When I first traveled to Nashville and Austin in January of 2023 locals told me over and over that X number of “people are moving here every day” when I commented on all of the new-build subdivisions. Never mind that the facts never supported those claims or if the claims were even remotely accurate it was for a very short period of time. Storytelling is how humans make sense of the world. This is why narrative and those who understand it can wield such significant power.

As many of you know, I have just returned from California, the land of Hollywood and American mythmaking. Boy howdy do I have some stories to tell. Today we will start with San Diego, otherwise known as America’s Finest City, where population has been decreasing since its peak in 2018, but the median home price has continued to increase to eye-watering heights.

Source: US Census Via FRED and Redfin

Unlike Nashville or Austin, population was not increasing during the COVID boom. Pray tell then, what story is San Diego telling itself? Or perhaps more precisely, what story are investors telling themselves about San Diego?

Second only to Miami in Q2 2024, San Diego has been infested with speculators. We should be getting updated Census projections in the next couple of months, but even if San Diego’s population shows only a modest decline for 2024, we know that much of what propped up population over the last several years has been the increase in the foreign-born population. Likely this is why you saw some moderation of the population decline after 2020 as San Diego’s “percentage of foreign-born persons is 26.5 percent, more than double the U.S. percentage (13.2 percent).”

So, again, why are investors convinced San Diego is a gravy train?

‘The reason investors are buying a lot of homes in San Diego is because they study markets all over the country and they perceive San Diego to be a really…really good investment,’ Battiata Real Estate Group San Diego Associate Broker and Team Leader Matt Battiata said.

Well, that clears it up. Investors study markets, so they must know. Thank you, Broker Matt! What I heard from several investors in 2023 was they believed the San Diego market was impervious to downturns due to the military presence there and their access to housing benefits. According to the San Diego Military Advisory Council there are 115,000 active-duty military stationed in San Diego. So, basically, investors banked on unlimited demand in the face of a declining population for what would occupy 9% of the housing stock? Of course, there is the entire service economy which caters to the military as well as defense contractors, but what else did the “smart money” see to warrant such mania?

Before we go there, I promised to address the recent WSJ article that has social media all a’twitter. This is a story we have been talking about for some time, but now that mainstream media has entered the chat, folks are starting to pay attention.

What stories was the last administration telling itself when they launched the most aggressive mortgage workout programs we have ever seen? The COVID response was just an (extremely) amped up version of the response we saw post the GFC. In the minds of those in charge, the emergency response was what was needed to give people breathing room as the economy righted itself after the pandemic. The mortgage relief story was the same as the PPP and ERC story - help was needed and fast. We now know that the PPP and ERC programs were rampant with fraud, essentially transferring wealth to the already well-to-do.

Such will be the finding with respect to the Federal Housing Administrative program once the dust settles. Across all of the agencies (FHA, VA, Fannie Mae, Freddie Mac, etc.), approximately 8.5 million homeowners have taken some form of assistance since 2020. Rightly so says industry insider Bob Broeksmit from the Mortgage Bankers Association: “imagine the economic and housing-market fallout if these homeowners went into foreclosure.” What if a big chunk of those borrowers were investors? FHA has long ago gone off the rails from its original intended purpose. During the last crisis, folks learned you could use the low downpayment and more lax credit score requirements to get cheap loans for speculation. That lore became lesson for the new breed of flippers and short-term rental investors who followed.

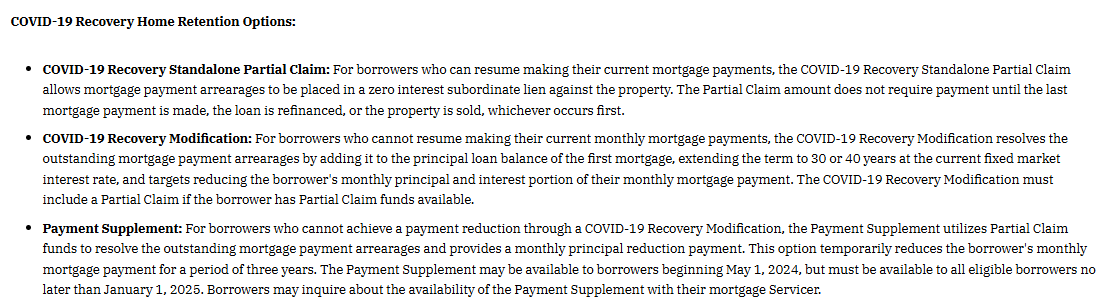

Let’s start with the basics. I have previously shared the extremely lax lending standards under the FHA program. What exactly are the options for relief under the FHA loss mitigation program for those who find themselves in default?

The idea behind the partial claim is that if you default you can put the arrearages into a non-interest-bearing lien to be tacked on to the back of the loan and satisfied when you sell the property or payoff the loan. During COVID, Fannie and Freddie used a similar workout called the payment deferral as a way to resolve the outstanding payments due at the end of the COVID forbearance. With the COVID emergency behind us, one wonders why FHA believes such aggressive workouts are still needed?

Recently I sat down with Mark McDonough who has been in the business for over 30 years to discuss the abuse he was seeing in the FHA workout programs. What Mark has discovered is that there are lenders who are pushing FHA loans with these partial claims as a feature. Reviewing FHA’s Neighborhood Watch reporting system, Mark discovered lenders whose loans have gone more than 50% delinquent in the first six months. When everyone thought you could date the rate, the game simply became about extending and pretending through the tough times. Many justifications were made to get by on the way to smoother sailing including taking out a loan you knew you didn’t have to pay. Mainstream media played along assuring us that rate cuts were coming to save everything…despite the fact that mortgage rates are not controlled by the Fed and that home ownership has become largely unaffordable for most Americans.

My colleague

has been digging into this data and has started sharing loan-level examples daily on xTwitter. These loan-level examples are representative of just how successful this program has been at kicking the can while also enriching our investor class.Politicians and industry insiders will tell you these low down-payment origination programs are necessary to give opportunities for home ownership to our most vulnerable Americans, but when the debt-to-income requirements were removed from the Dodd-Frank legislation this FHA program became predatory. Make no bones about it, many investors with little skin in the game will walk away with a ding on their credit while our working Americans who just wanted a home will be wrecked. That is unless someone in the new administration gets serious about owner-occupancy fraud and false claims. Every one of these workouts that used the Partial Claim was a claim made to the federal government. No faith in our government to hold folks accountable? The False Claims Act also

Allows private citizens to file suits on behalf of the government (called “qui tam” suits) against those who have defrauded the government. Private citizens who successfully bring qui tam actions may receive a portion of the government’s recovery. Many Fraud Section investigations and lawsuits arise from such qui tam actions.

The article linked above which can be found in the life science section of the WSJ is politically well-timed and does get some things wrong. These programs are not cash cows to the servicers. Servicing is a very thin-margin business. In fact, I really don’t think you can be profitable anymore. These incentive fees basically keep the servicers afloat especially when they are not receiving that gain-on-sale bump from selling tons of mortgages to the government-backed agencies. Are the servicers incentivized to keep pumping the workouts though? Absolutely. Mortgage is about moving dollars around the system to fuel the machine and the COVID “enhancements” to these programs just meant that you could move more of it from one pot to the next.

Debt slavery is the American way, but the pots are near empty. What new ways to fill them will be imagined I cannot say, but behind every one of these loans is an American story - the story of a young family with a new baby wanting to settle down and make a life or the investor who looked around and saw that working a full-time job just wasn’t going to cut it. There are other more nefarious stories as well…Overwhelmingly though I cannot stop thinking that it really is past time for us to cut through the bull. And there is a lot of bull in California...a lot. If San Diego is indeed America’s Finest City we are in a heap of trouble.

Below I will discuss what I saw in San Diego as well as what the reality on-the-ground means for not only the California housing market, but the national market as well. Additionally, I will share my deep-dive presentation for January sales, prices and inventory. January tells an important story for what’s to come with some devilish details hiding in the results. For instance, it looks as if existing home sellers are taking market share from the builders on the lower end of the spectrum. This has been an area where the builders have outperformed so what does this tell us for the year ahead? And, finally, it’s not just listings for sale that are increasing. We are seeing listings for rent outpace those listed for sale in key spots. This has long been expected, but the speed of the recent increases has been somewhat surprising. 2025 is racing by and constant head-fakes have numbed us at a time when we need to be paying attention. My goal today with this missive - as it is always - is not to stun but to inform.

Let’s take a tour…

Keep reading with a 7-day free trial

Subscribe to M3_Melody Substack to keep reading this post and get 7 days of free access to the full post archives.