Under the Hood

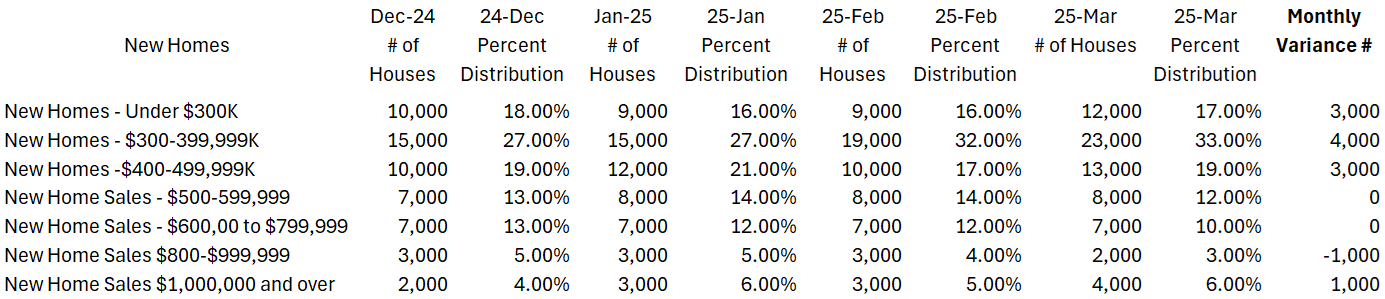

Last week we received new and existing home sales results for March, and they did not disappoint for what they are telling us about the path ahead. Much hope had been laid at the feet of the spring selling season for motivated sellers across the nation. Existing home sales sorely disappointed, coming in slightly below March 2008 levels. New home sales on the other hand sprang to life at the highest pace since January of 2022. Unfortunately, the builders are the only ones making headway as existing home sellers have yet to wake from their COVID fever dreams. Likely we will see some downward revisions in new home sales as the series is very volatile, but what these results show under the hood is that the builders have fully adopted “pace versus price,” and by doing so are elbowing existing home sellers to the sidelines, especially in the lower price tiers.

Importantly in March we saw the historic flip yet again where the median new home price came in slightly lower ($403,600) than the median existing home price ($403,700). Before last year, this only happened one other time in June of 2006. Every time this happened last year existing home prices went lower the following month, and the crown was firmly placed back on the head of new home prices. What would that mean? We could see actual YOY declines in the NAR existing home series as early as May. That would be quite the capitulation which I personally did not expect to see this early in the season.

The setup I’m currently seeing reminds me very much of late 2022/early 2023 before the banking crisis and the Fed backstop which gave everyone a little extra confidence to carry on with house-trading and speculation despite prices becoming completely detached from reality. By swooping in with liquidity and the BTFP in 2023, the Fed effectively arrested the deterioration in home prices we were starting to see. You can see this shot of hopium evidenced in labor and housing data across the nation. While gamblers and the top 10% rejoiced, the last administration also “compensated the losers” on the bottom end of the K in 2024 with generous loss mitigation programs for FHA loans which meant many did not have to pay mortgages despite being four years post the COVID crisis. The result: less than nine foreclosures in 2024 for FHA loans and over 500K workouts.

If only it were the unemployed and most vulnerable among us who were taking advantage of the FHA loss mitigation programs. Alas, no. Many investors have piled into these loans and used them to fund speculative bets as evidenced by details I’ve shared here as well as John Comiskey’s great work into the abuses of this program.

On that front we got incredible news just before Easter. Recently I’ve been detailing the signals we have been receiving from the current administration as to whether it planned to shore up housing. Based on small moves the signal seemed to be they were not going to rock the boat, but they also weren’t throwing out lifelines. And then, on April 15, 2025 (Tax Day), we received the announcement that the overly generous FHA COVID-19 Recovery loss mitigation program which was extended to February 2026 during Biden’s last days in office was being stopped early and the loosest components would end in September 2025. Additionally, a proposed rule limiting workouts to one every 18 months was replaced with a rule limiting workouts to one every 24 months which will also go into effect after September.

For those that don’t know, the MMIF, or Mutual Mortgage Insurance Fund provides insurance in the event of losses in the FHA program so the taxpayer is not left with the bill. What we know through John’s research and anecdotes from the field is that investors were using the Recovery option as an ATM. You may recall the passionate, open letter Danielle DiMartino Booth wrote to HUD Secretary Turner, pleading with the administration to stop the fraud and abuse.

The hastiest return to a prosperous America can be secured by honest discourse with its citizens. I might humbly suggest, Secretary Turner, that you take inspiration from my dear friend Melody Wright, a mortgage expert who has tirelessly crusaded for this FHA-funded racket to be shuttered: “In future years, when financial historians discuss this FHA episode, otherwise known as government subprime, and the speculators who utilized this program fraudulently, you will have a starring role. From those who lied on their application claiming intent of owner occupancy to benefit from lax credit and downpayment requirements for their passive investment play, to those who dishonestly availed themselves of the unprecedented and generous relief options -- a’ la “the gravy train” -- this program, more than any other, has propped up nose-bleed home prices. Tightening program standards and punishing those who abuse them would immediately result in true price discovery in many markets. We can only hope and pray that the current administration will have the political will to root out the systemic fraud and stomp it out. Perhaps then our younger generations might have a shot at achieving the ever-ephemeral American dream.”

If those loans which had been fraudulently originated as owner-occupied had been denied a workout and forced to foreclosure, price discovery would have continued in 2024 despite the Fed’s backstop. I am still a bit shocked that the administration heeded our pleas and freely admit to shedding tears of joy on that day as I thought that maybe, just maybe our young Americans will be able to dream of home ownership again. Always a realist, however, I have spent countless hours trying to think of ways we could get rug-pulled yet again as we did post the banking crisis in 2023. At the moment though all signs point to grifter hall passes in housing getting canceled left and right.

Although foreclosures were never a large part of my thesis due to all the government intervention, they will most definitely have an impact as they start to influence prices at the margin. For the first time in five years my clients are seeing their first foreclosure sales. What does this mean for the housing market in 2025 and beyond? We will walk through a current example to show you just how ugly this could get. Additionally, under the hood of March sales, price and inventory results are some surprising clues as to how the rest of the year will play out. Is the West still leading sales, or are sales starting to slow there? You may also be surprised to hear where inventory has been growing the most. Speaking of inventory, we will discuss how AirDNA can say that almost 700K short-term rentals are for sale when Realtor.com via FRED is showing only 900K listings for sale for the entire U.S. Are the majority of for-sale properties in the U.S. former Airbnbs? Or, is something else going on? Finally, as promised I will deep dive into one market to give you a birds-eye view of how micro meets macro to drive results. Due to the rampant speculation in the Midwest in 2023 and 2024, many have asked for an understanding of what’s happening there. Thus, our first stop on the spring selling tour will be Cincinnati, once known as the Paris of America.

Let’s begin…

Keep reading with a 7-day free trial

Subscribe to M3_Melody Substack to keep reading this post and get 7 days of free access to the full post archives.