An uncertain Powell falling over his words at the podium sent the market into a sharp correction yesterday.

Almost exactly one year after sparking a furious rally in financial markets, Federal Reserve Chair Jerome Powell did the exact opposite on Wednesday, staking out a cautious view on interest-rate cuts in 2025 that stunned investors.

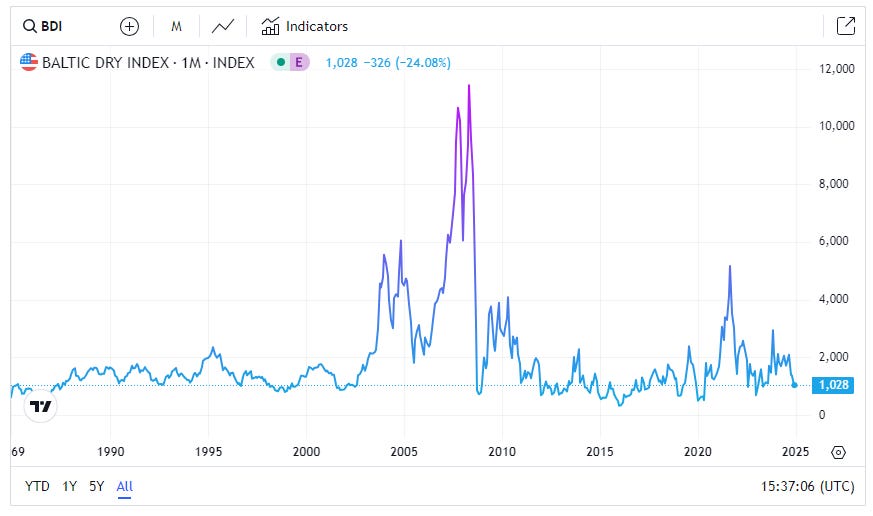

What a difference a year makes. Housing was mentioned as being “weak” while Powell also noted that increases in supply had contributed to the strength of the economy. Everyone and their mother has a theory as to the why of Powell’s nuanced projection of uncertainty, but in reality, I believe this isn’t just about one theory, but about multiple market forces working at once. Powell made a point to mention that the United States economy looks much better than other countries across the world. Foreign participation in the latest auctions have been down. What it feels like to me is that there are severe liquidity challenges across our globally synchronized economy. China is grasping for straws to turn things around, but the losses in the property sector have made it near impossible. The Baltic Dry Index which measures average prices paid for the transport of dry bulk material is down reflecting low consumer demand.

The Baltic Dry Index, a crucial measure for global shipping rates, has hit a 17-month low, pointing to major shifts in shipping demand affecting key commodity transports…the downturn in the Baltic Dry Index indicates tough times ahead for global trade, as it reflects the costs of shipping raw materials like coal and iron ore…this slump is driven by waning demand in critical markets like China and cautious economic forecasts influenced by possible US interest rate changes.

Waning demand in China has been the theme on earnings calls for some time. Despite Powell saying that the economy is bright, it is not. Does he know that? I don’t really care if he does or doesn’t. The path has been clear for some time, but most have chosen to ignore it deciding instead to base their hopes on the election outcome or lower rates. What did the bond market have to say about it? The 10-year treasury, which is the benchmark for mortgage rates, turned higher. Everyone is waiting for the flight-to-safety trade to the bond market, but is that trade still the safe trade? Russell Napier does not think so. My advice - as it was last year - is to be open in your view on rates. Instead of listening to those who speak with great confidence on the subject (and have been wrong) pay attention to what’s happening instead. I will keep you posted here.

Existing home sales were published this morning to a muted celebration and an official pivot by NAR’s Yun on inventory. As mentioned in my post last week, the industry is now having to cheerlead increased inventory and price reductions because it is the only thing that will bring people to the market. Although sales, non-seasonally adjusted, were up 5% YOY, they were down -9.5% MOM. Everyone knows that the combination of increased inventory, lower rates and election and stock market sentiment unseasonally buoyed the markets. Additionally last November was abysmal as we hit peak mortgage rates of 7.49% in October of 2023. On average, rates in September and October were 6.32%.

According to the National Association of Realtors (NAR), median home prices were up 4.72% YOY, but down -.17% MOM. Last month was revised down, and my contention is the revisions are not done. The median listing price for instance is down -.74% YOY and -1.90% MOM. For price discovery, you need sales. The West drastically outperformed the rest of the country with much higher sales. That’s precisely why I believe we saw an outsized price decline for California MOM:

The median home price in California declined by 4% on a monthly basis to $852,880 in November, according to the California Association of Realtors. 'The November median price had the largest October-to-November drop since 2008'"

For today’s post we will focus on the initial results by region for the 80+ cities I track as well as Lennar’s stunning results yesterday. If mortgage rates continue at these elevated levels and stock market sentiment turns sour, the next few months could be icy in the existing markets while pressure is building for the builders. What does that mean for the near future? Additionally, delinquency came in 6.88% higher MOM in November. Where are we and what can we expect with those rising delinquencies? Let’s dive in.

Keep reading with a 7-day free trial

Subscribe to M3_Melody Substack to keep reading this post and get 7 days of free access to the full post archives.