steady. And, in that vein, let’s study a little history. Based on the kindness of a subscriber I have finally gotten the existing home sale and inventory data. I cannot tell you how unbelievably thankful I am as certain things became immediately obvious and will equip me in my mission to be a better mediator.

The data only goes back to 1999, but let’s start with our most recent understanding of a housing boom and bust cycle.

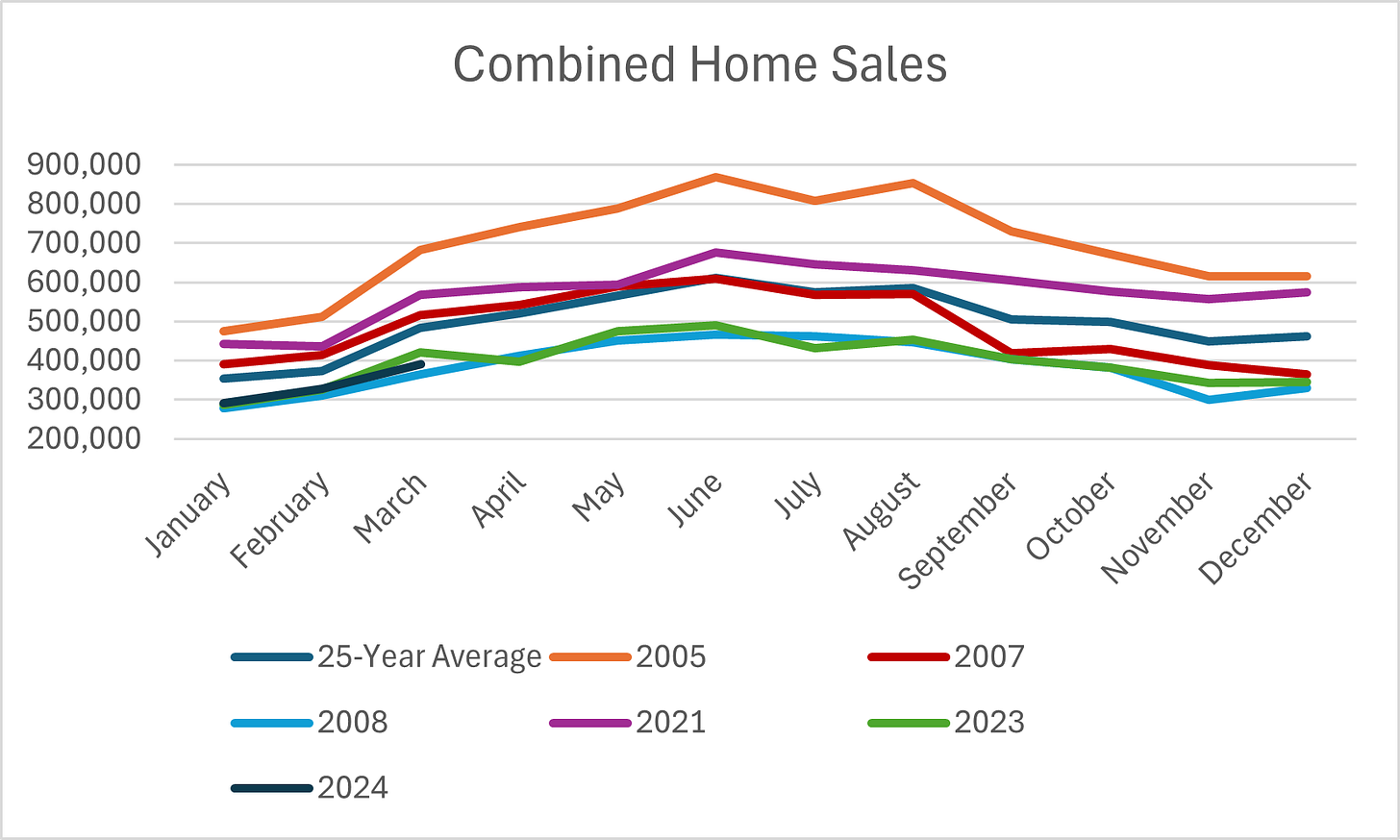

In this series, I have added both new and existing home sales to size the entire market. I wanted to do a comparison to the average for the data to show you the arc of the spring home-buying season and how typically we follow a very similar pattern where sales increase, peak and then decrease. You can see this in prices as well, but for this week, let’s pause here. I added in 2005 and 2021 as peak years in their respective cycle. And, I then looked at 2007 and 2008 which is in my opinion the inflection point of the last cycle.

Look at 2007. That year, sales tracked pretty close to the average, but after August they diverged. 2024 seems to be tracking closely to 2008 and 2023. My belief? Barring government intervention (that works), the layoffs we’ve seen in April and May suggest the rest of the year may behave more like 2007 after the middle of the year.

We just received the University of Michigan Consumer Sentiment preliminary data for May which shows sentiment dropping from 77.2 to 67.4. For perspective in May of 2007 consumer sentiment was 88.3 and in May of 2008 it was 59.8. The average reading for Consumer Sentiment since 1952 is 85.4, but since the GFC the average is 79.3 and since COVID the average is 70.3. The below graph has not been updated with the April or May preliminary reading, but it is important to look at past trends:

Consumption makes up approximately 70% of GDP. It matters how the consumer feels. Whether folks are pulling back on spending because they lack the funds, or because they are nervous about what’s ahead matters little. They are pulling back as also evidenced by Starbucks’ recent lackluster results.

The company reported a 4% decline in same-store sales in the latest quarter, while analysts expected growth. In China, same-store sales fell 11%. The pullback by consumers was widespread, with the overall number of transactions sinking 6% and retreating in each of the company’s geographic segments.

I would love to take Starbucks results as evidence that people are starting to make smarter decisions, but that is unlikely. Hard lessons will be learned in the coming years as this downturn progresses. The helmets provided by the government are shoddily made, Chinese-style, and end up being more harm than help.

Speaking of government intervention, the newly proposed Freddie program to buy second liens really threw me for a loop last week and is one of the reasons this post is a little delayed. For someone who spent most of their career trying to ensure we never experienced anything like the GFC in housing again, it was unbelievably shocking to see this program being pushed by the current administration. Luckily Adam Taggart let me come on his show to discuss, despite my poor connection due to some strong spring storms here in TN:

Even now I’m getting slightly nauseous thinking about this proposal which could be enacted without congressional approval….the hangover of a useful idiot I guess. After the destruction I witnessed during my days managing default I have nothing but disdain for this proposal. Like most government programs the unintended consequences are much worse than the initial pain.

What could this proposal mean and could it hasten or prolong our path? Let’s begin by looking at recent history. Additionally, this week we will dive into what I saw in San Antonio, the institutional selling by multiple investors highlighted there, as well as a summary of inventory for sale by Census region.

Keep reading with a 7-day free trial

Subscribe to M3_Melody Substack to keep reading this post and get 7 days of free access to the full post archives.