When folks are tentative to state the facts

For fear of being accused of wearing tinfoil hats

We must persevere and report

No matter if we are skewered for sport

- Me

Did I conjure it, that something wicked we all knew was coming? Last week was wild. If you don’t follow me on xTwitter, you may have wondered at my silence or absence. But a lot happened in boring old mortgage land last week that could especially cause trouble in the capital markets. As such I took to following the unfolding events, providing updates town-crier style with unfortunately no time to update you here.

Where to start? Well, let’s start with the hack at Mr. Cooper. Who the heck is Mr. Cooper? Well I still find it very hard to call them that…most of us in the industry will always call them Nationstar, a company once heavily invested in by Mr. Wes Edens of Fortress, but now public with the largest shareholders being BlackRock and Vanguard. Mr. Cooper was a small player at the end of the last cycle with grand dreams of purchasing most of the GMAC assets (my former company), including a system of record, at the bankruptcy auction. They got beat out at the last minute by Bill Erbey and the “gang” at Ocwen who did some back-of-the-envelope math that was very misguided. No one, I mean no one understands how hard the servicing game is for the agencies until you get really burned by it - and that typically happens in the default cycle. Mr. Cooper was not a big enough agency player last time around to really experience it. Everyone always thinks they know better…just ask Ocwen as they got decimated and are still paying the piper after all these years.

After months of wasted due diligence went down the drain, Fortress decided to use that cash and mass purchase mortgage servicing rights (MSRs), but no real system to manage them. For a long time Mr. Cooper hobbled along on a legacy tool and Excel and it was a real sh*tshow. I mean, really, really bad. But, Mr. Cooper always seemed to escape unscathed. They got hit with a $1.5M Consumer Finance Protection Bureau (CFPB) fine in 2020 with $73M in consumer redress, but that is nothing compared to the fines most of the bigger players paid. A CFPB fine is almost a badge of honor in the industry as it sort of signals you are big enough to matter. It’s so easy to catch the servicers doing something badly as their systems are just so limited with no true tasking or workflow. In these shops you live off v-lookup just to be able to create your production report as none of the systems talk to one another. It’s like a guaranteed win for a state AG who’s trying to prove their mettle. And the states and regulatory bodies work together aka “collude” on these investigations to win big headlines, but nothing really changes.

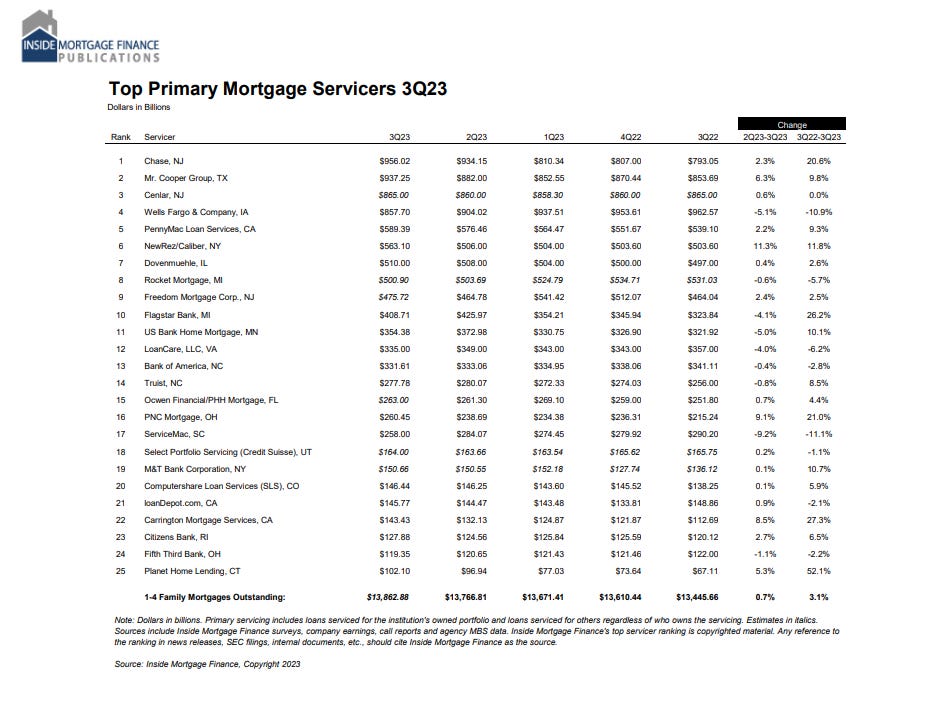

Fast forward, Mr. Cooper gobble, gobbled up MSRs and that in itself becomes a bit addictive as the initial bump to earnings from obtaining the servicing assets is a drug similar to gain-on-sale of mortgage loans. As long as you keep the engine running you can paper over most of those annoying expenses. But, that game also ends. At the end of Q3 they had 4.3M customers and were the 2nd largest servicer of Primary servicing rights (including owned servicing and servicing they do for others). You will hear many rankings for them, but know that they are in the top 5 of various categories with $937.25B in servicing assets.

According to an 8K filing on November 2nd, Mr. Cooper experienced a cybersecurity incident on Halloween which forced them to shut down systems - including the ability to take payments - to protect its customers. This announcement was largely ignored by the investing community. TechCrunch seemed to be the first publication to carry the story on November 2nd. Mainstream media stayed eerily quiet. Four million people could not pay their mortgage after millions of people had just been unable to access their direct deposits. To me, the fact that American consumers were unable to pay their largest bill was not only newsworthy but a human interest story which I discussed with Nobody Special in an interview on the issue on Wednesday. As we have noted here, housing is emotional. We all grew up watching It’s a Wonderful Life and I guarantee you that most of us have had anxious thoughts at one point in our lives in the wee hours of the morning about one day experiencing foreclosure or being homeless no matter how financially secure we may be. It’s almost a primordial fear.

The absence of MSM was hard to understand. A 4chan post circulated that claimed it was a media blackout due to a FBI raid. This was interesting because we had also heard a rumor about a FBI raid on a Fannie Mae multifamily lender on November 6th. I had received a call tipping me to a specific multifamily lender, but no one could confirm. The first mainstream media story about the Mr. Cooper hack was in the New York Times on November 7th (a full week after the incident) and seemed to just be a summary of the tweets we had all been tweeting.

Fox Business picked up the story on November 8th again with very little nuance. I was able to confirm through client contacts that Mr. Cooper was also not transacting in the secondary market and were not bidding. They are a big participant in the correspondent market and many of my customers sell their loans to them. So, when a top 20 originator steps out of those markets, that should make news somewhere, but it did not.

On November 8th, Moody’s joined the party with the following statement:

The cyberattack against Mr. Cooper...is credit negative, said Stephen Lynch, vice president and senior credit officer for Moody's. "The full impact of the event will depend on duration of the disruptions, ensuing potential reputational damage, and magnitude of the breach.”

Meanwhile we were hearing from message boards and individual customers that customers were receiving spam calls, etc. On November 9th, Mr. Cooper amended their 8K Filing, to say that “certain customer data” was impacted. In one news story they had the audacity to state that bank information was not on their core system without mentioning that your social security number, your credit reports, your phone numbers, addresses for all your properties, etc. are on their system. It only takes 2 pieces of that kind of information to authenticate security checks when calling in to any bank in the country.

To calm the markets, Mr. Cooper published the following impact estimates which based on stock price movement (negligible) had its desired effect:

While we cannot presently quantify the full extent of remediation and legal expenses associated with this cyber attack, we do not believe the impact will be material to our results of operations or financial conditions. We estimate fourth quarter earnings will include $5 to $10 million of additional vendor costs. Additionally, due to the precautionary shut-down of our systems, and the associated impact on operational revenues and expenses, we estimate that the originations segment will generate pretax operating earnings of $0 to -$10 million and that servicing segment will generate pretax operating earnings of $200 to $210 million, excluding MSR mark-to-market net of hedges. However, we expect that such operational impacts will be limited to fourth quarter.

That’s interesting - $5 to $10 million, huh? Perhaps they feel they are being above-board by only mentioning a charge to be taken in the 4th quarter because I feel like they should know better. Why just in June the CFPB levied a fine against Mr. Cooper’s payment vendor of over $25M for negligent (using live data for tech tests) data handling practices that impacted nearly 500,000 homeowners so it’s not like they don’t understand how costly these types of mistakes could be and how long the cleanup takes.

In fact, Mr. Cooper filed a lawsuit in September alleging that the incident with its payment vendor “made media headlines nationwide, damaging its reputation. In addition, it resulted in legal fees due to 10 class actions and at least two individual lawsuits.” Reputational risk here is paramount as an event of this magnitude could trigger covenants in most of their contracts including those with the agencies. The agencies could deem Mr. Cooper incapable of adequately servicing and force them to transfer servicing to a backup which will be a firm-killing event. This is what the agencies threatened us with for instance before our bankruptcy. Will they do this? There really is nowhere for this servicing to go. They could find some smaller player, but typically that ends up being disastrous. So, to me, it is not the likely outcome, but will be used to put the screws to Mr. Cooper in ways that people outside of the industry do not comprehend, nor can those outsiders truly size the potential cost.

And, just as the financial media, especially Bloomberg, seemed quiet on the data breach issue they were however going full court press on accusations of improper servicing with respect to confusion over the Veteran Affairs (VA) post-COVID workouts. This Bloomberg article included an interesting quote from Mr. Jay Bray, CEO of Mr. Cooper, from a spot on CNBC in April of 2020:

“There’s going to be complete chaos,” but due to its strong balance sheet, Mr. Cooper would be fine. And there indeed was chaos, but the CFPB had appeared to be giving everyone a hall pass due to the confusion that did abound. But, no sooner had reports about foreclosure being a thing again circulated over the last few weeks, this article seemed to lay the groundwork for the 2011 Obama playbook where the servicing departments of the banks (now sub in nonbanks) became the biggest boogeyman of the GFC. An election is coming and patsies are needed. The article claimed that for one of the homeowners, “Mr. Cooper, pushed her into default.” Are these nonbank servicers crappy providers? Yes, they sure are, and getting into a conversation with them can often feel like a descent into hell. But there are a lot of boogeymen in this tale. You may not realize you don’t get to choose your mortgage servicer and often lenders do a terrible job of disclosing that they will likely selling your mortgage before the ink on your note is dry. The agencies, inclusive of the GSEs, FHA, VA, USDA, etc. control 95% of the mortgage market and their guidelines are like a maze of contradictions and ellipses. I’ve only ever met a handful of professionals in this industry that actually understand those guidelines. And a lot of time that understanding is from experience, not from what is written in the guides as what happens in practice can often be very different from published procedures.

The 2011 playbook, Fed Consent Orders the AG Settlement are what pushed mortgage lending to the nonbanks in the first place. So, now what? It is my contention mortgage will be sent back to the banks after they wrangle concessions on Basel III requirements which rank some mortgage assets as very risky and more costly to the capital ratios. But that story is for another day.

Over this past weekend, NPR did its own story on the VA issue which gave a slightly different slant than the Bloomberg one insinuating that it was really the VA who dropped the ball by not getting an extension of its temporary Partial Claim program.

When thinking partial claim, think of the payment deferral, or the unprecedented relief that was offered to put up to 18 months of forborne payments at the back of the loan if you had a Fannie or Freddie loan. According to a study by the Philly Fed, 18.1% of the 8.5M people who were in forbearance took a payment deferral as their final workout for their COVID forbearance:

In the case of FHA and VA, the program is a bit different as it’s more about a whole number that is a % of your loan rather than missed payments. But, suffice it to say, both programs give you a pass on paying those late payments until you pay off the loan or sell the home. What I don’t know is if the Partial Claim is counted in the payment deferral number above as there was a modification that included the Partial Claim as well. To solve that mystery, I need $35K to buy Black Knight’s report on the balances.

Anyhoo, if you are falling asleep, I do apologize, but I think it is very important what is being set up here knowingly or not.

In October 2022, the Department of Veterans Affairs ended the so-called Partial Claim Payment program, or PCP, that enabled homeowners to do that. This happened even though the mortgage industry, housing advocates and veterans groups all warned the VA not to end the program, saying thousands of homeowners needed to catch up on missed payments. Interest rates had risen so much that many couldn't afford to refinance or get back on track any other way.

For its part the VA argues it did not have the authority to extend the program and would have needed Congress to intervene. The VA is working on a new program, but its delivery has been delayed and may not come in time to help some of these homeowners. Thus, consumer advocates argue that

"There should be a pause on foreclosures," says Steve Sharpe, a senior attorney at the National Consumer Law Center. "Veterans should really be able to have an ability to access this program when it comes online because it's been so long since they've had something that will truly work.

As I have often argued over the past few years, when foreclosures do start up again, there will be intervention at the state level and this article builds the case for intervention for at least VA loans at the federal level as well.

Mr. Cooper also had a starring role in this article as the servicer who told the couple they would be able to put the payments at the back of the mortgage:

So last year, with their savings dwindling, the couple says they called the company that manages their mortgage, Mr. Cooper, and were told they could skip six months of payments. And once they got back on their feet and could start paying again, the couple says they were told, they wouldn't owe the missed payments in a big lump sum (my emphasis)

If Mr. Cooper did tell these borrowers they would have that option available and it was not available that could be considered a UDAAP issue (Unfair, Deceptive, or Abusive Acts or Practices). Say what? The way our attorneys explained this consumer law to us is that if your grandmother can’t understand something you put in a notice or say verbally and can be misled in a way that creates harm, then you are guilty, regardless of intent. Mr. Cooper’s previous settlement with the CFPB included UDAAP violations. What’s funny, not funny is that the servicers all got in trouble initially in the early days of COVID for saying the lump sums would be due after the COVID forbearance as a result of confusing guidance from the agencies. Imagine the most bureaucratic experience you have ever had (DMV, Medicaid, etc.) and add about 10 layers of complexity.

NPR, like Bloomberg, also failed to mention the data breach. So, to sum up - we have a data breach from a top five servicer impacting over four million customers with very little coverage in the media, while at the same time you have two articles in the press about servicing issues for veterans who are facing default, mentioning Mr. Cooper specifically, just in time for Veterans Day.

And that was not the only breaking news last week. We found out on November 7th that it was a Freddie Mac broker who was in hot water and would have to cease new origination, not Fannie Mae (remember FBI raid rumor above). In 2022, Meridian Capital “took the crown for the most Freddie Mac and Fannie Mae (FNMA) originations through lenders for the seventh year running."

So, in the same week, you had two big players in the mortgage lending secondary market absent. And, to top it off, Fannie Mae announced that all broker loans would be subject to pre-review. Holy hole in a doughnut, Batman! Remember how I have often talked about these originators being addicted to gain-on-sale? Slowing the process down like this is akin to putting somebody addicted to heroin in solitary for a few days. It is going to have monumental effects on those markets. Will it be obvious right away? Not likely, but the events last week created a sucking sound for many in the industry as liquidity exited stage left just as they learned that a proposal for nonbanks to access the FHLB was a no-go and was going to be left up to Congress.

But, that wasn’t all. The Depository Trust and Clearing Corporation (DTCC), portending trouble, announced that due to "ongoing volatility in the fixed-income markets," FICC is "changing the following VaR model parameters for the Mortgage Backed Securities Division (MBSD)", effective November 20, 2023. What on Earth does any of that mean? Here is a good thread on the topic, but suffice it to say that this is really confusing stuff. To put it simplistically, MBS just became one of the dirtier shirts in your pile of assets you could potentially use to access liquidity. I’m reaching out to my contacts on the trading desks to try and understand potential impacts, so please leave a comment if you have more clues.

In my YouTube discussing these events I made a comment that I was NOT trying to sound “conspiratorial” but rather just stating the facts. Many responded that I shouldn’t be worried about sounding like a conspiracy nut. And, they were right (and then weirdly over the weekend I read 3 articles about conspiracies….I guess it was on everyone’s mind). The above events have the potential to be very disruptive in our capital markets and no one seems to really be talking about it. Additionally, you have the largest nonbank servicer who has as much information about you as your bank being hacked following close on the heels of an issue (individual user error?) in the banking system with direct deposits. And, of course we cannot forget ICBC, the world’s largest bank, being forced to trade via USB Stick due to a hack on the same day as an abysmal treasury auction causing some in the media to link the two, while others dismissed the connection.

But, to bring this back closer to home, all of these events are transpiring while borrowers in Florida are getting escrow notices about significant increases in payments due to higher insurance premiums and property taxes. While escrow is not sexy or exciting, Florida is at a boiling point and the negative demographic trends we have seen in places like Miami will accelerate as well as the defaults. Defaults equal more expense for the nonbanks and the need for more liquidity. For Mr. Cooper they have quite a few debt facilities (think line of credit) that will be expiring in the next six months. That data breach is going to make things uncomfortable.

Is the world ending? No, but the path ahead just got a lot more precarious for the mortgage nonbanks and our economy as all of these events will have a ripple effect. Inventory is starting to really climb in places like Fort Lauderdale and Fort Myers and on a net basis across the United States with a 5.08% month-over-month increase according to the Fed (-1.97% compared to last year). Nervous and distressed sellers will start to unfreeze the markets, especially as they realize they can no longer afford their mortgage payment due to those increases in tax and insurance.

2023 has been a fascinating year where events have sped up and slowed down on several occasions. While government intervention and nonbank collapse may be in our future, these things will likely take time due to the dysfunction in our regulatory oversight bureaus and Congress (shutdown?) unless we do have a full-scale credit event or crippling cybersecurity incident. Until then I would encourage everyone to stay frosty. There is much danger afoot and many gremlins hiding under the covers of the strong and resilient consumer narratives which abound.

I’m headed to Denver tomorrow morning to get a boots-on-the-ground perspective as we heard last week that new-build sales were cratering there, so wish me luck and talk soon!

A quick administrative note: I am in the process of making some decisions about the future of the Substack, its frequency and my focus. Although I have made no definitive conclusions, I will be turning on pledges next week as the amount of time I’m spending has meant I’ve sacrificed some client work and need to pay that health insurance. If you have pledged by accident, you can remove your pledge by following the steps found here at the bottom of the page. Please make sure to do so by next week. It will likely be a couple more weeks before I start making some of the content paid. I am so appreciative of everyone’s support, but also want to give anyone the option to cancel the pledge.

Listings for Sale

*Monthly summary should be available next week with month-over-month and year-over-year data

As mentioned above, listings for sale increased 5% month-over-month according to the Fed and down -2% year-over-year. Of the 71 cities I track 53 had week-over-week inventory increases (up from 33 last week). In aggregate, listings for sale were up approx 1% week-over-week, but up 4.32% to the 18-week average and 18.64% compared to start (January).

Top Cities with Largest % Increase in Inventory Week-over-Week (11/05-11/12):

Cape May 8.80% (small numbers, but big moves for this small city)

Rochester 5.92%

Johnson City 5.45%

Westchester County 4.02%

Rosemary Beach 3.45%

Top Cities with Largest % Increase in Inventory Compared to 18-week Average (11/5-11/12)

Bakersfield 35.54%

Palm Springs 20.12%

Cape May 18.78%

Fort Lauderdale 13.43%

Sedona 11.69%

Top Cities with Largest % Increase in Inventory from Start (1/1/23)

San Ramon 108.33% (up from #2)

San Francisco 91.43% (down from #1)

Bakersfield 83.33%

Denver 61.03% (up from #5 and next up on my list to visit)

Couer d’Alene 60.88% (down from #4)

Seattle 53.35%

San Jose 51.11%

Dallas 46.94% (new to the top 10)

Galveston 45.83%

Austin 44.02%

*Austin is back and kicked Boston out of the top 10

Top Cities with Highest % Increase of Single-Family Rental Listings (11/5-11/12)

Listings for rent were up .50% week-over-week and by 7.75% up compared to 18-week average.

San Francisco 16.23% (listings for sale down, so this may be a move to LTR)

Brattleboro 15.38%

Cape May 14.29%

Wexford County 12.50%

Rosemary Beach 7.69%

Top Cities with Highest % Increase of Single-Family Rental Listings to 18-week Average

Cape May 90.48% (listings for sale and rent both up materially)

Rosemary Beach 67.16%

Sevierville 46.63%

Dallas 38.00% (listings for sale and rent both up)

San Francisco 31.93%

Top Cities with Highest % Decrease of Single-Family Rental Listings to 18-week Average (11/5-11/12)

Tampa -27.40%

Orlando -22.66%

Bozeman -13.65%

Boston -11.83%

Wexford County -11.11%

Airbnb/VRBO - Short-Term Rental

SO - guess what Airbnb removed from its website? The ability to see average daily prices for a selected date. Things must be getting tough….October short-term rental data should be available next week. Until then, I will just leave last week’s ratings up:

Top Cities with Biggest Decrease in Airbnb Average Daily Rate Week-over-Week Compared to 16-Week Average

Average daily rates were down on average -4.32% week-over-week and -16.77% compared to their 16-week average

Rosemary Beach -55.65% / M-O-M -5.62% / Y-O-Y -3.92%

Destin -45.37% / M-O-M -8.72% / Y-O-Y -12.69%

Chicago -39.16% / M-O-M -4.84% / Y-O-Y -11.17%

San Francisco -32.89% / M-O-M 1.21% / Y-O-Y -.40%

Portsmouth -31.94% / M-O-M .73% / Y-O-Y 2.17%

Commercial Real Estate (CRE)

Looking forward to hearing final prices on the recent Signature fire sale, but it’s more likely we won’t hear much.

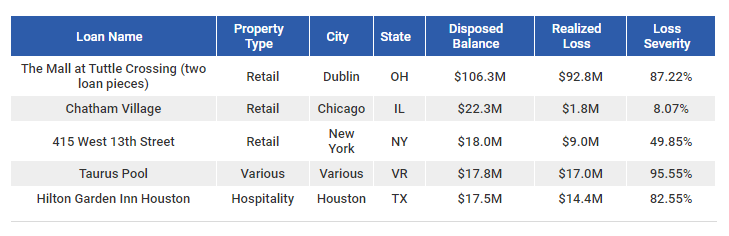

And a very interesting nugget gleaned from Trepp and Rudy’s latest stack - the biggest losses in 2023 weren’t even in the office space (yet)….

OUCH

and

h/t: JuliusMiami

And leaving this chart here for fun

I fear friends that winter is starting early this year…stay warm!

I must say I get tired of the whining by the media/homeowners/loan takers over this or that thing going bad BECAUSE THEY DIDN'T ACTUALLY READ WHAT THEY ARE SIGNING. At some point, you have to take some responsibility for your actions. If you don't understand it, don't just sign it, find out, get some clarification (in writing) and understanding. It's your largest investment (your house/mortgage) don't you think you should try and understand? And make sure it has no errors. Every single closing I"ve had (over 30 years) has had errors that have to be corrected before we could continue that nobody but me ever caught. And i'm just an average guy.

Good stuff Melody,

My f

Good stuff Melody, My cybersecurity pal sez "hold onto your hats you ain't seen nothing yet". WoAR will solve this sticky wicket.

God Help Usa All.