Wait, What?

Says the Entire Real Estate Community

No matter what you think should or shouldn’t have happened on Wednesday as the Fed made its first rate-cut, there is one group that is scrambling right now to manage their messaging because they just got it so very wrong. In early August, I wrote a piece about why lower mortgage rates would not be the panacea those in real estate thought (or were told to think). As the markets opened Thursday bounding with Tigger-Style glee, an entire industry was playing catch up as borrowers called in asking why their rate didn’t go down or when they would be able to refinance. Prior to the announcement of the Fed’s decision, the 30-year mortgage rate ended Tuesday, September 17th, per Mortgage News Daily, at 6.11%.

When rates actually went up the following day to 6.15% after the Fed’s announcement, there was lots of splainin’ to do. Although rates would settle at 6.06% on Friday night, the cracks in the narrative had been widening since late May when mortgage rates started their move down. Every realtor, broker, housing industry publication has made the innuendo or explicit case that when “rates” go down everyone was going to be fine, and the housing engine would restart. Additionally, if you ask one of these industry insiders about mortgage rates, they refer to the latest news from the Fed. No matter how many times I have pounded the table that the Fed does not control mortgage rates, the bond market does, those in the industry failed either to grasp or overtly acknowledge this fact. Do the Fed’s actions have an impact? Sure, but the bond market had already front-run the move with large drops in August when the Yen Carry Trade started to unwind. The confusion out there has gotten so bad that Jerome Powell himself had to state explicitly from the podium that “he can’t really speak to mortgage rates.”

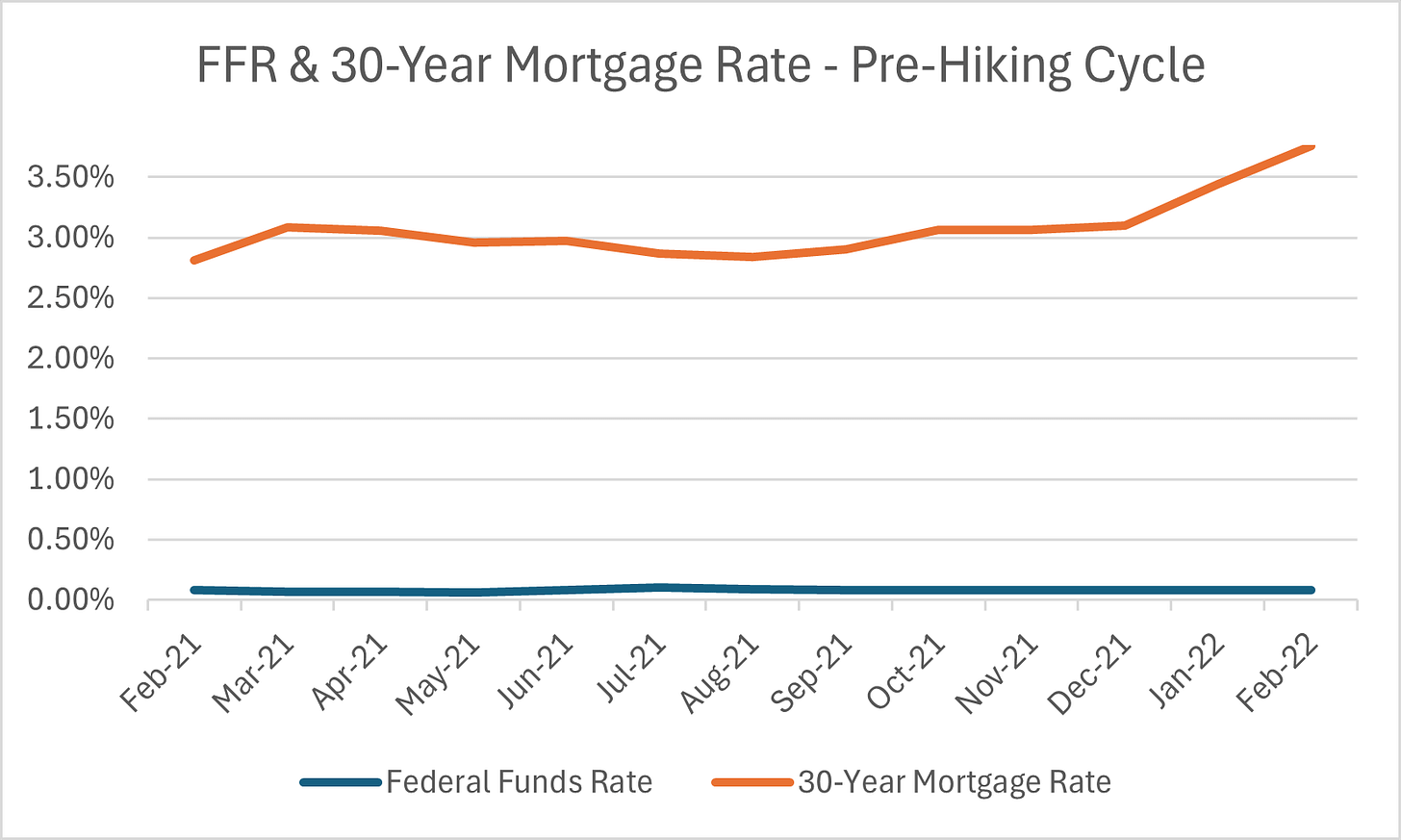

Since the 80s these two data points have largely shared a general trajectory.

But in taking the most recent case as an example, the 30-year mortgage rate started coming down before the Fed lowered its benchmark rate. Many argue, including the folks at Eurodollar University, that the Fed’s actions are inconsequential or largely follow the bond market and not the other way around.

Remember when Jay Powell pivoted in December of 2023 and everyone believed rate cuts (and a lot of them) were just around the corner?

Mortgage rates, which largely follow the 10-year treasury (or the world’s borrowing rate), had already started their descent without permission from Jay Pow due to deteriorating conditions in the economy as well as muted inflation expectations. Could that have been why he changed his tune so abruptly in December? The 10-year and mortgage rates started sloping back up as we moved through the year and inflation prints started to heat up again. At the end of May however, mortgage rates renewed their descent, falling to their lowest levels just before the rate-cute announcement.

Here is another view of mortgage rates during this last hiking cycle

Are you scratching your head? Powell said on Wednesday, mortgage rates “depend on how the economy evolves,” but you would not have heard that from the mouths of broker babes. “Date the rate,” the industry said. Mainstream media supported the narrative, and the whole gang pointed to the Fed as opposed to admitting home prices are too high. Additionally, everyone could have been a little bit more explicit that the reason mortgage rates reached their absolute lowest point in January 2021 at 2.65% was due to the Fed intervening in the secondary market and buying mortgage-backed securities. The tricksters at the Fed however were banking on their sleight of hand to keep hopium alive, crossing their fingers, praying no one would notice and they would achieve their soft landing. They believe your expectations have quite a bit to do with changes in the economy and as such their #1 job is managing those expectations versus managing monetary policy. It was a little too inconvenient to explain what truly drives mortgage rates. What Powell should have said at the podium is that mortgage rates “depend on how the economy evolves” or if we, the Fed, directly intervene. Those purchases are what tightened the spread between the 10-year treasury and mortgage rates during the COVID boom and caused mortgage rates to go down. For a more detailed explanation of this relationship and what truly drives mortgage rates, please check out my deep dive into mortgage rates and the 10-year treasury.

And what of the housing industry professionals? They rely on the tricksters. Most of them are simply ignorant and look to industry economists to guide them. These industry economists and analysts parrot the Fed and provide no explanation when things turn on a dime. These are the very folks who picked up my leaders in 2007 and took them on a magic carpet ride to bankruptcy.

“Date the rate” is just the latest iteration, of “you can always refi” which was not only the refrain during the Global Financial Crisis (GFC), but also during the Great Depression, per the St. Louis Fed:

Refinancing was easily accomplished during the 1920s, when household incomes and property values were generally rising, but next to impossible during the Depression. Falling incomes made it increasingly difficult for borrowers to make loan payments or to refinance outstanding loans as they came due.

As rates plunged from 6.78% in late July to 6.35% at the end of August an entire industry watched with bated breath as mortgage applications to purchase homes refused to respond week-after-week. There have been small upticks, but at least for existing home sales that has mattered little, with August coming in at the lowest August in the 25-year non-seasonally adjusted data series except for August of 2010. August sales of 378,000 homes were far below August’s 25-year average of 525,800. In August of 2007, sales were 570,000; in August of 2008, sales were 447,000 and in 2009 August sales were 453,000. I cannot emphasize just how bad this year has been.

During the last housing cycle, the purchase index from the Mortgage Bankers Association peaked the week of May 9th, 2005 at 526.2 with 30-year mortgage rates at 5.77%. The purchase index during the COVID boom peaked at 334.6 the week of February 1, 2021 with mortgage rates at 2.73%. We have never again reached those levels for purchase or refinance activity. In a few years from now we will likely find that the shadow markets played a role in how low purchase and refinance activity has been, but until then we have to rely on the data we have.

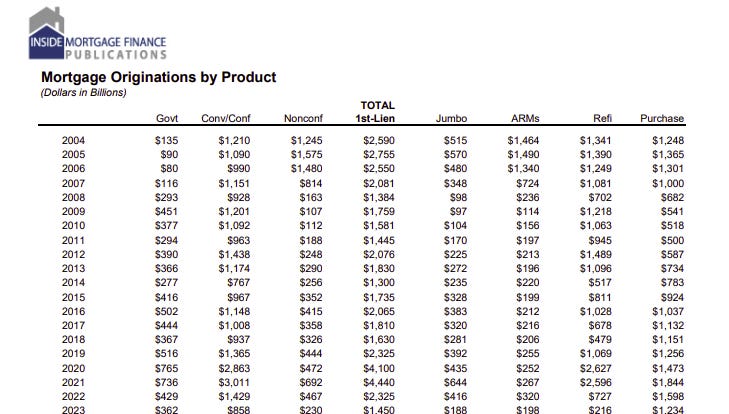

In case some of you forgot, the COVID boom was largely about refinancing and investors buying with all cash (30%….and that’s what we know). Those investors would then refinance those properties to get more cash to buy more homes. Social media influencers pushed BRRR or Buy, Rehab, Rent, Refinance and Repeat. As speculation went on steroids and every Mom, Pop and Harry bought a second home to fix and flip, Airbnb or list for long-term rental, there were fewer homes for those who were looking for a white-picket fence versus an investment vehicle. The institutional investors focused mainly on building homes for rent versus buying existing homes as there weren’t enough homes to satisfy the appetites out there for short-term rentals (Airbnb/Vacasa) and long-term rentals. As the mania progressed, most Mom and Pops pivoted to short-term rental because they could get more cash out of their mortgage. Refinance activity went on steroids which is really how the mortgage industry makes its bread and butter.

Notice anything about the period from roughly April 2004-February 2008? Were those borrowers “locked-in,” or put another way, had the industry run out of refi candidates? You see pops in refinances from 2009-2016, but those pops did not do enough to revive the housing market. In March of 2020, the starter pistol went off with a bang, and refinances exploded again. I remember being on a project at PNC when our volume doubled overnight and then tripled for imaging closed loan files. Our teams had just been sent home, and we were not allowed to use our offshore teams. I count that time as one of the most stressful of my life as we incurred penalties if we did not meet service-level agreements (despite COVID).

The last meaningful activity for refinances occurred between February and July of 2021. The Fed did not start raising its rates until March of 2022.

Mortgage rates started rising in September of 2021, well before the Fed hiked in March of 2022.

For another view of purchase versus refinance activity, here is mortgage origination by product. Look at those massive increases in refinances to the far right of the schedule in 2020 and 2021…mortgages to purchase a home did not make the same leap.

I wrote my 2023 story in HousingWire around debunking the inventory myth to encourage the industry to take advantage of the opportunities in the purchase market. The industry’s delusion about inventory was partly fueled in my opinion by laziness as refinances are much easier and thus result in higher margins. The multitudes of new entrants into the mortgage industry just prior or as the COVID boom had gotten underway were not used to really worrying about helping folks who wanted to own a home. The majority of their paycheck relied upon those who wanted to use their home as an ATM. I remember visiting a mortgage shop in 2019 to discuss a technology solution for them. When I pulled into the parking lot I saw a Lamborghini, a Porsche and other luxury cars, all parked in the front of the building. I did side-by-sides with the loan officers to get a sense of their operational workflow. As I was chatting with one of the loan officers, I told them about a potential lead I had met at the hotel the previous night - a hotel manager - who was a first-time buyer. You would have thought I had suggested killing a favorite pet. One of the reasons I believe the private note space blossomed is that immediately following the crisis, credit was indeed tight and lenders were not all that keen on helping. However, as the refinance pool dried up, they had to start working a bit harder. Believe me, the entire industry is hoping that tiny little tick you see below becomes something else altogether different.

Nonetheless, this is the lowest share of refinance activity we have seen since 2000/2001. Although refinance applications have recently ticked up, I have heard anecdotally many of those who applied are not qualified, or were told by their brokers “not yet” as with closing costs borrowers are not getting enough bang for their buck.

Mortgage rates went under 6.5% in early August and have averaged 6.21% in September. It can take 45-60 days to close a mortgage, so we will not know exactly how much activity these lower rates will generate for refinances for a few more weeks, but even with a small refinance boom this will not move the mortgage market enough to sustain prices at this level. As you can see from the graphs above, we had higher index levels for both purchase and refinance during the worst of the housing crisis. Existing home sales tells us that absolutely when it comes to purchases. New home sales will be out Wednesday, but even if they have another blowout month it won’t change the picture materially. Builders long ago lowered their rates and prices for borrowers through buydowns and incentives.

All of this stuff is incredibly complicated and boring, but if nothing else I hope you understand that you will not find the help you need from mainstream media, industry participants or by listening to the Fed when it comes to buying a home or protecting your real estate investments. By hook or by crook they want to ensure their paycheck keeps coming and will manage the message with little care or concern whether that leads to wealth or ruin for you and your family. One final point on rates before moving on - if our foreign buyers have to redirect resources home as distress moves across the world (think China and Japan) that could potentially mean less participation in our Treasury markets and a higher 10-year which would lead to higher mortgage rates. This is not something most are expecting. The largest share of buydowns (including those done by both builders and other nonbank lenders) will start to reset to their final rate in July of 2025. If rates don’t come down from that 5-6% mark, the buydown reset could be a shock similar to when Adjustable Rate Mortgages started to reset during the GFC (I am working on sizing this population, so stay tuned). For an excellent, general discussion of interest rates since we were scratching on cave walls, I highly recommend The Price of Time by Edward Chancellor.

Was all the hullabaloo last week much ado about nothing? I think not for what it signaled to sellers, not buyers. The floodgates have opened and the moves I’m seeing in inventory over the past two weeks are a bit wild, defying average increases and seasonal patterns. 35 of my 82 cities hit all-time-highs (ATH) for listings for sale in the almost two years I’ve been tracking. Several cities had double-digit moves week-over-week including Boston, Nashville, San Francisco, Seattle and Washington DC. San Francisco had its second double-digit week-over-week (WOW) move in the past two weeks. Since I last posted we have received further confirmation that California is indeed on a seasonal skid. Typically, CA sees home prices start to re-accelerate in the late summer to reach another (slightly lower) peak in December. That is NOT happening and the decreases in prices month-over-month are defying their seasonal arc. To understand what’s going on, let’s dive into those disappointing existing home sales results for August. Additionally, I will share even more qualitative and quantitative data to contextualize what we are seeing in California as I believe there are clues there for what’s to come. And finally, I will share the August M3 summary schedule which contains critical metrics such as price, sales, days on market, inventory, delinquency and credit score data by city.

Now to the good stuff….

Keep reading with a 7-day free trial

Subscribe to M3_Melody Substack to keep reading this post and get 7 days of free access to the full post archives.