The Playbook

From Here to There

In the past week, time has started to speed up at a dizzying pace as we confront more data, more natural disasters, more escalations, more stories, more evidence (downgrades) that what’s ahead could be very problematic for many.

I’ve been called a doomer in one way or the other my whole life. Take for instance that time my friend wanted me to sneak out the window of her bedroom. Always a light sleeper, I knew her mother was also a poor sleeper and would often lay in bed listening to her rummaging around in the kitchen while my friend slept blissfully under her flowery pink bedspread. So when this was suggested, I simply said “I don’t think that’s a good idea.” Fast forward and of course we got caught. I was then labeled a “psychic” by all of my friends. I kind of liked the moniker (better than the super derogatory ones that came later - Chicken Little, Crazy B, etc.) and I didn’t really have words to explain that I was just assessing patterns and playing probabilities, or thinking something all the way through.

It’s been a couple of rough weeks talking to people in the industry who don’t want to face what is coming and getting my hand slapped by clients I’ve been working with for years for pointing out the obvious. It’s perhaps easier for my readers to hear these things, but for the people inside this means something altogether different. Hard, hard choices are around the corner just as they thought they had already made all the hard choices. And, who can blame them when the media keeps talking about no landing, soft landing, rising home prices, etc. But all the messaging does not change the fundamental story and the structural issues we have, outlined here in my January HousingWire article.

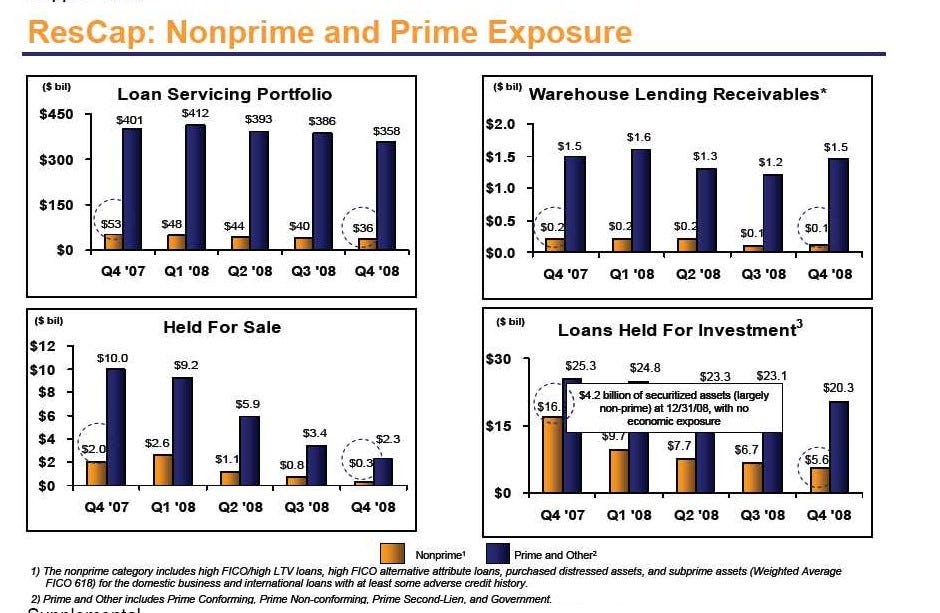

As I’ve said before, we spent most of 2007 and early 2008 in total denial at my company. I was responsible for the Earnings decks and investor presentations and saw how hard everyone around me was straining to see even the smallest glimmer of hope. My friends in Risk have similar stories about how a very small number of them begged the executives to see what was happening - as the models were screaming once you did a little peeking under the hood of the smoothing-over their predecessors had performed.

What I’ve ultimately come to accept is that people can trust you absolutely but still not hear you when it comes to uncomfortable realities. This time around though there are a few of you who are listening and the message is important. Right before I left on my travels I wrote that I was seeing serious stress in FHA (typically first-time homebuyers) and VA (veterans) which was then validated by Black Knight in a footnote. I then saw in June Fannie and Freddie loans coming under fire which was validated again by Black Knight. If you missed it, that is totally understandable as it would be hard to spot from the headline of their press release for June data:

Anybody care to wager what product this little headline is advertising? Before you answer, let’s take a brief exit to talk a bit about Black Knight. They currently have approximately 80% of all mortgages on their servicing platform. I have had multiple, difficult contract negotiations with them over the years. It is quite the monopoly, but as other tech players started to enter the market during the recent FinTech heyday they decided it would be a good idea to merge with ICE who owns the biggest origination platform, as well as the NYSE. The FTC (encouragingly) had a few things to say about that, but are now backing off (terrifying). This merger has most in the industry quaking in their boots as they are already held hostage by huge transaction fees by at least one of them. Many though don’t use both - they use one or the other - so people are afraid they will get squeezed and cornered into adopting a platform that is barely functional, hard-coded and works about as well as a box would for complicated mortgage transactions. And these technologies were built a very long time ago. If you walk around a servicing shop you will see black and blue screens everywhere with what looks like DOS prompts. And zero workflow in these tools. Most in the industry survive by buying wrap-around tools for workflow and that is a lot of what I have built over the last several years. I could write a novel on this topic, but there are a few players out there who could give them a run for their money, and I have worked with some. But usually those products are bought up and retired, or bullied into submission.

So, putting it mildly, Black Knight and ICE rely heavily on higher transactions and ever-increasing transaction fees, typically driven by refinances, so be wary their messaging. Down in the report for June data, we get a brief nugget:

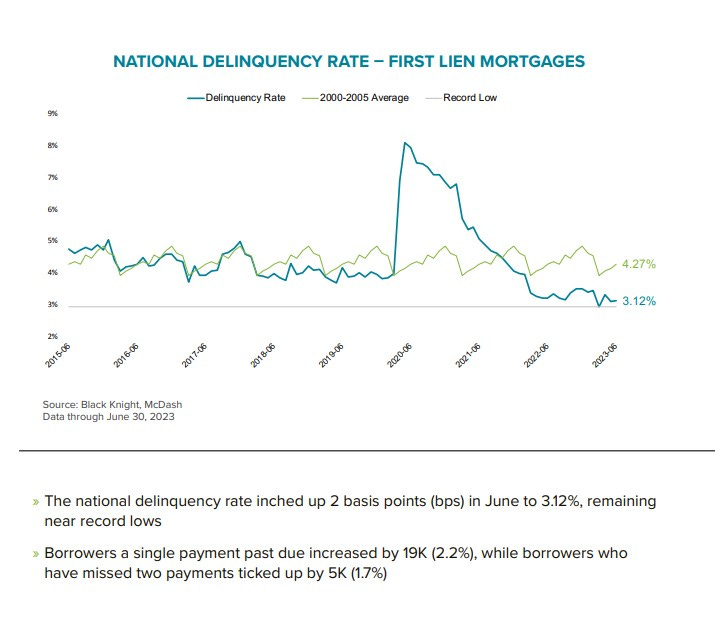

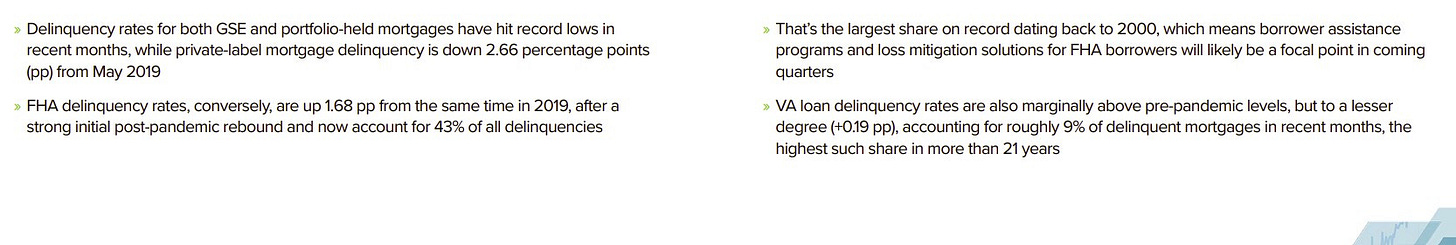

The single payment past due is the death-cross I’ve mentioned and is accelerating. These numbers are low and near record lows as Black Knight emphasizes everywhere, but what about the rate of change and what’s happening under the covers with FHA (typically first-time homeowners)/VA (veterans) particularly?

Note the 2nd, 3rd and 4th bullet point about being above pre-pandemic levels from the May report.

And of course delinquencies are low when many people were simply not paying their mortgage for up to a year, and then got a payment deferral of up to 12 months (unheard of), pushing the payments to the back of the loan. I’ve noted before these balances are not being reported to credit. And, if you still couldn’t pay there was a complete moratorium on foreclosure as well as state money from the Homeowner Assistance Fund which is still in play with only approximately 50% of the near $9.4B being spent as of Q1 23.

So, of course delinquencies are low. According to the Fed, as of Q1 2023 we are at a delinquency rate of 1.73%. Black Knight is only using data from the mortgages on their platform as well as they are only looking at first liens which could be a reason for the difference.

But, since Black Knight (BK) only goes back to 2015 in this report, let’s revisit the historical Fed delinquency numbers:

1.92% in Q4 2006

2.08% in Q1 2007

2.29% in Q2 2007

2.71% in Q3 2007

3.10% in Q4 2007

3.68% in Q1 2008

4.36% in Q2 2008

5.28% in Q3 2008

6.58% in Q4 2008

8.01% in Q1 2009

8.57% in Q2 2009

9.48% in Q3 2009

10.40% in Q4 2009

And topped at 11.48% in Q1 2010

In Q2 of 2015 (which is the first period shown in the BK data), the Fed had delinquency at 5.82% which is higher than above, but somewhat in line. Instead of just showing you the historical data Black Knight uses an average of delinquency from 2000-2005 as a comparison. Not sure why because the Fed has those rates as much lower. I do know that my company, GMAC ResCap, one of the top 5 biggest originators and servicers during that time, servicing approx $400B, did not use Black Knight. We were on a different technology, so maybe that’s why they have delinquency so high between 2000-2005? There are just so many rabbit holes to chase….

But, instead, let’s just look at the trajectory. This COVID boom has been a little weird, and I feel like we crammed five years of activity into two years. I think it is safe to say in terms of understanding, we are somewhere around late 2005, maybe middle of 2006. But there are things happening now like the bank crises that didn’t happen until 2008 or later, so it’s a mixed bag.

I’ve talked before about how many people misunderstand the last crisis and thus misunderstand the potential for the next one. In 2008 you were largely seeing your government portfolios and your non-traditional subprime/nonprime products suffering. It was not until much later that delinquency accelerated, infecting your prime borrowers and spiking to astronomical heights. Subprime/nonprime was just the kindling, not the fire.

To illustrate, here is a snapshot of my company’s prime to nonprime ratio at the end of Q4 2008:

Throughout 2008 we pursued asset sales, etc. and were early in de-risking due to our purchase by Cerberus who was vying for a price reduction, but our foreclosure crisis was not about the subprime. It was your borrowers, who started out healthy, but came under stress first as costs skyrocketed due to increased home prices and then later due to job losses. Many in 2010 drew down their equity, trying to survive, in the little refinance boom caused by lower rates which slowed the crisis, but did not fully mitigate it.

Black Knight is attempting to hide behind the fact that 90-day delinquency is historically low, but as I’ve discussed with you here and on YouTube 90-day delinquency will stay relatively low for some time due to loss mitigation efforts. Right now it seems to be the FHA/VA borrowers, the fraudsters and the investor class who have either used all of their benefits, or simply don’t have the interest to retain the properties that are heading into Foreclosure….and it is accelerating much faster than I would have thought. Is my argument that we will suddenly have a default crisis? It will not be sudden, but it is going to be a crisis. Will the government respond like they did last time with multiple products and options? Sure, but they came out with HAMP in 2009, implemented in 2010. In Q3 2012 delinquency was still at 10.48%, and I was overseeing over 65K default properties across the United States….and no, the majority were not the strippers or the fraudsters. They were regular, everyday Americans. Reading those hardship letters - which are required for every loss mitigation application - is truly one of the saddest things I’ve ever done. And, I read one yesterday that was just as bad as anything I read back then.

Can I get a little angry? Because I’m getting angry that nobody is listening. Property taxes, insurance costs, credit card debt and interest are exploding. The fires in Maui will certainly imperil insurance companies that are already teetering:

The above Bloomberg story was published the same day as the Maui fires started blazing, devastating whole communities and who knows how many structures. I’m pulling the historical data now, but Lahaina, Maui alone had over 6,010 Airbnbs listed in July. Last week I mentioned Fort Myers who had almost 3K Airbnbs listed right before Hurricane Ian hit and now 711 remain.

Although most in housing pay no attention to the Airbnb phenomenon, they should. It’s pervasive as many wanted to find a way to ensure an additional income stream to prepare for retirement or to escape the abysmal state of Corporate America prior to COVID.

So, let’s summarize - we have increased costs, a mom-and-pop investor class that took on too much leverage and of course the institutional investors who built or bought Built-to-Rent as if the UFOs are landing tomorrow. But, if I was a UFO I would probably choose the glitzy multifamily which is under construction at the highest pace since the 70s without the demographics to support it. It’s much closer to the city and has some cool amenities. As well, let’s not forget, access to credit which was propping up the small and institutional investors is disappearing at an alarming speed, along with it credit quality in the portfolios I see. What’s next? Oh yeah - job losses. Yellow’s bankruptcy recently left over 30K employees uncertain about their future:

Workers at the Columbus warehouse and hub were not informed that they are being laid off or terminated. In fact, more than one week since the company shuttered operations they have yet to be contacted by the company on their status. Workers only found out that they were out of a job on Sunday, July 30th when they arrived at the warehouse and found the gates padlocked shut.

If you want to dismiss my experience and prefer to listen to the Fed, please check out any of several Fed papers on what really happened during the GFC. They themselves say subprime was a trigger and not a cause:

With more than $1 trillion in subprime mortgages outstanding, the potential for losses on these loans was large in absolute terms; however, judged in relation to the size of global financial markets, prospective subprime losses were clearly not large enough on their own to account for the magnitude of the crisis…Rather, the system's vulnerabilities, together with gaps in the government's crisis-response toolkit, were the principal explanations of why the crisis was so severe and had such devastating effects on the broader economy.

The nontraditional (subprime) and private MBS (investors - now called non-QM) started the fire, but then:

Everybody who says there won’t be a default crisis because credit quality is so good has completely missed the boat on what happened last time and that is likely by the design of many in our financial media (did you know News Corp -owner of the WSJ, my former employer, owns Realtor.com?). The default cycle is coming as I discussed in this Twitter space with Michael Gayed, but what makes it even worse are the all-cash buyers in the investor and fraudster classes who will absolutely walk away. At this time the banks will not (yet) be paying to cut the grass, paying to remove the mold, paying the code violations, paying the taxes, paying the insurance like they did last time. No, because a large portion of what was bought in late 2020-today has been bought with all-cash, which is likely over-leveraged cash from loans on crypto and stock portfolios, not mortgages:

Nationally, more than 36% of single-family home and condo purchases were cash deals, which is an increase from about 23% in 2020.

I think this is why in many ways I have been more focused on those developments in the superprime thinking mortgage would take a little more time to come under stress. But, after seeing tiny bubbles of stress at the end of December which were calmed during bonus and tax refund season, start to percolate again quite strongly, I believe it is starting.

So where are we in the playbook? Over the weekend, my good buddy Trish circulated this Philly Fed paper from January on social media.

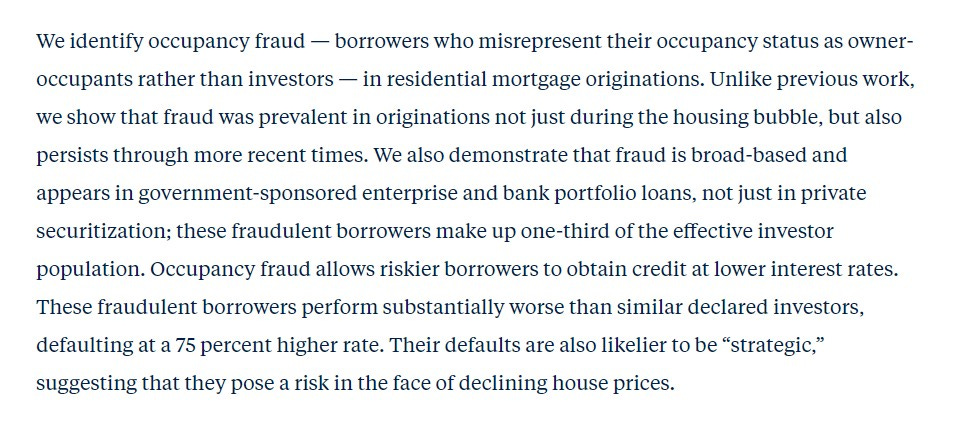

The intro alone was enough to garner quite a bit of attention on social media:

“Persists through more recent times.” In essence we can conclude one-third of mortgages by investors are likely fraudulent. And this tracks with what I’ve been seeing in portfolios with early delinquency as well as what I have been seeing in county records with deed flipping and all sorts of schemes. I planned to focus this entire post on that component and the fraudsters, but there is simply too much going on and people are not paying attention. Our financial media will lead them like lambs to slaughter.

So, more to come on that soon and the particular role of that bezzle in the cycle. I will be posting the regular updates on listings for sale, rent and Airbnb in a second post this weekend as there is simply too much happening to keep up. So, in summary, where are we? We are at the very beginning of the crisis of our lifetimes. These are strong words I know, but the time for ambivalence is over. We have to start thinking about how to manage it.

Yours Truly,

The Psychic, Chicken Little, or The Crazy B

With everything I see not making sense, this does.

Appreciate you. I'm a consultant in the building products industry, and have never seen so much complacency in my life. Beyond the early 2000's crazy. Hiring, spending, etc like this will never end. Linear planning. It's hard to be the only one who thinks "you might want to be careful".