Wow - there is a lot going on. For someone like me who likes to dive deep into a subject before talking about it, times like these can be a little overwhelming as I’m torn between getting the info out as soon as possible and my perverse obsession with perfection. I’ve never had trouble admitting I’m wrong, because usually I don’t say anything until I’m absolutely sure I’m not. That’s why this 17+ year veteran of the housing market spent two years on Twitter NOT saying anything and watching instead. I had to learn the game. And before I stepped into the arena officially I had to see it for myself, which is why I hit the road in February and March (btw - next road trip is in the planning stages, so please comment with any suggestions, but will be including a for-sure trip to Florida).

Perfection is not possible and highly over-rated, but a sickness that plagues many Gen Xers like me. We were obsessed with self-improvement - which I think is a great thing - but no pure obsession is a good thing. And I think maybe we missed a lot of true engagement because of it. What-did-I-do-poorly-and-how-can-I-improve discussions with self often ended in some internal storytelling about how not to say anything again, or not go to that place again, or never talk to that person again - never die, never surrender. But, we are going to die, and we have to accept our limited humanity.

There she goes again, waxing philosophical. I can’t help it because what we are witnessing now is a story about our humanity and its serious limitations. We are always looking for an ending to the story. This goes back to fight, flight or fawn. In order to figure out our next move we try to superimpose judgment, “perceived” facts and order over something that is very complicated and messy, messy.

So, let’s get started talking about the news we’ve had this week:

Housing starts. You may have been living under a rock, or gallivanting around the Caribbean as I was and missed it, but this week’s increase in housing starts caused quite a stir. When I first returned from Austin in February plagued by calls for data to support my theories, I spent ALOT of time trying to understand how this data could be so misleading and disconnected from what I saw in front of my very eyes. That brought me to its methodology and the Survey of Construction which is described below:

My deep dive into this survey is backlogged along with about 50 other deep dives, but alas time is ever-fleeting. Of all the gobble-dee-goo above the most important thing to note is that this data starts with a survey. Remember what we’ve heard about survey data? And then layer on all the adjustments and you’ve got trouble and inconsistency in the data:

Total housing starts in May were well above expectations, however, starts in March and April were revised down, combined.

For a detailed look into the data and revisions be sure to check out Bill McBride’s post. And in general, I highly recommend his blog….he’s got good chart, if you know what I mean (I do not). What I can tell you is that this process is manual key entry into a survey by humans. Sometimes those humans don’t even know what they are being asked and sometimes those humans know exactly what they are being asked.

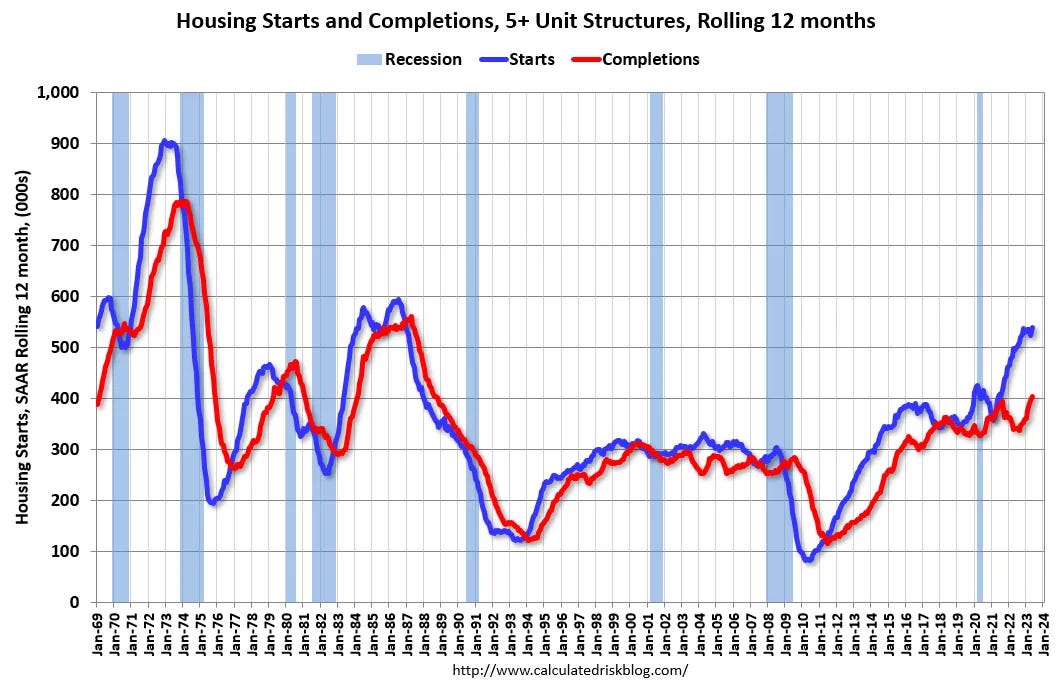

So, what do I think? Well, I think maybe these starts are a catch-up, or perhaps labor finally showing up to start work as other projects stall or cease due to issues in funding. The gap between starts and completions is very wide for multifamily in particular.

Perhaps it was due to some developers and builders getting a little slap-happy with the ride-up in the stock market, thinking the collateral issues in the financial system are behind us and wanted to catch the new-build wave. I mean everyone came into the year saying there was no demand. I argued that there was at a certain price point and these rate buydowns and incentives the builders are offering brought reluctant folks off the sidelines which is exciting everyone and inspired some chops-licking.

Does it really matter? It matters in what it might tell us about our humanity and need to create order when there is none. But, specifically for our purposes it’s important to watch, but I do not think it alters our path….especially not from what I saw in my review of some client portfolios yesterday. FHA books are stressed in ways I was not expecting. I saw the wobble in April and noted it. Black Knight attributed to the short month, but I could see in my client portfolios it persisted. And then came May. Boy oh boy. There is one thing they teach you in mortgage default land….the cross from 30 to 60 days is the death-cross, and May’s increase was significant. Black Knight’s data should be out next week, so I will use it to confirm how systemic this might be and then share the %s because they were just that large….and I’m still of a bit of a perfectionist :).

Why is the cross from 30 to 60 so bad - it’s just 30 days, you say? It’s the decision that’s made by the borrower to let it happen…in the U.S. we are obsessed with credit scores. When you let that payment slide to Day 31, you are giving up on your credit score as most know that your delinquency gets reported after day 30. Now I’m not saying we are about to have a million foreclosures tomorrow. I recommend you check out my deep dive on loss mitigation to understand it could be a year before we see serious foreclosures and longer in some states. But what I’m seeing is SEVERE consumer stress. How do I know it’s severe? Part of my methodology is to sample the comments from borrowers that come through the call centers, and folks are reeling from tax season….reeling. As I talked about in previous posts delinquency was starting to get severe in December, but then most people were able to catch up in bonus and tax season as is typically the case (not for autos though). I guess when we realize the new debt-to-income reality of these borrowers we should not be surprised, but during the boom time many forgot that it isn’t just the credit score that matters - it’s important to dive under the score.

My plan is to spend a good deal more time talking about this when the Black Knight report gets published likely next week, so stay tuned.

Next up is existing sales which came in a touch higher month-over-month in the aggregate data, but in the cities I track it was much, much higher in the Redfin data which includes new-builds. For the 60+ cities I track, sales increased on average by 20.46%. But what is even more interesting is that the change in price drops was also significant, increasing 19.33%. The Redfin data has a much lower denominator than say the Realtor.com data (NAR), but it is a signal. Is this increase the re-acceleration of the housing market so many on FinTwit want? I would argue it’s the motivated sellers….remember the scene in The Big Short when Baum says everyone seems “motivated”. Uh-huh. They are starting to get motivated. I saw payoffs in May for delinquent loans as well which is another sign of stress.

I’m hitting send this week late and missing the usual data as I felt the message was important, so my apologies. I will update this post tomorrow with all the data on listings, Airbnb, etc. And, hang tight, it’s going to be a bumpy ride.

Coming Soon: YouTube tomorrow and an exciting Twitter Spaces with a demographic guru on the 26th.

This week’s updates:

Listings for Sale

Listings are up on average .09% for the cities that I track week-over-week, down from last week’s significant moment. But we see some notable movement in the top 5 with Bozeman and Sevierville (Airbnb Capital of Appalachia) making some notable gains. Next week I am going to try and add the comparison to the average from start.

Top Cities with Largest % Increase in Inventory Week-over-Week (6/11-6/18)

Hoboken 8.24%

Bozeman 4.78% (up from #4 last week)

Salt Lake City 3.51% (down from #2 last week)

Sevierville 4.35%

El Cajon 3.20%

Top Cities with Largest % Increase in Inventory from Start (1/1/23)

Coeur d’Alene 79.79% (up from #3 last week)

San Ramon 78.33% (down from #1 last week)

San Francisco 76.65% (down from #2 last week)

Denver 57.64%

Austin 52.31%

San Jose 44.17%

Boston 43.79%

Galveston, TX 42.55%

Seattle 40.44%

Portland 38.30%

Rent

Next week RealPages updates. For this week focus will be on newly added Long-Term Rental (LTR) listings…can’t wait to spend more time on these city movements. Looky, looky though at Sevierville and Bozeman showing up in highest listings for sale and rent. Very interesting.

Top Cities with Highest % Increase of Single-Family Rental Listings (6/11-6/18)

Bentonville 9.62%

Hoboken 9.42%

Winter Garden 8.82%

Sevierville 7.14%

Bozeman 5.29%

Top Cities with Highest % Decrease of Single-Family Rental Listings (6/4-6/11)

El Cajon -22.94%

Tampa -17.84%

San Diego -14.72%

Los Angeles -9.35%

Newport Beach -8.69%

Airbnb

More and more message boards are lamenting the lack of bookings thus far for the summer. I firmly believe it’s critical to watch this space closely over the next several months. For this week I’m comparing the Memorial Day Weekend to this upcoming holiday weekend in the U.S. (6/30-7/2) to see how things have changed over the last month.

Top Cities with Airbnb Average Price DECREASES Comparing Memorial Day to Our Next Holiday Weekend (6/30-7/2):

Indianopolis -55.04%

Ventura -54.87%

Rosemary -42.63

Hoboken -31.80%

Boston -31.03%

Sedona -29.52%

Las Vegas -25.54%

San Francisco -25.27%

Fort Lauderdale -22.29%

Miami -17.72%

Top Cities with Airbnb Average Price INCREASES Comparing Memorial Day to Our Next Holiday Weekend (6/30-7/2):

El Cajon 79.75%

San Diego 62.39%

Encinitas 40.82%

Carlsbad 36.22%

Coeur d’Alene 31.68%

Commercial Real Estate (CRE)

Surrendered keys and special servicing are the name of the current CRE game. And, by all accounts it is going to get much worse.

This week’s feature is an incredible podcast with Jack Farley, John Toohig and Randy Woodward about the upcoming pullback in lending which in their opinion hasn’t really even got started yet.

Per John, the only commercial real estate trading at the moment is for Trash and Trophies (likely the name of my next post :) and despite MSM narratives trouble is on the horizon. Miss this at your own risk.

Reference articles for this week:

Big commercial real estate downturn could sink 300+ banks: Report | American Banker

Westfield Gives Up Downtown San Francisco Mall (sfstandard.com)

Goldman Sachs CEO Solomon warns of commercial real estate write-downs (cnbc.com)

Hotel Owners Start to Write Off San Francisco as Business Nosedives - WSJ

And ICYMI last week:

Sunbelt Construction Boom Threatens Top Apartment-Building Owners - WSJ

US banks prepare for losses in rush for commercial property exit | Financial Times (ft.com)

Interest-Only Loans Helped Commercial Property Boom. Now They’re Coming Due. - WSJ

Coming soon: YouTube later today and hoping to do a few deep dives in the next month on commercial real estate, Airbnb and demographics (6/26). Stay tuned!

Reference

Airbnb

(AGAIN - Crossing fingers April/May Airbnb data will be out next week)

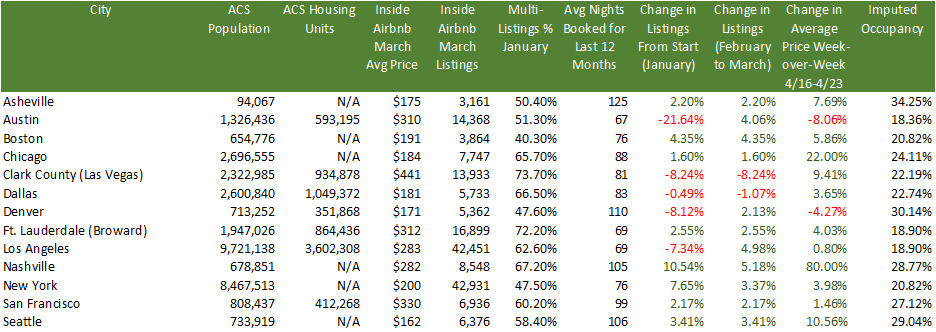

Inside Airbnb has published its data for March and in many cities there were increases month-over-month for listings after significant decreases the previous month. A good example is Austin which went from 18,337 listings in January to 13,808 listings in February and now up to 14,368 listings. Based on my travels I would say that a good chunk of people still think it’s 2021, especially the fix and flippers who may have been constrained by labor or supply chain issues and are coming late to the party. It will be very interesting to watch this trend for sentiment changes post the mid-March banking crisis and now subsequent credit crunch.

Some stats:

A really interesting stat above is the % of multi-listings per city. This metric represents the % of owners that list multiple properties, not just one. So, in other words, this will give you a flavor to how many investors operate in that market. The average for the cities above for multi-listings is 58.74%. So, despite what Airbnb said on that doozy of an earnings call when no one asked them about their miss in listings projections, their typical client is not someone who is trying to make just a little bit of extra cash. These are investors with multiple properties who are looking for passive income and likely bought these properties with DSCR loans or cash from loans on equity and crypto assets. And, with so many listings the imputed occupancy in these cities is very low and is likely no longer covering debt service cost.

For those who have listened to my Twitter Spaces (check out this one on Airbnb if you haven’t), you know my biggest issue with Airbnb is that besides excursions and nebulous technology improvements, adding listings is Airbnb’s only strategy for growth. I’m pretty sure there is a limit to how many hotel rooms and Airbnb listings we need in each city.

Rents

Rents are cooling from their meteoric rise and this week we see some interesting shifts:

Top Cities with Highest % of Average Rent Price Decreases (April-May)

Destin -7.01%

Rosemary Beach -6.28%

Orlando -4.66%

Winter Garden -4.66%

Costa Mesa/Los Angeles/Ventura County -4.05%

Top Cities with Highest % Increase in Vacancy (April-May)

West Palm Beach 1.00%

Cleveland .60%

San Jose .60%

Knoxville .50%

Tampa .40%

Top Cities with Highest % Decrease in Rent Per Square Foot (RPSF) for Specific New Multifamily Complexes (March-April)

Encinitas -3.57%

Ft. Myers -3.56%

Asheville -3.20%

Tampa -1.76%

Boise -1.09%

Redfin - Homebuyer Searches

I recently discovered this on Redfin’s website. Although searches certainly do not translate into purchases I think it is an interesting metric similar to consumer sentiment. As mentioned above, we need to be looking at more data instead of less, but none of it should be considered in isolation.

Cities with the Highest % of People Searching to Move INTO that City

Los Angeles, Costa Mesa, Newport Beach, Palm Springs 6.0%

Chicago 4.0%

Seattle 4.0%

Cities with the Highest % of People Searching to Move OUT of that City

Tucson 61%

Destin 49%

Huntsville 41%

Asheville 39%

Demographics

The demographic story has been one of the biggest drivers of narratives in the media. Unfortunately, those narratives are conflicting and source-dependent. I’m working on a full post comparing Census, NAR, UHAUL, United and I finally found some cell data so hope to have some time to work on this soon. And, the 2022 vintage for the Census has been recently published, so updated figures here soon.

ACS Population Change from 4/1/20-7/1/2021

Top 3 Cities with Highest % of Positive Population Change

Ft. Myers +7.9%

Bentonville +4.8%

Coeur d’Alene +2.5%

Top 3 Cities with Highest % of Negative Population Change

San Francisco -6.7%

New York -3.8%

Boston -3.2%

Cities with the Lowest Inflation-Adjusted Median Average Salary

Knoxville $50,245

Augusta $52,286

Johnson City $53,572

Miami $54,273

Tucson $54,498

Ft. Myers $58,607

END

Hey Melody, I just found your Substack and I really like it. I'm going to share it in my newsletter. Can I ask you though, what's your background in real estate? How did you come to have this level of interest/expertise in the subject?

After reading this post and watching the accompanying YouTube video, I have to ask you this as nicely as possible: have you given any serious consideration to the possibility that your thesis (or to be more charitable, your timing) is simply wrong? In the video, I noticed you pointed out a significant increase in Airbnb prices and said something like "this doesn't line up with the news we're receiving." Well, could it be that the data doesn't line up with the news you're receiving because the news you're receiving is cherrypicked? Not necessarily by you, but by the people delivering it to you, who largely agree with your thesis and (like me!) want it to be true?

I have to tell you that when I leave the comfortable echo chambers of housing bubble subreddits and crashtwit, I see a whole lot of data suggesting anything BUT the beginning of a recession, in housing or anywhere else. It's looking more and more like the trillions of dollars of printed money are still sloshing around with abandon, and with the latest AI stock bubble and the rebound of housing (and crypto, ffs) prices and the general mainstream narrative--once the banking nanocrisis ended--of "everything's fine now," the wealth effect is back in effect.

So how much do you believe in your "it's about to turn over" narrative at this point, really? I just have a sinking feeling that the markets aren't quite done being irrational.