Yet another week passes in the YOLO-FOMO reality distortion field, and it feels at once like we are moving at warp speed and at the pace of molasses. Is this what it felt like for the ones in the know last time we were rounding the corner to something of this magnitude? For me, I was so young, dumb and poor (most of that is still true) that I really felt like I was watching from the sidelines as people lost their life savings, 401Ks, high-paying jobs. I didn’t have any of those things and weirdly the years after the GFC were the most lucrative for me, but the bill eventually came due for me as well as for the majority of Americans since 2007.

Though some quibble about the term inflation, what kind we have or don’t have, that matters little to the people who are experiencing food scarcity and are watching their cars get repossessed. We can all question their choices, but who was educating them to make better choices? And, when you have our mainstream media barking that everything’s fine, including Fed presidents who make ridiculous statements, can we really blame these yolo-fomoers for going with the flow?

Cars and houses have driven the American economy for some time and as the great Lacy Hunt directs us, it is there that we will find the true health of the American consumer. And, it is not good. Younger Americans are behind on paying their car loans at rates not seen since 2009 (since the GFC….we’ve been hearing this a lot recently, but it’s all good, right?!), already hovering around 4.6%, a hair from the peak of 4.7% back then. And, team, we are just getting started. Unlike many who travel the halls of FinTwit spouting out ridiculous statements about the GFC, I was there. I actually watched credit quality deteriorate in our portfolio. I saw prime, A borrowers, lose equity month-after-month as home prices declined. I watched the credit scores of prime, A borrowers, sink as they came under pressure from lost jobs and the mountains of debt they crawled under during the early 2000s. By my estimation we are in the very early innings of a similar destruction. When I posted over the weekend the article from National Mortgage News that discussed an April survey where 62% of new homebuyers stated they have struggled to pay their mortgages, the responses were telling.

I see Twitter as a lab to test out ideas as well as to get intel about local markets and consumer sentiment. The lesson from this weekend is WHOA. What would be your response to a survey that inferred people were struggling? My first response is typically empathy. But, this article struck fear in the hearts of many and the responses ranged from outright denial, a myriad of challenges and then weirdly a lot of anger from older Gen X and Boomers directed at the younger generations for whining.

Yes, as discussed last week, since 2007 we have all been a little lost, finding comfort in binge-watching, sugary beverages, frantic vacations, Birkin bags, etc. If you listen to much of the music from this time you will hear many messages about not being able to pay bills and hitting the club to spend the last dime, because really, what else can they do:

I knew my rent was gon' be late about a week ago

I worked my ass off, but I still can't pay it though

But I got just enough

To get off in this club

Have me a good time, before my time is up

Hey, let's get it now- Time of Our Lives, Pitbull, 2014

Listen, team, none of us will escape this unscathed. We are going to need to find common ground to navigate these treacherous waters. The first thing we can do is listen. Yeah, yeah, we all know this, but I am so amused (but not) by the folks on Twitter that throw up charts, images and articles versus trying to engage in real debate to truly understand the issues. I usually don’t like to wield the experience card because I feel like you should be able to amicably debate any subject no matter one’s experience. But, several times this week, I found myself going there which I hate because I feel like I sound like the kind of Class A A**hole that used to annoy me so much. And, maybe I do. Maybe this is what happens as the generations turn over. But the you-only-live-once and fear-of-missing-out combo is creating a reality distortion field that rivals anything the creators of Star Trek could conjure.

And, it’s being fueled by vested interests that catch us in complicated and imbricated webs such that just as we think we are freeing ourselves from one, we realize there is another and another and another. It can feel almost overwhelming each time you peel back a layer of the psychosis and its competing narratives to find yet again that you are standing on shaky ground….so much so that I think that is why people constantly back away from the edge. It is just so destabilizing and disorienting.

There are very few who can live in that uncertainty with comfort. Instead we look for heroes, touchstones, distractions, brands, authorities, anyone who will tell us that our truth is for sure true. And, then we hang on for dear life. Take for instance the below conflicting views of a site I visited in the Phoenix metro.

On the left is Realtor.com’s listings for the neighborhood and on the right is Zillow’s. Both parties have an interest in portraying a certain view…one might argue that the one on the left is to entice potential homeowners and keep realtors from freaking out and the one on the right supports the high-price narratives which are supported by the housing inventory myth. Check out this video from my pal Scott who took me to the site above and who recently visited Bozeman. This video from Bozeman is just another example of exactly what I saw on the road - new-build sites like a swarm of locusts all over the South and Southwest, yet not listed, or not listed in their entirety. Are the builders slow rolling? Do they list one new home on a listing site when there are multiple? Do they list some on Zillow, some on Redfin, some on Realtor? Do they “salt” the lots and put different color Sold stickers on the new-builds so the sales folks know which ones are really sold? Are there a ton of Built-to-Rent that are now being re-shifted to For Sale as some investors become net sellers? At least one big investor believes the BTR play has legs even as rents cool. But, as the multifamily mania starts to take its toll and the inventory starts rolling on in, rents will continue to cool and this bet will likely look very ill advised, sending more single-family inventory to the market.

What, pray tell, is the real story on inventory? Well, that’s what we are trying to determine here. What I can tell you is that no one has a real inventory count, nor do they have a real count of how many people might need or even afford homes. If they say they do, they are missing a piece of the puzzle like the multifamily, the BTR story, pocket listings or the pull-forward of household formation. I can say for sure that the houses that are out there right now will not be purchased at their current prices for much longer as incentives start to fail to entice people to the market. Nearly every economic indicator has turned over but labor. But, come on guys, if you wipe away the promises and hopes we had about wage gains, what do you think will enable us to afford these homes, the majority of which are listed above that $400K mile marker, when 57% of Americans can’t afford a $1K emergency?

There are many, many stories, not one story. And, it’s very important we start to understand the threads now before the web becomes too thick.

This week’s updates:

Listings for Sale

I keep underestimating the amount of money that continues to make its way into the economy preventing many of the top earners from tasting fear. But, as the IRS slows down its processing of the ERC business tax refunds ($23.5B in May) as well as launching fraud investigations and student loan payments restart, I believe reality is starting to come home to roost as taxes and insurance continue to crush the Forgotten Man. Until then, though, most buyers will not buy and most sellers will not sell.

Top Cities with Largest % Increase in Inventory Week-over-Week (5/28-6/24)

Rochester 23.75%

Boston 6.06%

Oceanside 3.57%

Carlsbad 3.38%

Salt Lake City 2.81%

Notable Mentions: Coeur d’Alene 1.97% and Nashville .87% (although a small increase, still an increase from that notable increase last week)

Top Cities with Largest % Increase in Inventory from Start (1/1/23)

San Ramon 81.67%

San Francisco 77.44%

Coeur d’Alene 74.61%

Denver 53.02%

Austin 46.07% (up from #7 last week)

San Jose 43.89% (down from #5 last week)

Boston 42.16% (up from #8 last week)

Galveston, TX 37.50%

Seattle 35.75%

Portland 33.27%

Rent

Rents are cooling from their meteoric rise and this week we see some interesting shifts:

Top Cities with Highest % of Average Rent Price Decreases (April-May)

Destin -7.01%

Rosemary Beach -6.28%

Orlando -4.66%

Winter Garden -4.66%

Costa Mesa/Los Angeles/Ventura County -4.05%

Top Cities with Highest % Increase in Vacancy (April-May)

West Palm Beach 1.00%

Cleveland .60%

San Jose .60%

Knoxville .50%

Tampa .40%

Airbnb

I believe this summer is going to tell us quite a bit about where we are headed, so next week I will introduce not just week-over-week changes in Airbnb but also comparisons to their averages since January.

Top Cities with Airbnb Average Price DECREASES Week-over-Week

Nashville - 48.03%

Bozeman -15.97%

Sedona -33.92%

New York -13.14%

Sacramento -9.15%

Top Cities with Airbnb Average Price INCREASES Week-over-Week

Pittsburgh 68.44%

Cape May 49.01%

Ventura County 24.55%

Rochester 16.41%

Carlsbad 14.96%

Commercial Real Estate (CRE)

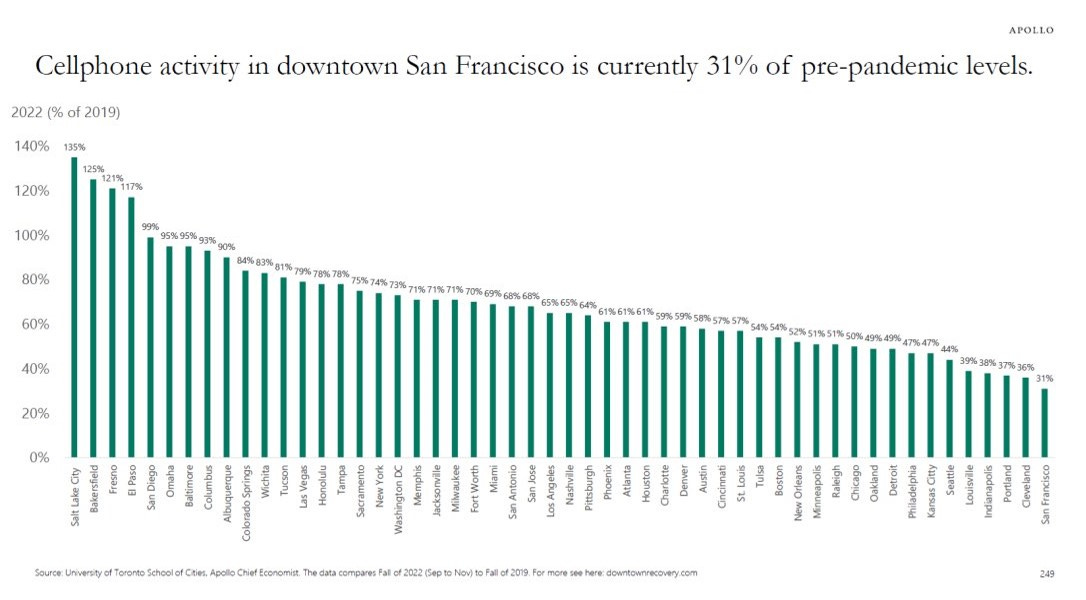

There is so much going on in Commercial Real Estate it’s a bit hard to keep up. But, the thing to keep front and center, is that the Great Reshuffle has to begin soon. We simply do not need the central business districts the way we did previously. And, honestly, most have known this for a very long time and COVID’s shifts just confirmed the inevitable. In next week’s post, I will try and focus on some of the recent sales and banishments to special servicing otherwise known as default servicing.

Reference articles for this week:

Sunbelt Construction Boom Threatens Top Apartment-Building Owners - WSJ

US banks prepare for losses in rush for commercial property exit | Financial Times (ft.com)

Interest-Only Loans Helped Commercial Property Boom. Now They’re Coming Due. - WSJ

Coming soon: YouTube later today and hoping to do a couple of deep dives in the next few weeks on commercial real estate and Airbnb. Stay tuned!

Reference

Airbnb

(Crossing fingers April/May Airbnb data will be out next week)

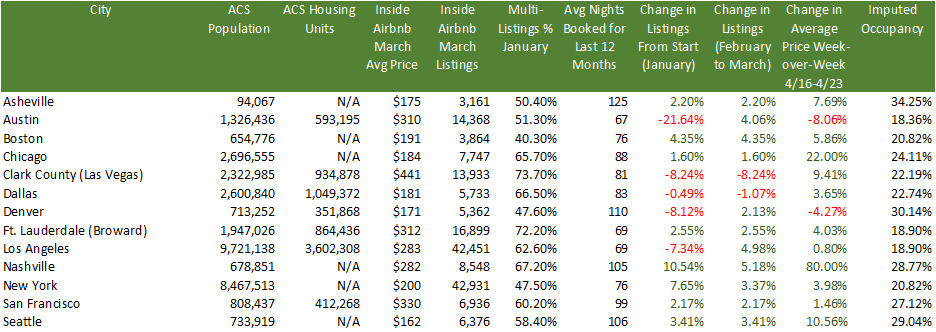

Inside Airbnb has published its data for March and in many cities there were increases month-over-month for listings after significant decreases the previous month. A good example is Austin which went from 18,337 listings in January to 13,808 listings in February and now up to 14,368 listings. Based on my travels I would say that a good chunk of people still think it’s 2021, especially the fix and flippers who may have been constrained by labor or supply chain issues and are coming late to the party. It will be very interesting to watch this trend for sentiment changes post the mid-March banking crisis and now subsequent credit crunch.

Some stats:

A really interesting stat above is the % of multi-listings per city. This metric represents the % of owners that list multiple properties, not just one. So, in other words, this will give you a flavor to how many investors operate in that market. The average for the cities above for multi-listings is 58.74%. So, despite what Airbnb said on that doozy of an earnings call when no one asked them about their miss in listings projections, their typical client is not someone who is trying to make just a little bit of extra cash. These are investors with multiple properties who are looking for passive income and likely bought these properties with DSCR loans or cash from loans on equity and crypto assets. And, with so many listings the imputed occupancy in these cities is very low and is likely no longer covering debt service cost.

For those who have listened to my Twitter Spaces (check out this one on Airbnb if you haven’t), you know my biggest issue with Airbnb is that besides excursions and nebulous technology improvements, adding listings is Airbnb’s only strategy for growth. I’m pretty sure there is a limit to how many hotel rooms and Airbnb listings we need in each city.

Rents

Top Cities with Highest % Decrease in Rent Per Square Foot (RPSF) for Specific New Multifamily Complexes (March-April)

Encinitas -3.57%

Ft. Myers -3.56%

Asheville -3.20%

Tampa -1.76%

Boise -1.09%

Redfin - Homebuyer Searches

I recently discovered this on Redfin’s website. Although searches certainly do not translate into purchases I think it is an interesting metric similar to consumer sentiment. As mentioned above, we need to be looking at more data instead of less, but none of it should be considered in isolation.

Cities with the Highest % of People Searching to Move INTO that City

Los Angeles, Costa Mesa, Newport Beach, Palm Springs 6.0%

Chicago 4.0%

Seattle 4.0%

Cities with the Highest % of People Searching to Move OUT of that City

Tucson 61%

Destin 49%

Huntsville 41%

Asheville 39%

Demographics

The demographic story has been one of the biggest drivers of narratives in the media. Unfortunately, those narratives are conflicting and source-dependent. I’m working on a full post comparing Census, NAR, UHAUL, United and I finally found some cell data so hope to have some time to work on this soon.

ACS Population Change from 4/1/20-7/1/2021

Top 3 Cities with Highest % of Positive Population Change

Ft. Myers +7.9%

Bentonville +4.8%

Coeur d’Alene +2.5%

Top 3 Cities with Highest % of Negative Population Change

San Francisco -6.7%

New York -3.8%

Boston -3.2%

Cities with the Lowest Inflation-Adjusted Median Average Salary

Knoxville $50,245

Augusta $52,286

Johnson City $53,572

Miami $54,273

Tucson $54,498

Ft. Myers $58,607

END

Astounding: “What, pray tell, is the real story on inventory?”

What, indeed...so much fudgery going on it’s incredible, tho nothing surprises me much. I almost missed the second marriage of my cousin because I wanted to watch the second episode of The Menagerie. I should have, it was a disaster...

I agree with Jeremy. Innate talent. Your "voice" is grounded & knowledgeable, yet passionate & humane. Quite refreshing nowadays to be able to sail rather than fight thru somebody's articles, videos, and tweets. Thank you.