Is your head spinning? We are 27 days into the new year and 7 days into a new presidency. The rapid-fire executive orders and screaming headlines have been nonstop. This weekend social media was abuzz with chatter about DeepSeek, a potential Chinese AI disruptor, who is claiming they used $6M to train their model which purportedly can rival OpenAI’s OI model, while U.S. based companies have spent billions. Is this revelation based on a lie as some claim? The engineering sounds intriguing, and DeepSeek has published the code so it can be tested. Having trained models in the past, I find these concepts fascinating. Nonetheless, we have to take this with a grain of salt against the current geopolitical backdrop. If nothing else, the market has woken up to the potential of disruption. The golden child who has led our stock market rally now has a black eye. According to some, this is not Nvidia’s first black eye, but just one of many that have been ignored by the market.

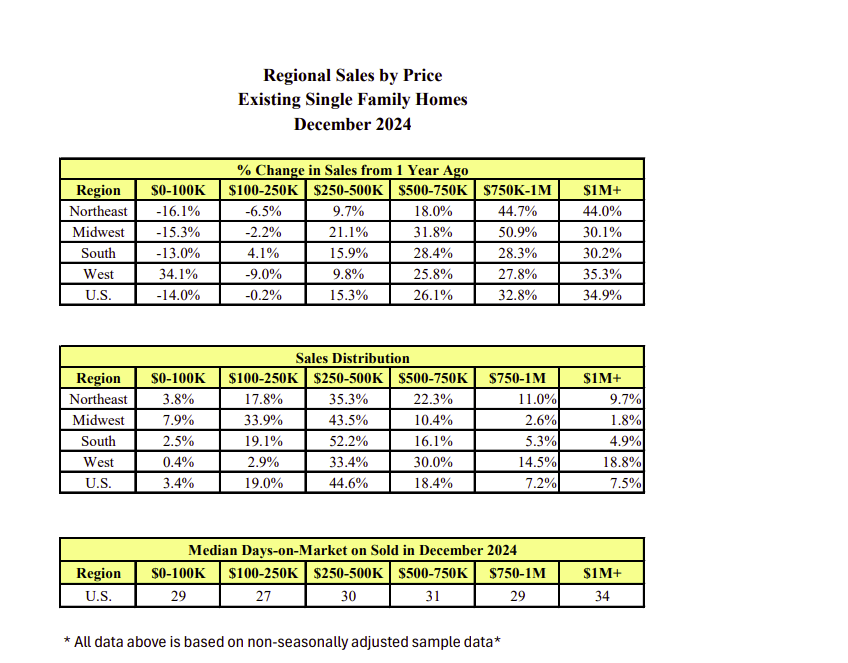

We started last year with the stock market rallying on the back of Nvidia, and I believe it gave our top 20% who have stock holdings the greenlight to wade out into the housing market. This is evidenced in the sales mix monthly breakdown from the National Association of Realtors (NAR). From this month’s results:

The largest YOY increases in existing homes sold are those over $500K while those below $250K saw declines. According to Statista, 60% of American households make less than $100K a year. A household with a median income of $100,000, no debt and a 20% downpayment can afford a home for approximately $335K. Hardly anyone puts down 20% these days.

22.4% of existing home sales in the U.S. were below the $250K price level versus 22.3% last month

44.6% of sales were between the $250-500K price level versus 44.3% last month

33.10% of sales were above the $500K price range versus 33.3% last month

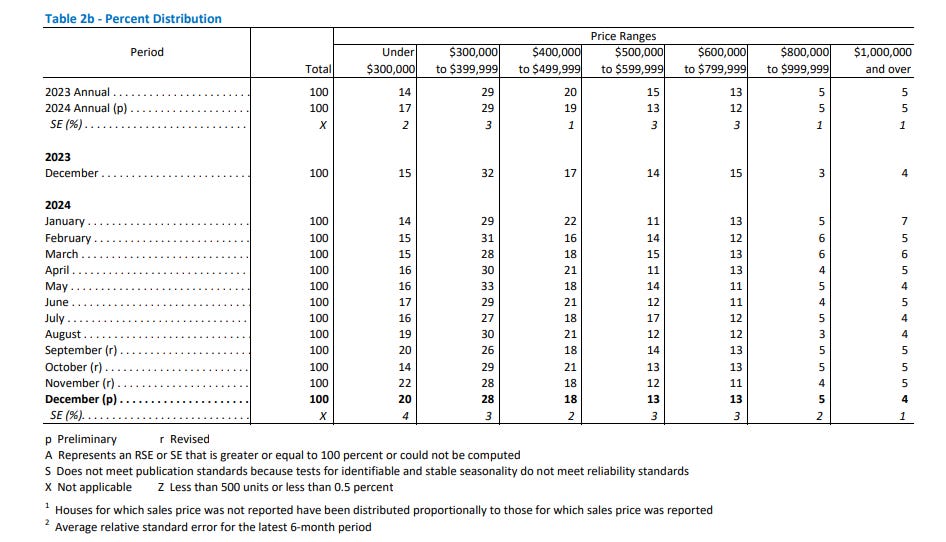

Here is the sales distribution for new homes from the Census:

For new homes, the largest YOY increases in sales occurred in the under $300K category. There were slight increases in the $400-499,999 and $800-999,999 categories YOY, but the 43% jump in the under $300K category is noteworthy. The builders are cornering the market for those lower-priced homes while the existing market sticks up its nose, preferring to remain largely frozen with the lowest home sales since 1995. By the by, we have increased our population by 70M people or 26% since 1995.

20% of new home sales in the U.S. were below the $300K price level versus 22.0% last month and 15% in December 2023

28% of sales were in the $300-399,000 category versus 28% last month and 32% in December 2023

18% of sales were in the $400-499,000 category versus 18% last month and 17% in December 2023

13% were in the $500-599,999 category versus 12% last month and 14% in December 2023

13% were in the $600-$799,999 category versus 11% last month and 15% in December 2023

5% were in the $800,000-$999,999 category versus 4% last month and 3% in December 2023

4% were in the $1M+ category versus 5% last month and 4% in December 2023

The builders are not seeing similar improvements in sales in the middle tiers of the market and only slight increases at the higher end of the market. There is trouble across the K as each income cohort is becoming less hopeful. Just take a look at the latest results from the University of Michigan consumer sentiment survey as presented by Danielle DiMartino Booth in today’s Daily Feather:

Headline sentiment fell for the first time in six months and across all income cohorts, but it’s the wealthiest tercile that’s seen the most rapid deterioration of late (red line). In the last four months, upper-income sentiment has fallen more than ten points, from 84.7 in September to January’s 73.7, a 13-month low. While still relatively more optimistic than the respective 67.9 and 66.5 prints for their middle and lower-income peers, the gap between the well-to-doers and the rest has narrowed significantly

The positive sentiment wave we saw with the election and rate-cut hopium is already starting to peter out with our wealthiest Americans showing the most rapid, recent deterioration. This does not bode well for homebuying activity.

Speaking of, we now have both existing home sales and new home sales for December. How do those results compare to historical time periods? Also, did you hear about the two recent studies that are challenging the housing shortage narrative? Speaking of inventory and lots of it, what was all the hubbub about this past week with respect to disinflation in the New Tenant Rent Index? And, finally, which markets were hot in December and which ones were not?

Without further ado, let’s get down to the nitty gritty…

Keep reading with a 7-day free trial

Subscribe to M3_Melody Substack to keep reading this post and get 7 days of free access to the full post archives.